This thesis discusses the development of an efficient intrusion detection system (IDS) specifically for denial of service attacks, utilizing a minimal subset of network traffic attributes to enhance detection performance. By employing various machine learning algorithms, the study identifies the best performing classifier and emphasizes the importance of selecting relevant features for improving classification accuracy. The proposed model shows significant improvements over traditional methods and aims to aid network administrators in implementing effective IDS solutions.

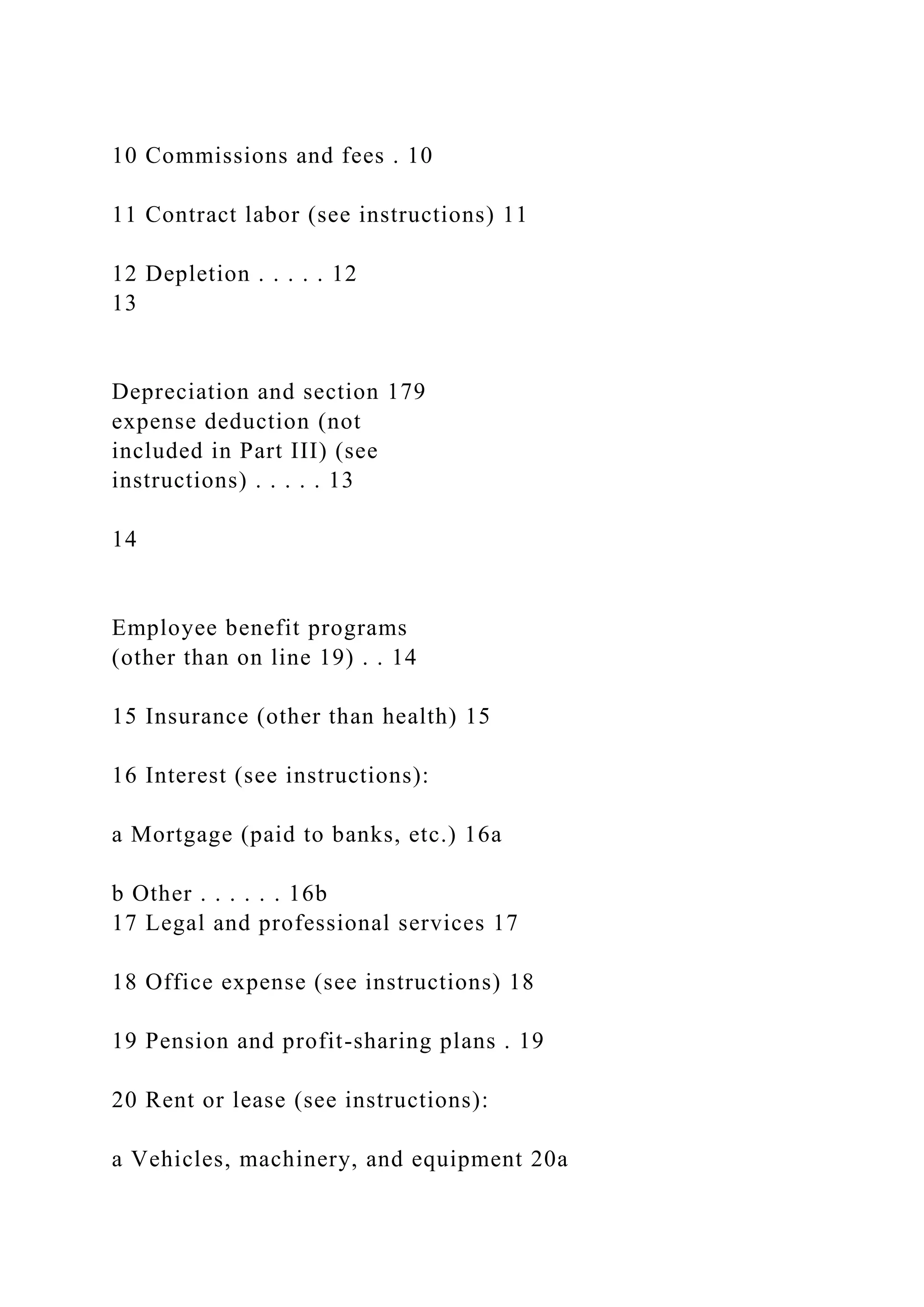

![nominal among all the feature subset found. Further, the

performances using Artificial neural networks(ANN), decision

trees, Support Vector Machines (SVM) and K-Nearest

Neighbour (KNN) classifiers is compared for 7 subsets found by

filter model and 41 attributes. Results: The outcome indicates a

remarkable improvement in the performance metrics used for

comparison of the two classifiers. The results show that using

17/18 selected features improves DOS types classification

accuracies as compared to using the 41 features in the NSL-

KDD dataset. It was further observed that using an ensemble of

three classifiers with decision fusion performs better as

compared to using a single classifier for DOS type’s

classification. Among machine learning tools experimented,

ANN achieved best classification accuracies followed by SVM

and DT. KNN registered the lowest classification accuracies.

Application: The proposed work with such an improved

detection rate and lesser classification time and larger merits of

the minimal subset found will play a vital role for the network

administrator in choosing efficient IDS.

1.0 Overview

This chapter presents the background information to the study,

the research problem statement to be solved, the objectives to

be achieved and the research questions. Additionally, the

motivations behind the works are outlined in the problem

justification and finally the scope to be covered is presented.

2.1.1 Network Behaviour Anomaly Detection (NBAD)

NBAD provides one approach to network security threat

detection which is a complementary technology to systems that

detect security threats based on packet signatures.

A NBAD approach will thus comprise of two stages namely the

training and testing phases. The training phase entails training

the classifier using the available data that is labelled whereas,

the testing phase instances are classified as anomaly or normal

using classification algorithm. The central premise of anomaly

detection is that intrusive activity is a subset of anomalous

activity[32]. An intruder who lacks the idea of the authenticated](https://image.slidesharecdn.com/copyrightthisthesisiscopyrightmaterialsprotectedunderthe-230108063757-0c732e2a/75/COPYRIGHTThis-thesis-is-copyright-materials-protected-under-the-docx-2-2048.jpg)

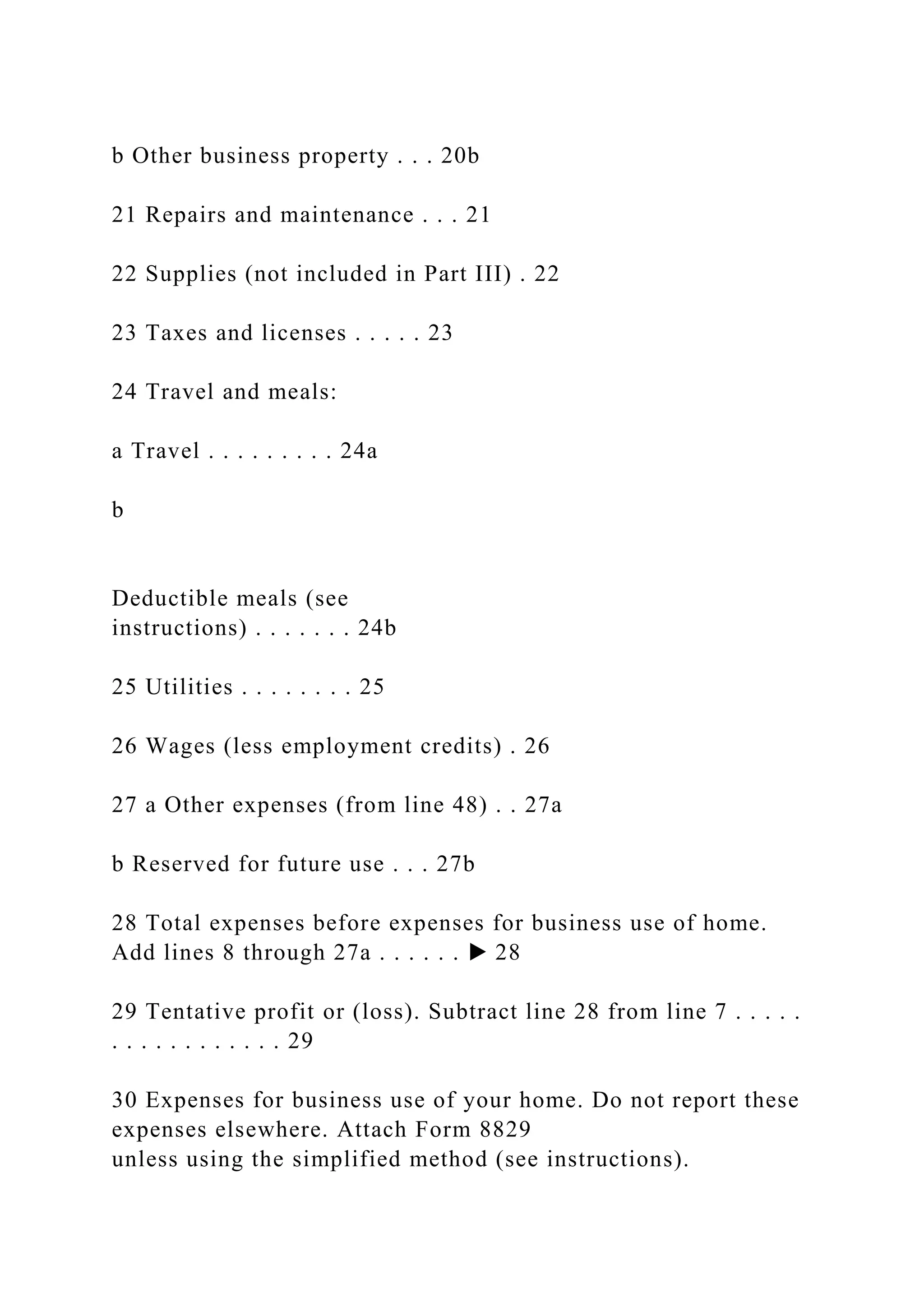

![user’s patterns activities, getting an access to the host computer

or system, the highest probability is that the activity of an

unauthenticated user is detected as anomalous[33]. This means

that, the set of anomalous activities will be the same as the set

of intrusive activities. In such a case, flagging all anomalous

activities as intrusive activities results in no false positives and

no false negatives. However, intrusive activity does not always

coincide with anomalous activity which may dupe the anomaly

detection algorithm.

Routinely Network staff are challenged with a wide range of

events that are unusual. Some of these events may or may not be

malicious[34]. The network operators are required to detect and

classify some of these anomalies as they occur and choose the

right response. A general anomaly diagnosis system should

therefore be able to detect a range of anomalies with diverse

structure, distinguish between different types of anomalies and

group similar anomalies[5]. This goal is indeed ambitious

though at the same time this goal is coming into focus because

network operators are finding it practical to harvest network-

wide views of traffic in the form of sampled flow data[35]. An

important challenge therefore is to determine how best to

extract understanding about the presence and nature of traffic

anomalies from the potentially overwhelming mass of network-

wide traffic data[36]. In the case of malicious anomalies, it is

difficult to permanently and clearly define a given set of

network anomalies. Over the time the new network anomalies

will continue to raise and therefore, an anomaly detection

system should avoid being restricted to any predefined set of

anomalies.

Network traffic analysis is the process of reviewing, recording

and analyzing network traffic for the purpose of general

network management, operations, security and performance. It

is a process of using automated and manual techniques to

review the statistics within network traffic and granular-level

details[37].

2.1.3 Traffic Analysis for Network Operations](https://image.slidesharecdn.com/copyrightthisthesisiscopyrightmaterialsprotectedunderthe-230108063757-0c732e2a/75/COPYRIGHTThis-thesis-is-copyright-materials-protected-under-the-docx-3-2048.jpg)

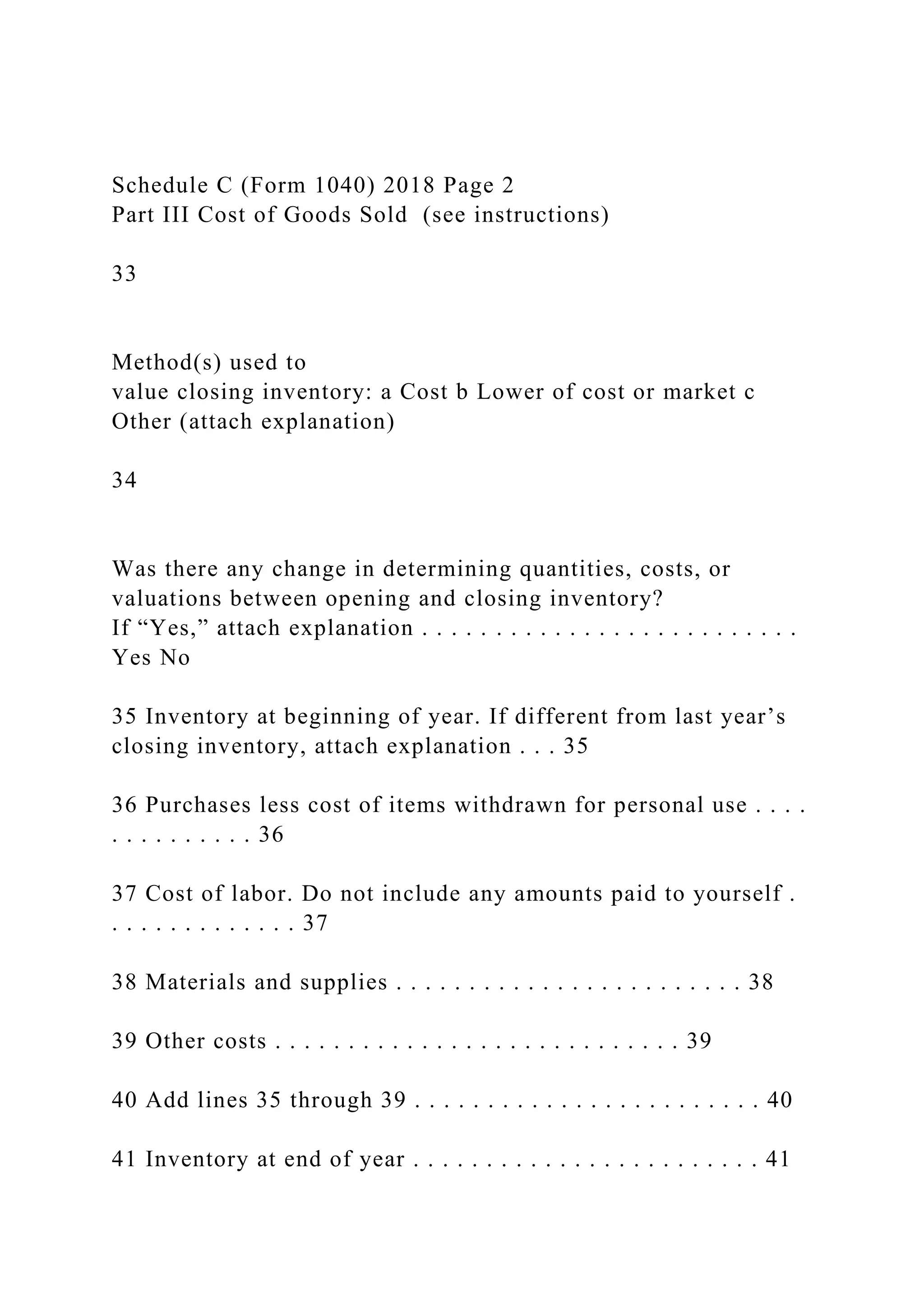

![Since network operation is more technical, traffic classification

is pertinent to understanding the network. The main objective of

classification is to aid in identifying the types of applications

that are used by the end users and the percentage of the share

traffic generated by various application in the total traffic

mix[51]. Moreover, the communication between IP network

nodes can be organized into flows, and traffic classification can

assign a specific application to each individual flow. A flow is

defined as a collection of IP packets emanating from a given

port [52][53] at one IP address to a given port at another IP

address using a specific protocol. A flow is thus identified

using its five-tuple flow identifier: destination IP address,

protocol identifier, destination port, source IP address and

source port[54].

2.2.2 Small - World Networks

As the name suggests, this type of networks are characterized

by relatively small average path length between any pair of

nodes in the network. Watts and Strogatz[71] define them as

"highly clustered, like regular lattices, yet have small

characteristic path lengths, like random graphs”. Formally, they

are defined as networks in which the distance L between any

two randomly selected nodes is directly proportional to the

logarithm of the number of nodes, N in the network,

2.3.1 Intrusion detection systems

Most IDS use machine learning (ML) tools to achieve detection

capability that is high for automation to ease user from task of

constructing signatures of attacks and novel attacks[82].

Theoretically, it is possible for a ML algorithm to achieve the

best performance, that is, it can maximize detection accuracy

and minimize the false alarm rate. The commonly used

supervised learning algorithm in IDS are decision trees due to

its accuracy, simplicity, fast adaption and high detection.

Artificial Neural Networks (ANN) is another method that

models linear and non-linear patterns and performs highly

well[83]. The resulting model can generate a probability

estimate of whether given data matches the characteristics that](https://image.slidesharecdn.com/copyrightthisthesisiscopyrightmaterialsprotectedunderthe-230108063757-0c732e2a/75/COPYRIGHTThis-thesis-is-copyright-materials-protected-under-the-docx-4-2048.jpg)

![it has been trained to recognize. IDS that are based on ANN

usually achieve a lot in detecting difficult tasks.

Support Vector Machines (SVMs) has a capability of dealing

with large dimensionality of data and provision of real-time

detection. Through nonlinear mapping and labeling each vector

by its class, SVMs is capable of plotting the training vectors in

high dimensional feature space[84]. The data is then classified

by determining a set of support vectors, which are members of

the set of training inputs that outline a hyperplane in the feature

space. SVMs are relatively insensitive making them scalable to

the number of data points.

2.3.2.1 Artificial intelligence (AI) based techniques

Artificial intelligence (AI) based IDS techniques involves

establishment of an explicit or implicit model that allows the

patterns to be categorized. Ponce has listed many advantages of

using AI based techniques over other conventional approach.

The major advantages include Flexibility (vs. threshold

definition of conventional technique); Adaptability (vs. specific

rules of conventional technique); Pattern recognition (and

detection of new patterns); Fast computing (faster than humans,

actually) and Learning abilities.

2.3.3.1 Artificial Neural Networks

MLP has made ANN IDS tools more efficient and accurate in

terms of normal and detection communication. Compared to the

traditional mechanisms, MLP-ANN shows detection outcomes

better and overcomes the limitation of low-frequency

attacks[87]. MLP-ANN can easily define the type of attacks and

classify them. This feature allows system to predefine actions

against similar future attacks. 2.3.3.2 Support Vector Machines

(SVM)

The SVM is a classifier based on finding a separating

hyperplane in the feature space between two classes in such a

way that the distance between the hyperplane and the closest

data points of each class is maximized[88]. The approach is

based on a minimized classification risk rather than on optimal

classification. SVMs are well known for their generalization](https://image.slidesharecdn.com/copyrightthisthesisiscopyrightmaterialsprotectedunderthe-230108063757-0c732e2a/75/COPYRIGHTThis-thesis-is-copyright-materials-protected-under-the-docx-5-2048.jpg)

![ability and are particularly useful when the number of features,

m, is high and the number of data points, n, is low (m >> n)

[89].

When the two classes are not separable, slack variables are

added and a cost parameter is assigned for the overlapping data

points. The maximum margin and the place of the hyperplane is

determined by a quadratic optimization with a practical runtime

of O (n2), placing the SVM among fast algorithms even when

the number of attributes is high. Various types of dividing

classification surfaces can be realized by applying a kernel,

such as linear, polynomial, Gaussian Radial Basis Function

(RBF), or hyperbolic tangent[90]. SVMs are binary classifiers

and multi-class classification is realized by developing an SVM

for each pair of classes.2.3.3.3 J48

It is an extension of the algorithm, the most common classifier

used to manage the database for supervised learning that gives a

prediction about new unlabeled data, J48 creates Univariate

Decision Trees[91]. J48 based used attribute correlation based

on entropy and information gain for each attributes. J48 has

been utilized in various field of study that includes; pattern

recognition, machine learning, information extraction and data

mining. J48 is capable of dealing with various data types’

inputs; nominal, numerical and textual. It can build small trees

and follows depth-first strategy, and a divide-and conquer

approach[92].

Tools that are popular and powerful for prediction and

classification are Decision trees. It has three main components

namely; arcs, leaves and nodes. Each arc out of a node is

labeled with a feature value for the node’s feature, each leaf is

labeled with a category or class and each node is labeled with a

feature attribute. J48 can be used in classification of data point

by beginning at the root of the tree and proceed until a leaf node

is reached and then the leaf node give data point

classification.2.3.3.4 K-Nearest Neighbour

K-Nearest Neighbors (KNN) is an algorithms used in Machine

Learning for regression and classification problem. It utilizes a](https://image.slidesharecdn.com/copyrightthisthesisiscopyrightmaterialsprotectedunderthe-230108063757-0c732e2a/75/COPYRIGHTThis-thesis-is-copyright-materials-protected-under-the-docx-6-2048.jpg)

![data and classifies new data points based on a similarity

measures. For example, distance function. Classification is done

by a majority vote to its neighbors. It uses data. It is one of the

most simple and traditional nonparametric technique to classify

samples.

It computes the approximate distances between different points

on the input vectors, and then as signs the unlabeled point to the

class of its K-nearest neighbors. In the process of create k-NN

classifier, k is an important parameter and different k values

will cause different performances. If k is considerably huge, the

neighbors which used for prediction will make large

classification time and influence the accuracy of prediction. K-

NN is called instance based learning, and it is different from the

inductive learning approach. Thus, it does not contain the model

training stage, but only searches the examples of input vectors

and classifies new instances. Therefore, k-NN‘‘on-line” trains

the examples and finds out k-nearest neighbor of the new

instance.

2.3.4.1 Denial of Service

DoS attack are the activities that, attackers, which are also

computers connected to the network, try to exhaust computer

resources or network bandwidth of a targeted victim system, in

order to prevent it from providing services to legitimate users.

The resulting effect of DoS attack mainly depends on its impact

on the target and its similarity to legitimate traffics[101].

The attributes of the DOS includes; increased traffic flow,

where several unauthorized users send a huge amount of service

requests which are legitimate to the targets per time unit to

finish up their capacities. Effective DoS attacks usually lead to

traffic flows with a lot of different source IP addresses but only

very few different destination IP addresses[102]. For this

reason, they are called Distributed DoS (DDoS) attacks. In

addition, like scanning, other properties of the flows are usually

the same or very similar. 2.3.4.2 Flash Crowds

Flash crowd is very similar to DDoS. It is characterized by an](https://image.slidesharecdn.com/copyrightthisthesisiscopyrightmaterialsprotectedunderthe-230108063757-0c732e2a/75/COPYRIGHTThis-thesis-is-copyright-materials-protected-under-the-docx-7-2048.jpg)

![unusually high amount of traffic from a set of IPs. Contrary to

DDoS, however, a flash crowd is not a result of malicious

activity[103]. With the rise of social network sites and websites

where users can share interesting hyperlinks with each

other[104]. Basic botnet architecture are situations where

people from all over the world access a particular site during

the same time interval. This effect can cause websites to load

very slowly or even go down entirely[105]. Flash crowds differs

from DDoS in the amount of different IPs observed in the

anomaly. While a botnet used for DDoS attacks can be of a very

large size, they are normally eclipsed by sheer amount of IPs

present in a flash crowd. It is distinguished by an increase of a

particular kind of traffic flows (e.g. FTP flows). There are

several approaches that have been proposed for anomaly

detection. These include: machine learning based techniques,

statistical anomaly detection and data-mining based

methods.2.3.5.3 Decision Table

A decision table is an organizational or programming tool for

the representation of discrete functions[124]. It can be viewed

as a matrix where the upper rows specify sets of conditions and

the lower ones sets of actions to be taken when the

corresponding conditions are satisfied; thus each column called

a rule, describes a procedure of the type if conditions, then

actions[125].

Given an unlabeled instance, decision table classifier searches

for exact matches in the decision table using only the features in

the schema (it is to be noted that there may be many matching

instances in the table). If no instances are found, the majority

class of the decision table is returned; otherwise, the majority

class of all matching instances is returned[126].

If the training dataset size is, say D and test data set size is, say

d with N attributes, The complexity of predicting one instance

will be O (D*N). So, the underlying data structure used for

bringing down the complexity is Universal Hash table[127]. The

time to compute the hash function is O (n’) where n’ is the](https://image.slidesharecdn.com/copyrightthisthesisiscopyrightmaterialsprotectedunderthe-230108063757-0c732e2a/75/COPYRIGHTThis-thesis-is-copyright-materials-protected-under-the-docx-8-2048.jpg)

![number of features used as schema in decision table. So

complexity will become lookup operation for n’ attribute

multiplied by l, number of classes that is O (n’ + l).

To build a decision table, the induction algorithm must decide

which features to include in the schema and which instances to

store in the body[128]. More details can be found in. We use

CFS algorithm as induction algorithm for our experiment.

3.2.2 DoS dataset

DoS attacks are classified in to two categories namely; high-

level or low-level variations. High-volume attacks are

characterized by high volume of application-layer requests

transmitted to a victim. Low-volume DoS attacks are

characterized by small amounts of attack traffic transmitted to a

victim strategically. Since one-shot attacks generally exploit a

specific weakness or vulnerability in application level

protocol/service, in this study we will focus our attention on

more universal type of application DoS slow-rate attacks that

are often seen in two variations: slow send and slow read. The

lack of data with application layer DoS attacks prompted us to

create an evaluation dataset. The set up was testbed

environment with a victim web server running Apache Linux

v.2.2.22, PHP5 and Drupal v.7 as a content management system.

The attack was selected to represent the most common types of

application layer DoS.

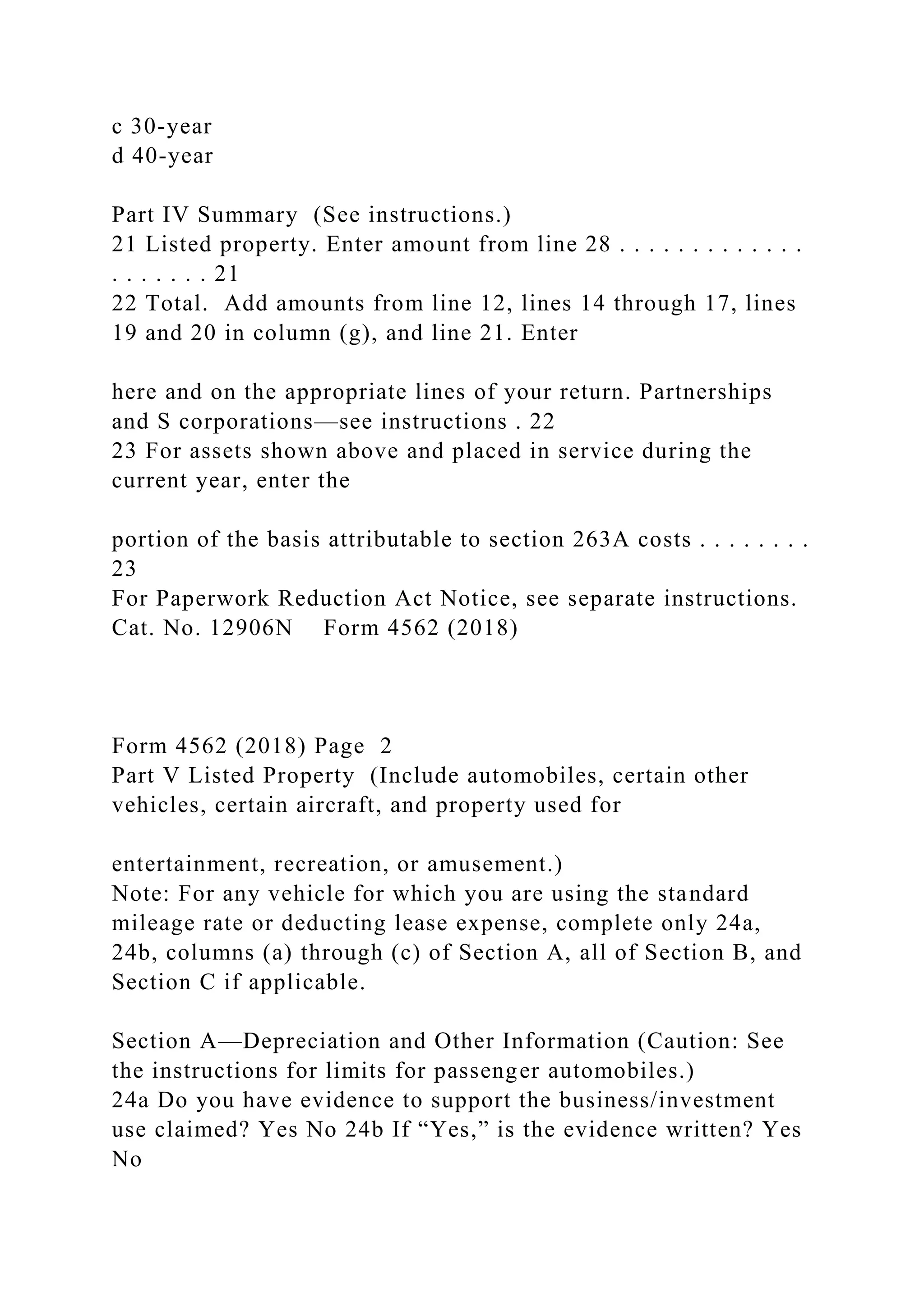

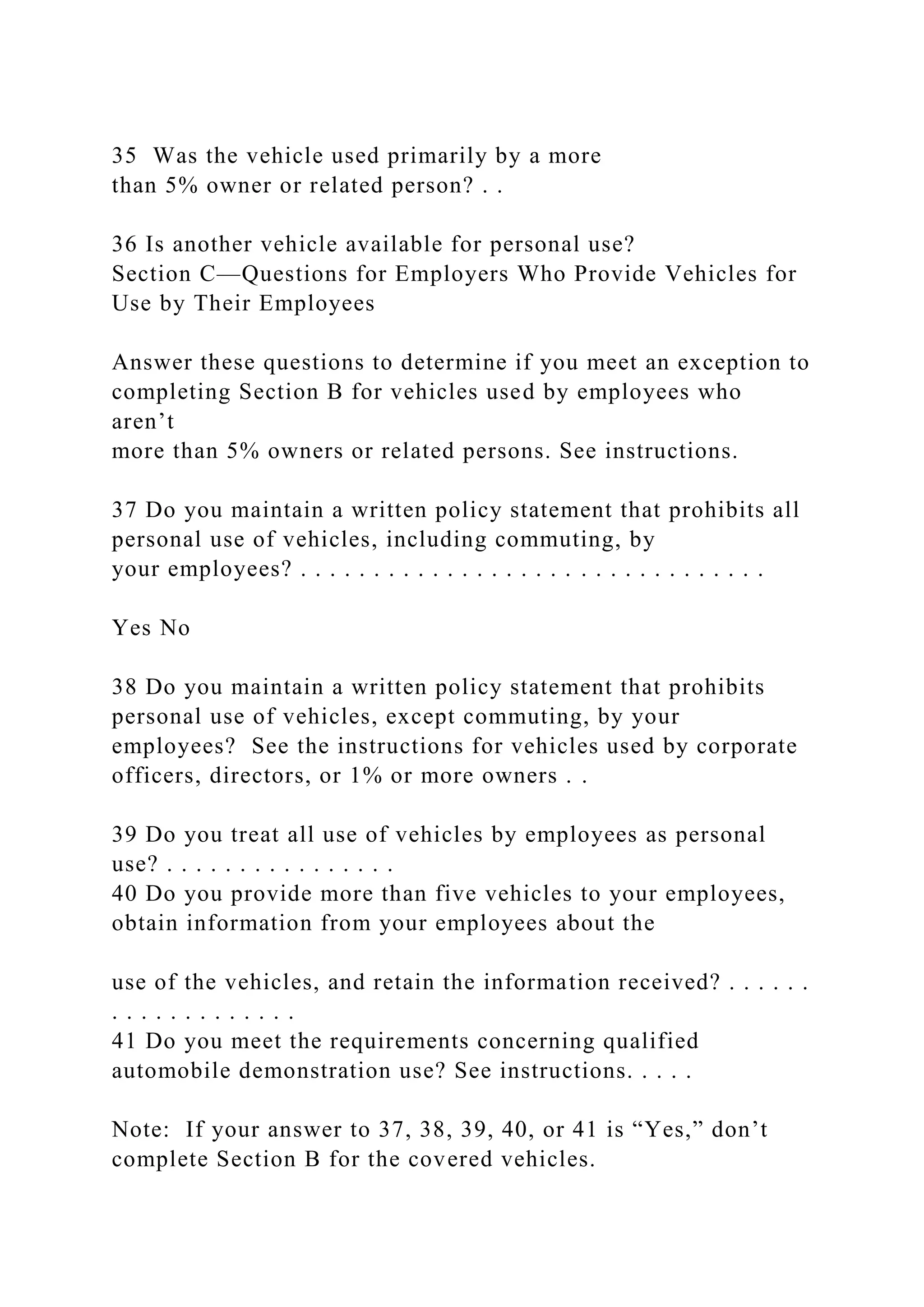

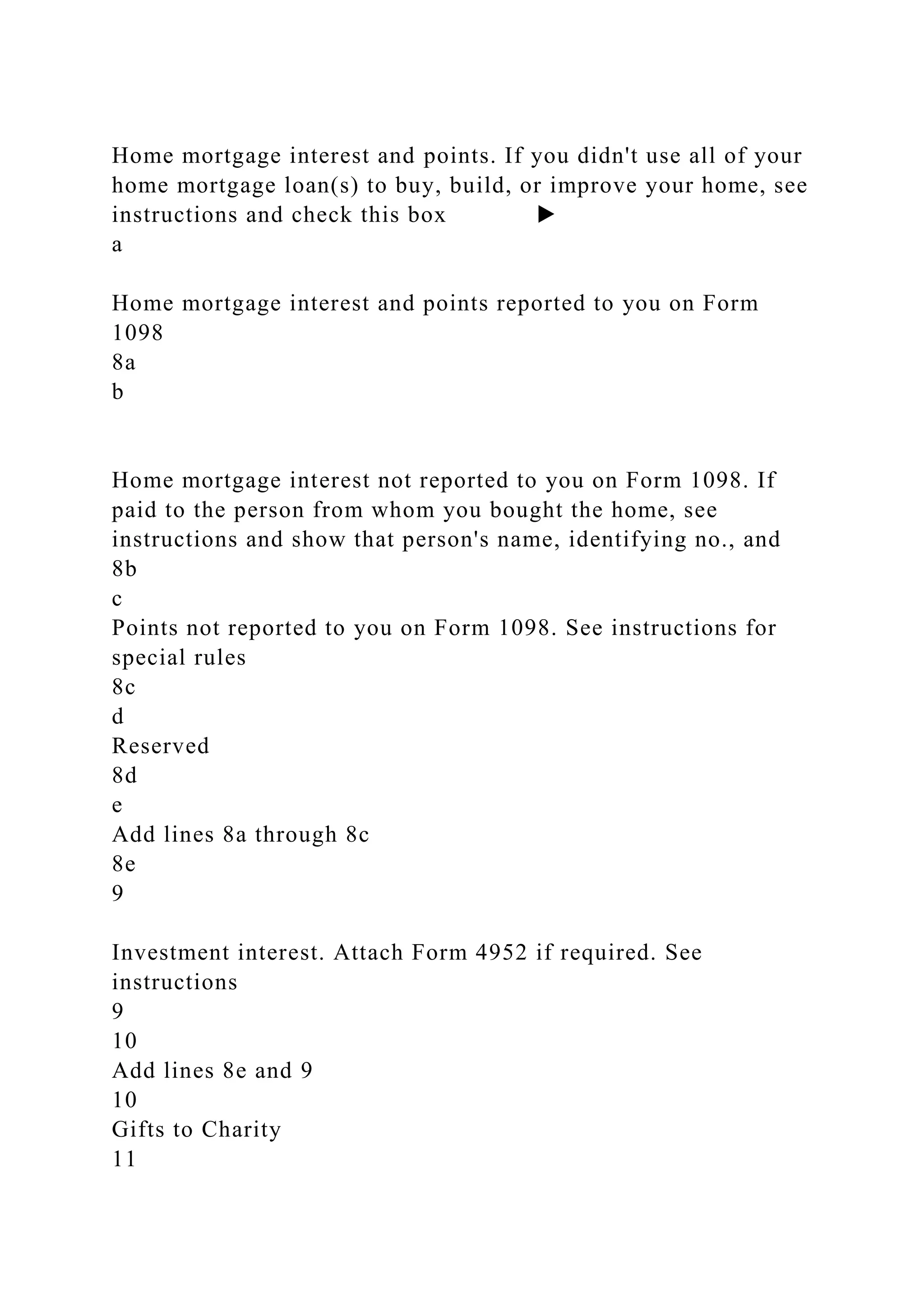

Form 4562

Department of the Treasury

Internal Revenue Service (99)

Depreciation and Amortization

(Including Information on Listed Property)](https://image.slidesharecdn.com/copyrightthisthesisiscopyrightmaterialsprotectedunderthe-230108063757-0c732e2a/75/COPYRIGHTThis-thesis-is-copyright-materials-protected-under-the-docx-9-2048.jpg)