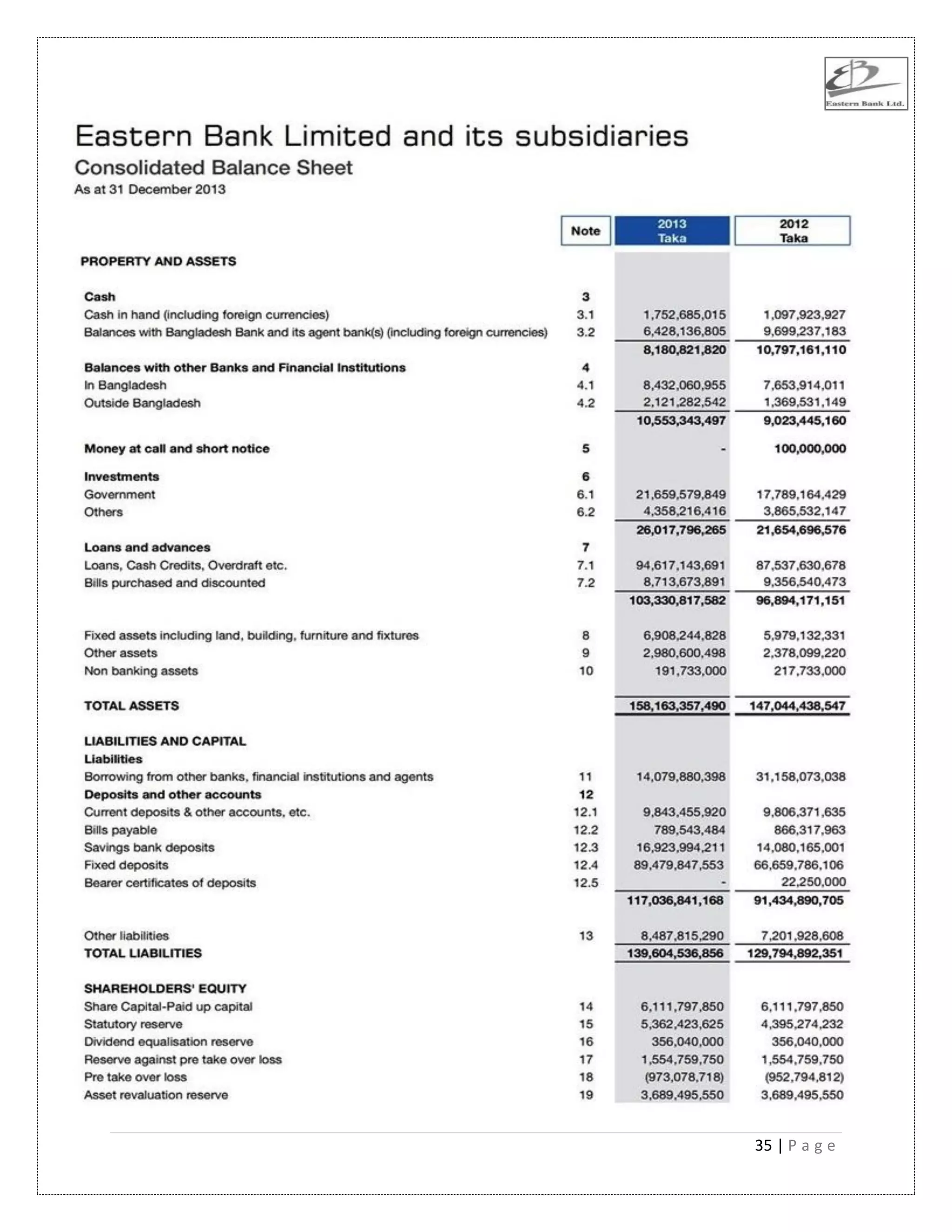

The document provides an overview of the organizational structure of Eastern Bank Limited (EBL), a leading private sector bank in Bangladesh. It discusses EBL's mission to provide excellent customer service, vision to be the bank of choice through superior growth and performance, and strategic priorities such as integrating sustainability and strengthening internal controls. The document also outlines EBL's history, milestones, board of directors, products, services, and benefits gained from centralizing operations. Overall, the document presents details on EBL's organizational setup and strategic direction as one of Bangladesh's top private banks.

![9 | P a g e

As for example, Asian Development Bank (ADB) describes corporate governance as “(i) a set of

rules, that define the relationship between shareholders, managers, creditors, the government and

stakeholders, (ii) a set of mechanism that help directly or indirectly to enforce these rules” (Asian

Development Bank, 2000, p. 5).

Corporate Governance ensures to bring transparency, accountability and professionalism in the

management system of a corporate body that enhances the credibility and acceptability to the

shareholders, employees, potential investors, customers, lenders, governments and all other

stakeholders.

This is truer in case of Banking Industry. Since Banks deal in public money, public confidence is

of outmost importance in this Industry. The study aims at finding out problems & deficiencies

involved in Corporate Governance practice in Banking Industry in Bangladesh and also

suggesting ways and means to remove the same in order to make the Corporate Governance

practice sound and effective. In this study, both the primary and secondary data were used.

3 ORGANIZATIONAL PART OF EBL:

3.1 INTRODUCTION:

The emergence of Eastern Bank Limited in the private sector is an important event in the

banking industry of Bangladesh. Eastern Bank Limited started its business as a public limited

company on August 08, 1992 with the primary objectives to carry on all kinds of banking

business in and outside of Bangladesh and also with a view to safeguard the interest of the

depositors of erstwhile BCCI [Bank of Credit and Commerce International (Overseas)] under the

Reconstruction Scheme, 1992, framed by Bangladesh Bank.

In 19991, when BCCI had collapsed internationally, the operation of this bank had been closed

in Bangladesh. After a long discussion with the BCCI employees and taking into consideration

the depositors‟ interest, Bangladesh Bank then gave the permission to form a bank named

Eastern Bank Limited which would take over all the assets, cash and liabilities of erstwhile BCCI

in Bangladesh, with effect from August 16, 1992. So, it can be said the EBL is a successor of

BCCI.](https://image.slidesharecdn.com/corporategovernanceofeasternbanklimited3-170226190505/75/Corporate-governance-of-eastern-bank-limited-3-9-2048.jpg)