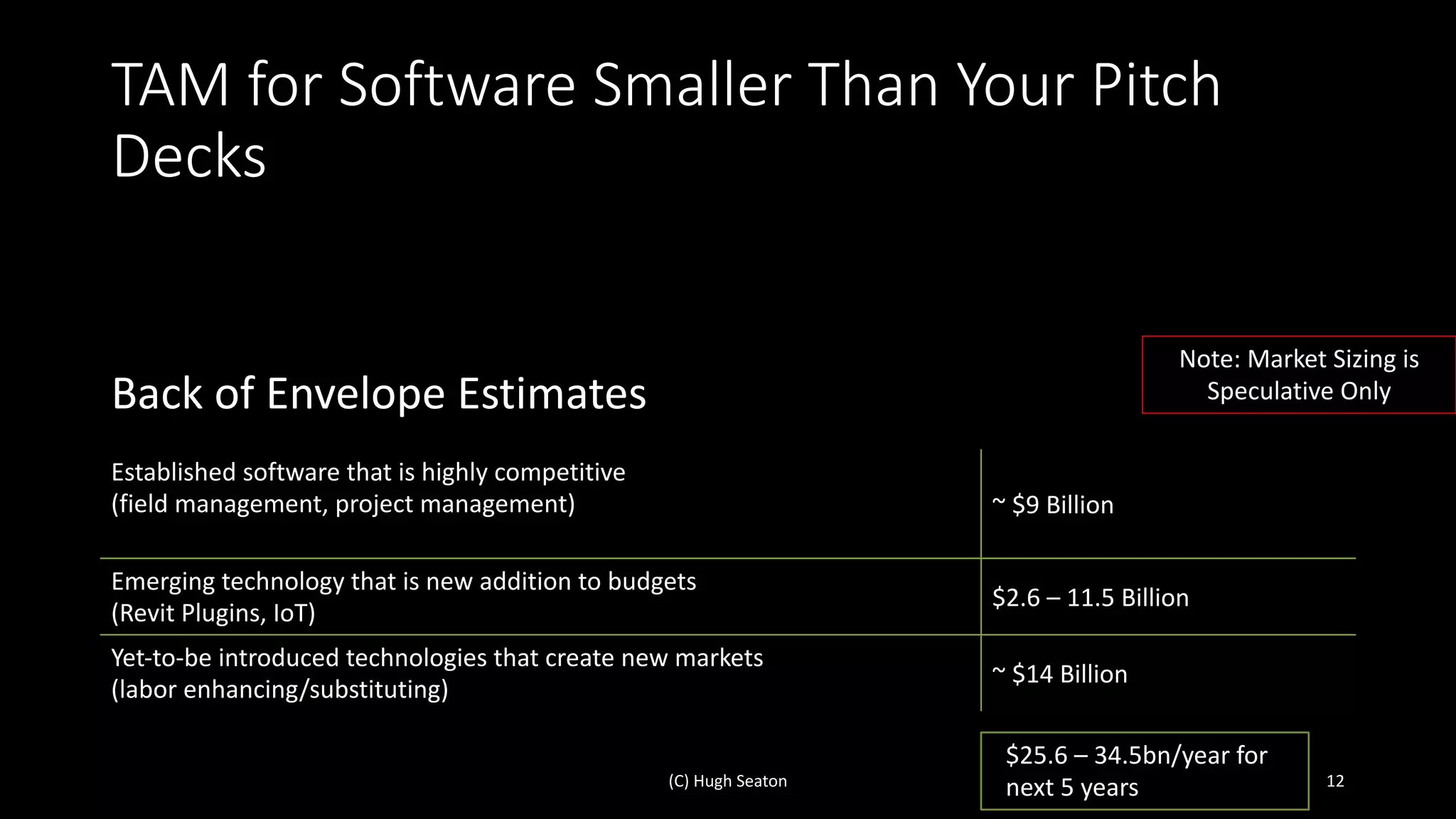

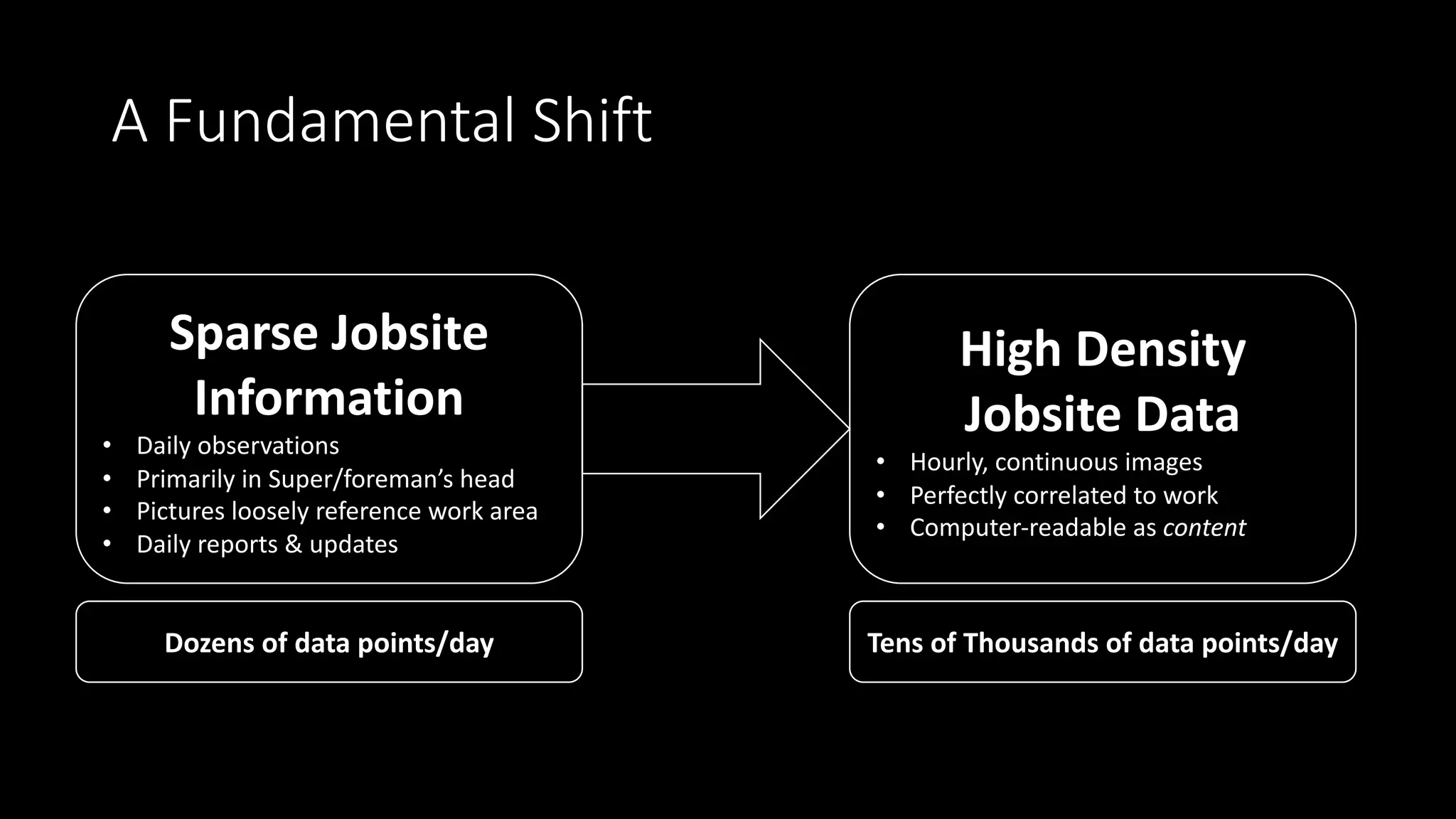

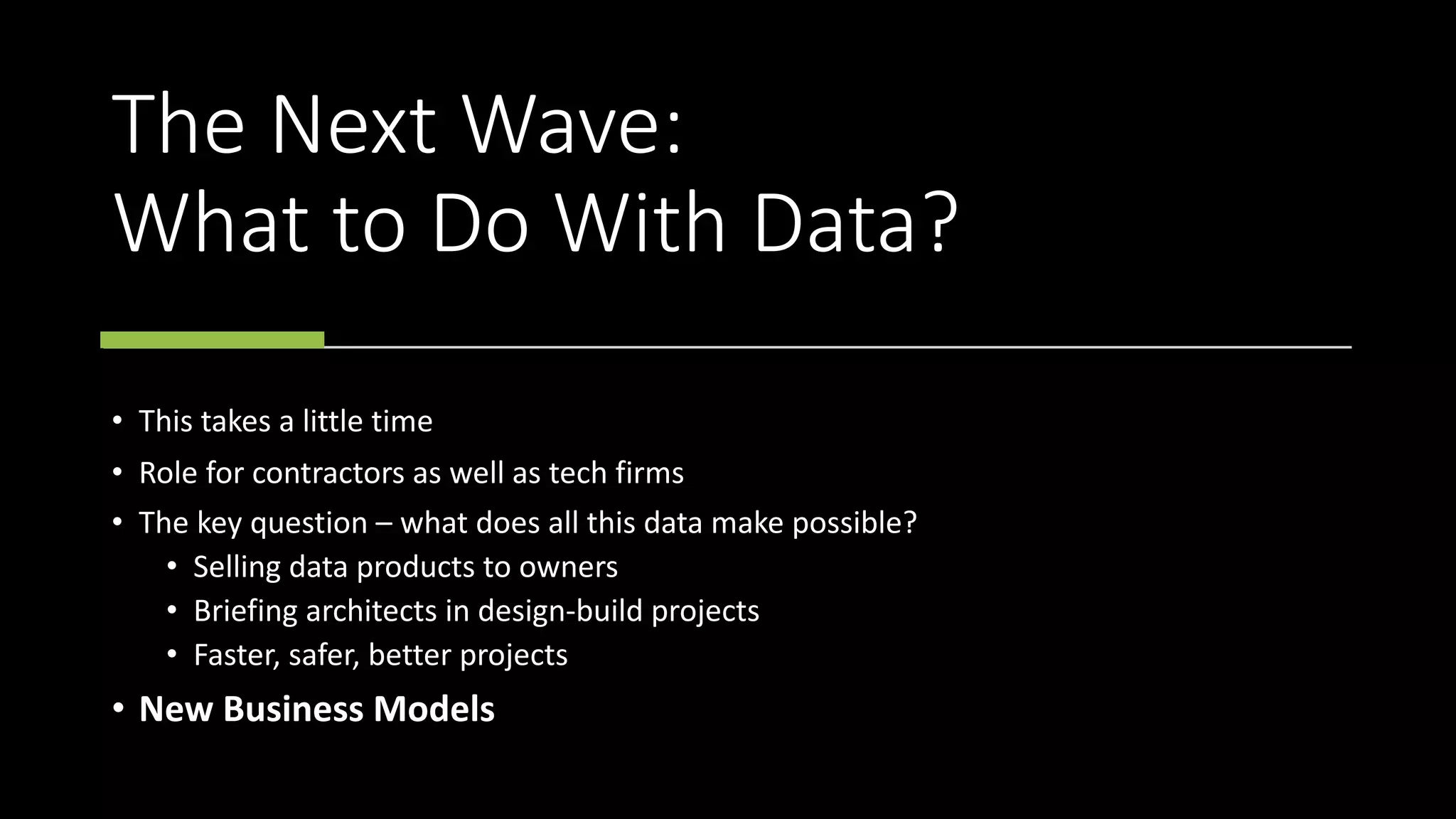

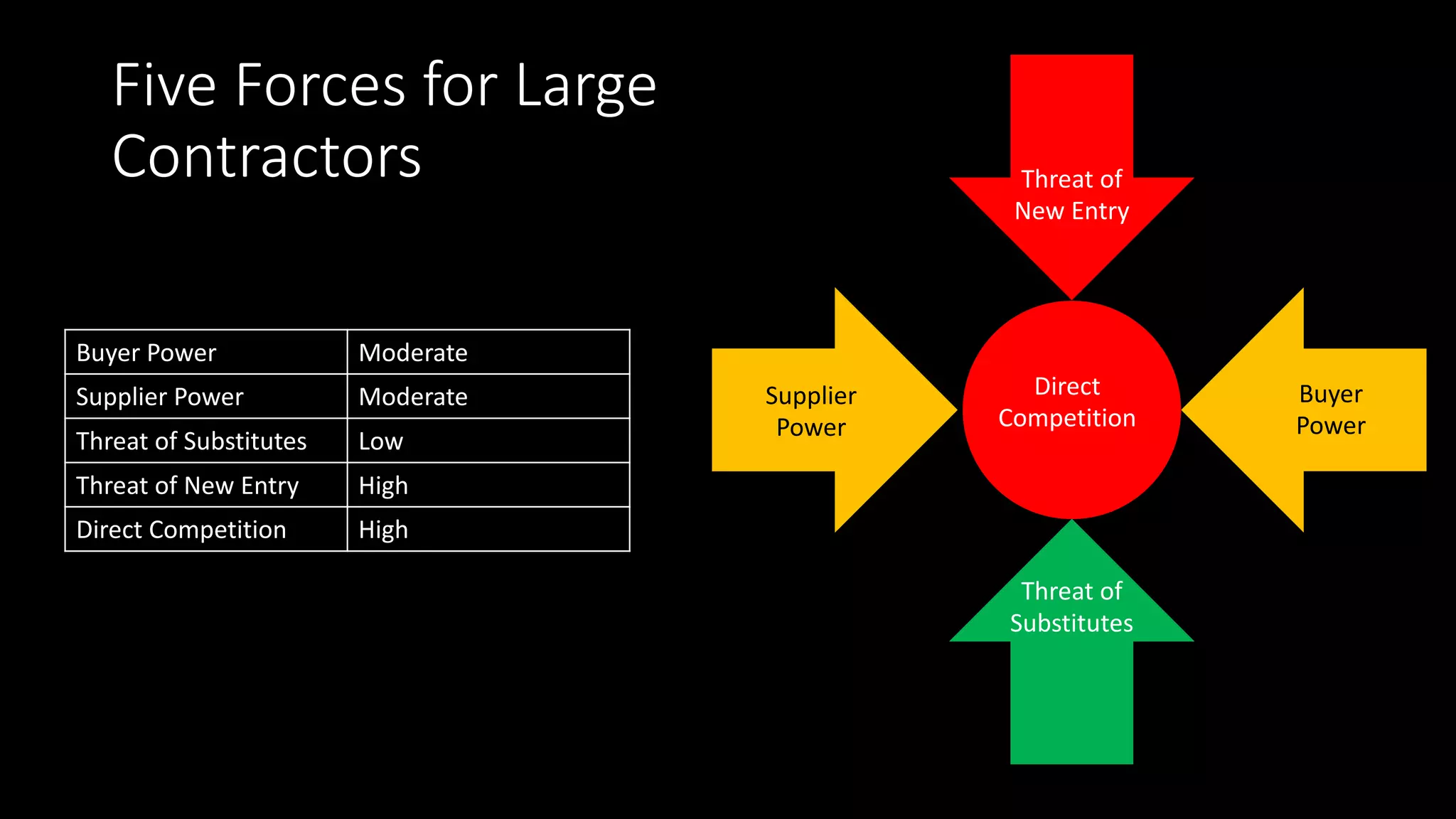

The presentation discusses the construction industry's demand for technology amid a structural labor shortage, emphasizing that technology must compensate for workforce gaps. It highlights the evolving role of IT departments in construction firms, focusing on strategic integration and cybersecurity as essential for competitive advantage. The document addresses the challenges and opportunities presented by emerging technologies and data-driven approaches in optimizing productivity and operational efficiency.