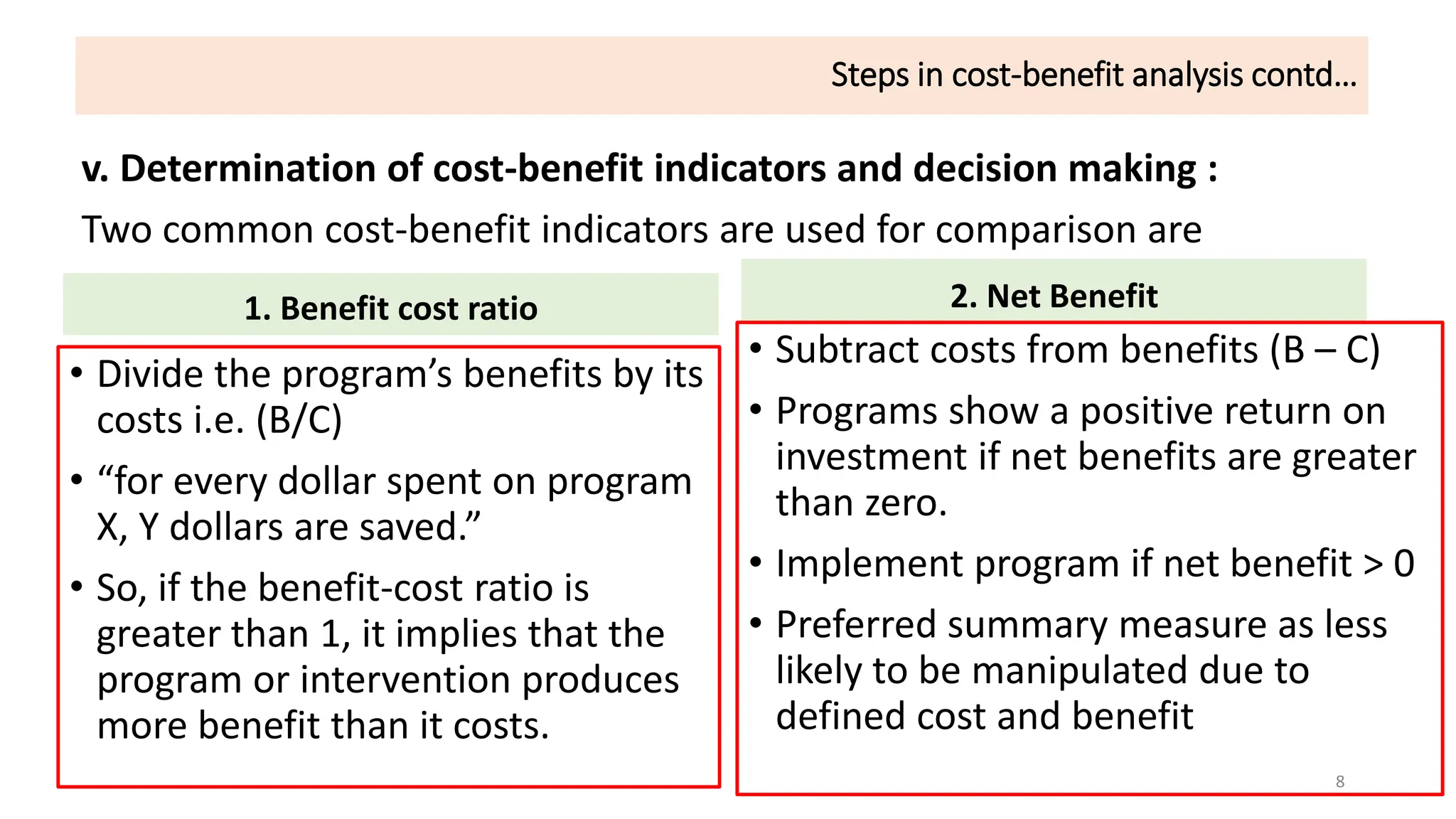

Cost-benefit analysis (CBA) is a method for comparing the costs and benefits of an intervention expressed in monetary terms, aiming to determine if the benefits outweigh the costs. It is used by policy makers to assess investments in large programs and to maximize net benefits through a systematic process, including discounting future values. Challenges include quantifying health benefits, potential delays in investment due to future discounting, and varying results from different valuation approaches.