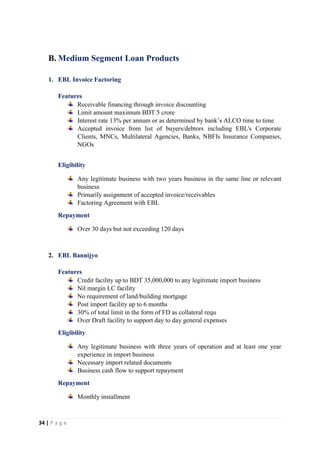

This document provides information about Eastern Bank Limited (EBL) and its activities and role in Bangladesh's economic development. It discusses EBL's functions such as receiving deposits, providing loans and advances, creating loan deposits, and facilitating foreign trade. It also outlines EBL's public utility functions like money remittance and safekeeping valuables. Finally, it describes how EBL promotes capital formation, trade and industry, and agriculture through providing financing and other services. Overall, the document shows how EBL operates as a commercial bank and contributes to Bangladesh's economic growth.

![EASTERN BANK LIMITED

[Document subtitle]

3/25/15

LAW & PRACTICES OF

BANKING](https://image.slidesharecdn.com/ebl1-150327104702-conversion-gate01/75/Eastern-Bank-Limited-1-2048.jpg)