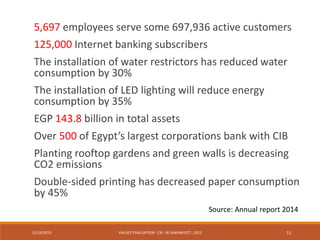

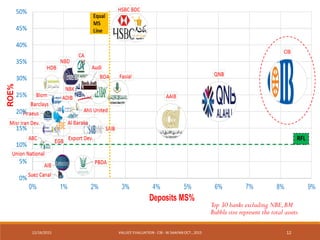

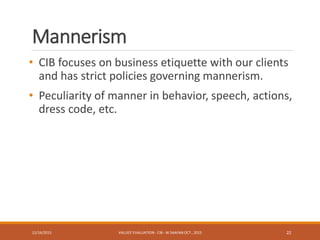

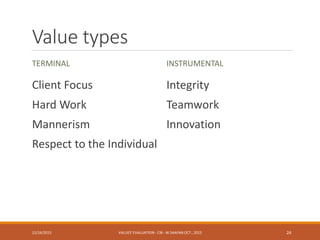

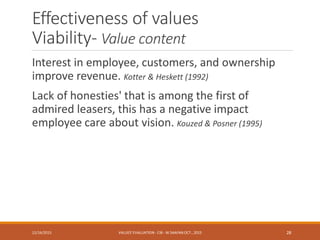

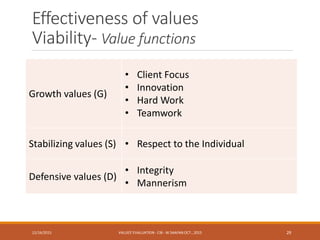

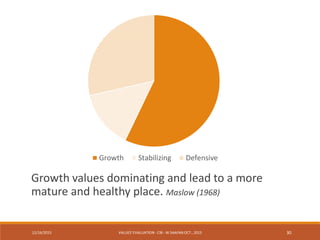

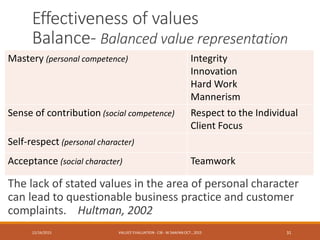

The document evaluates the corporate values of Commercial International Bank (CIB) and their impact on organizational growth and performance. Established in 1975, CIB aims to uphold a distinct reputation in Egypt's financial sector through integrity, client focus, innovation, hard work, teamwork, and respect for individuals. The evaluation examines the effectiveness of these values in achieving the company's mission and aligning with stakeholder interests.