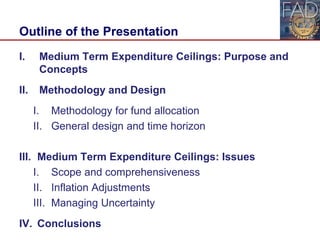

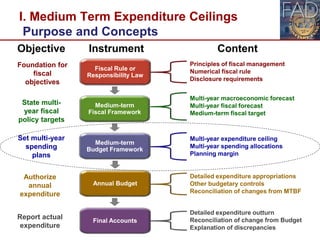

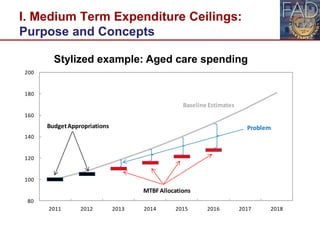

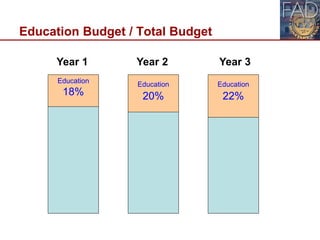

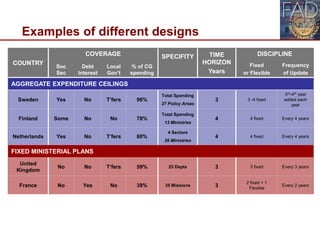

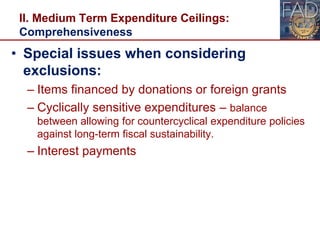

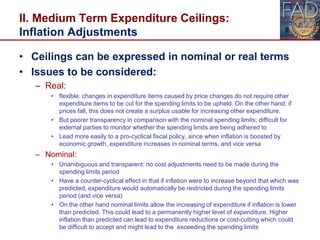

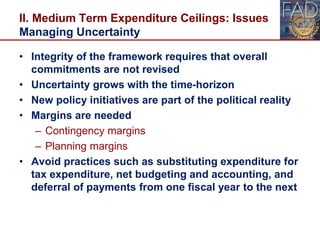

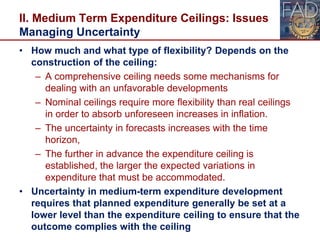

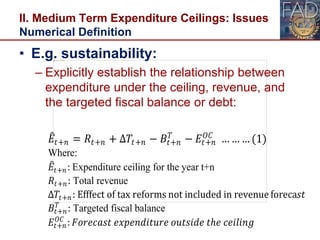

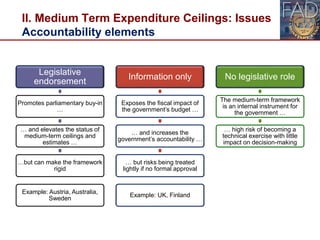

This document outlines the purpose, concepts, methodology, design, and issues related to implementing medium-term expenditure ceilings. It discusses how ceilings can provide understanding of government costs over multiple years, separate baseline estimates from new policy impacts, and ensure realistic budgeting. The methodology section covers approaches for allocating funds across sectors and designing time horizons. Key issues addressed are scope, inflation adjustments, and managing uncertainty. Different country examples illustrate variations in coverage, specificity, time horizons, and frequency of updates.