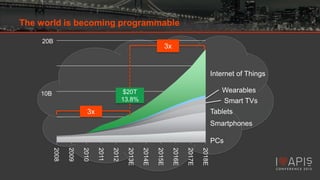

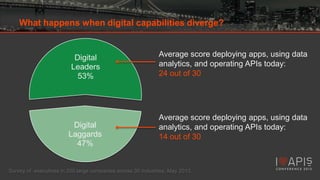

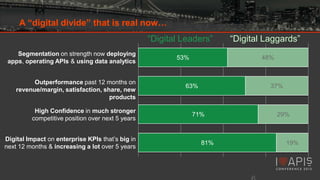

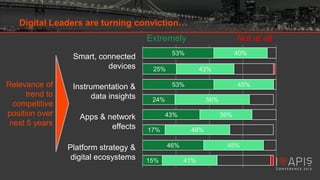

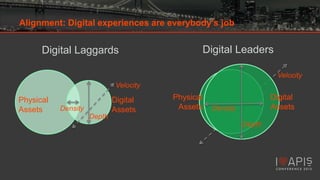

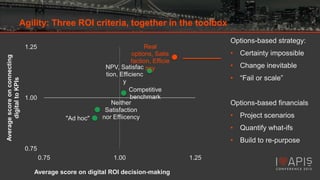

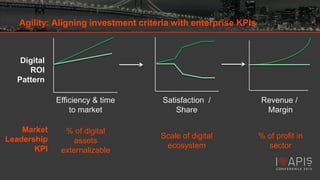

Conviction, Alignment, Agility are the three keys to staying on the right side of the digital divide. As the world becomes more programmable, digital leaders are turning conviction into a case for change and plan of action through alignment and agility. Digital leaders achieve alignment by making digital experiences a priority for all teams and connecting digital investments to key performance indicators. They demonstrate agility through an options-based approach to ROI using criteria like satisfaction, efficiency and revenue to evaluate digital investments over multiple scenarios. A programmable world means every sector is now in a race to build digital ecosystems, and alignment and agility are critical for organizations to scale their digital assets and stay ahead of competitors.