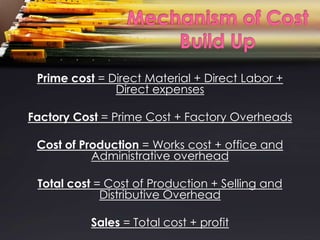

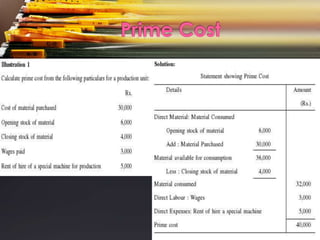

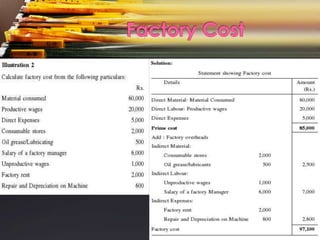

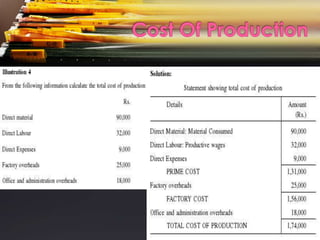

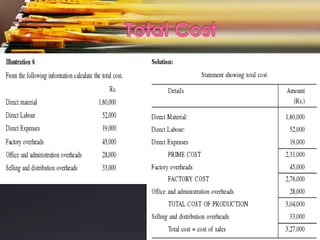

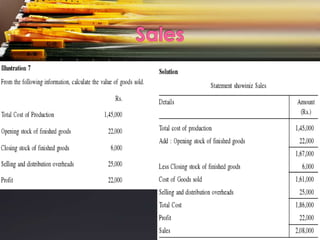

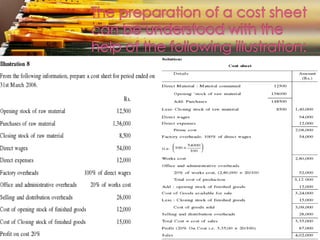

Accountants define cost as resources sacrificed or forgone to achieve an objective. Cost is usually measured monetarily and includes direct materials and advertising. Process costing collects information on all costs during an accounting period and divides the total costs by the quantity produced. Process costing is used by industries like oil refining and involves direct material, direct labor, direct expenses, and production overheads. The two basic costing methods are job costing and process costing. A cost sheet systematically presents the various cost components and classifications like prime cost, factory cost, cost of production, total cost, and sales. It helps ascertain costs, provide management information, and estimate profit or loss.