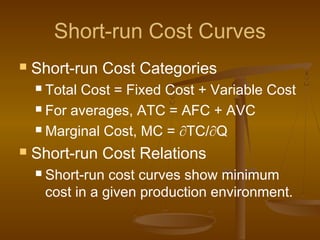

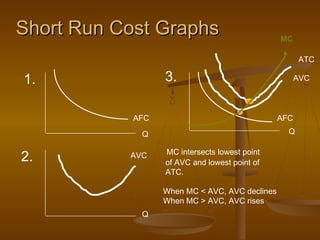

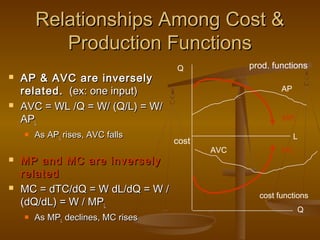

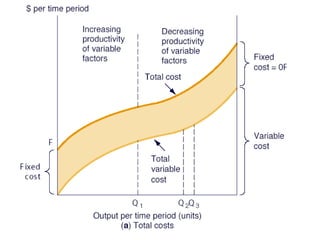

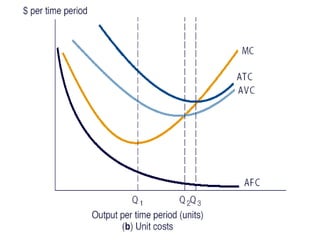

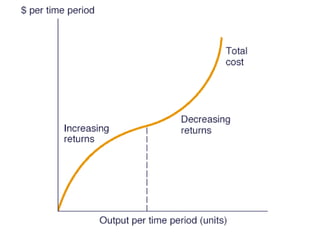

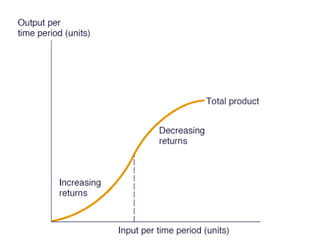

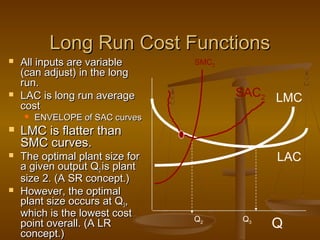

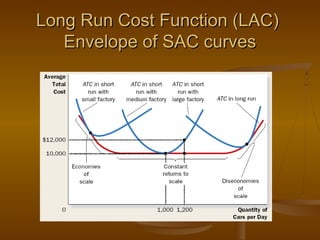

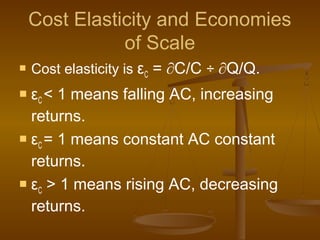

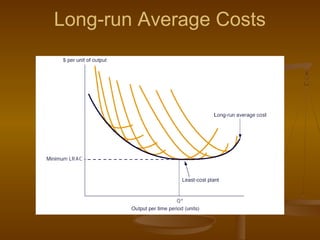

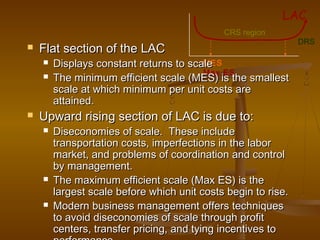

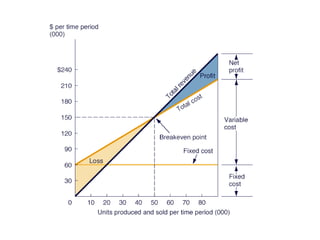

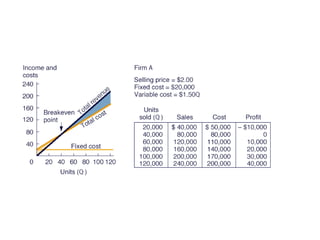

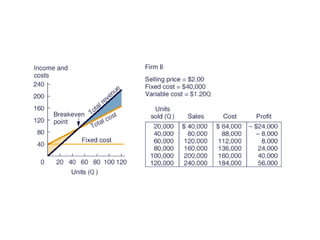

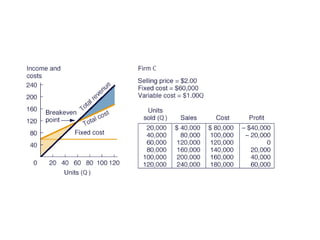

This document discusses various concepts related to cost analysis and estimation. It covers the differences between accounting and economic costs, as well as historical versus current costs. The document also defines opportunity costs, incremental costs, sunk costs, and fixed versus variable costs. Additionally, it examines short-run and long-run costs through cost curves and production functions. Finally, the text explores economies of scale, scope, and cost-volume-profit analysis.