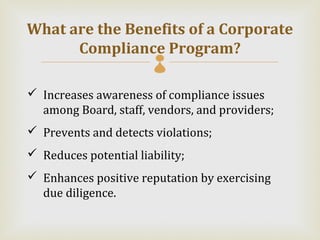

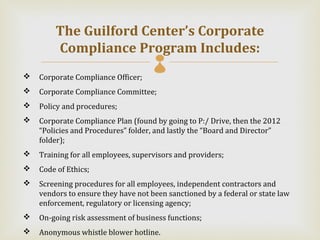

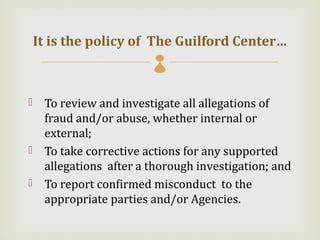

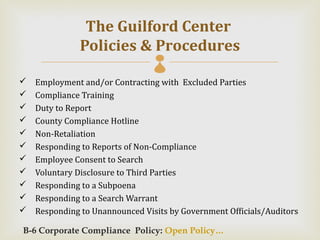

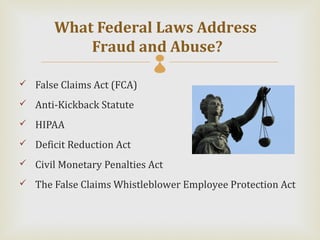

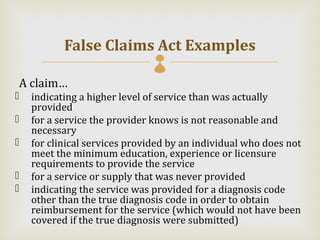

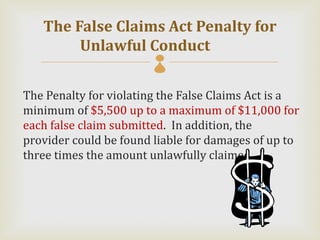

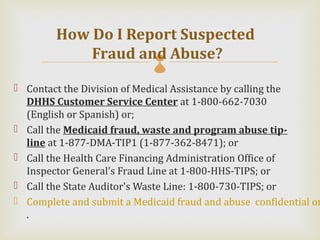

The document discusses the requirements for corporate compliance programs according to federal and state laws. It notes that health care entities that bill or pay out over $5 million annually in Medicaid must establish a compliance program. The focus of compliance programs is ethics, integrity, and compliance with fraud and abuse laws. Key components of compliance programs include a compliance officer, training, and anonymous reporting mechanisms. The document reviews several federal and state laws pertaining to fraud, kickbacks, and false claims. Employees' responsibilities to adhere to compliance policies and report any issues are emphasized.