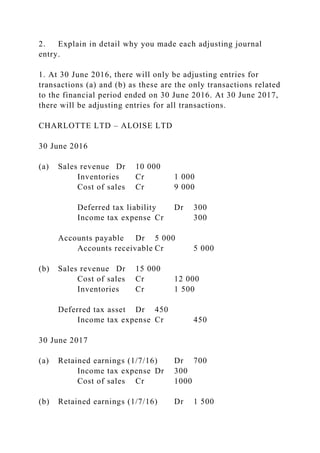

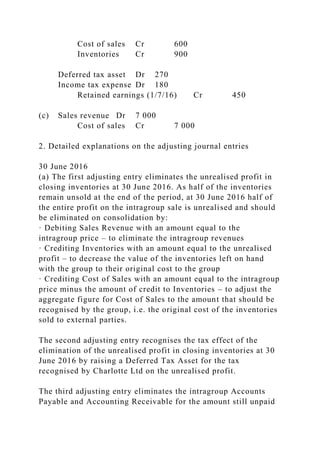

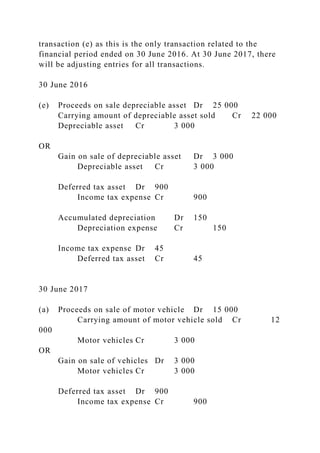

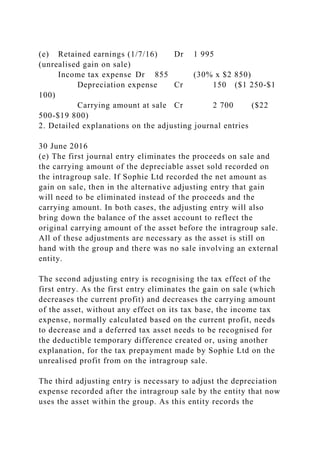

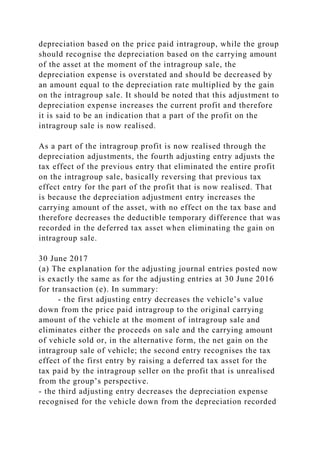

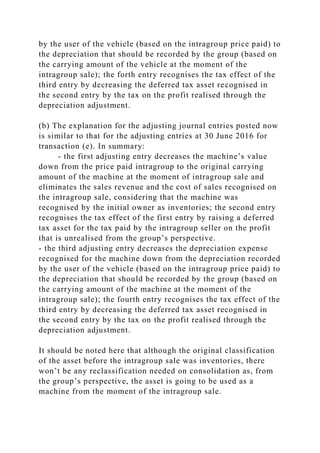

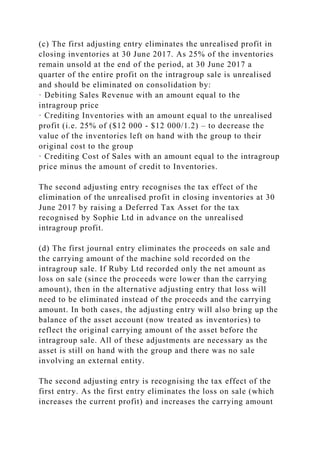

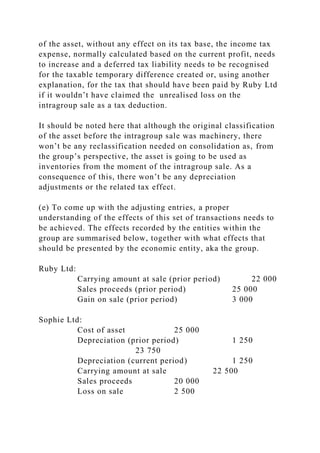

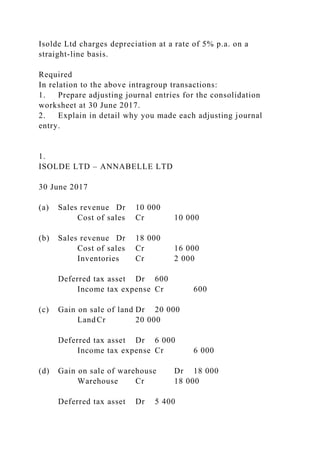

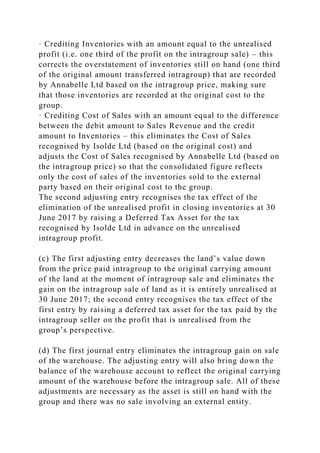

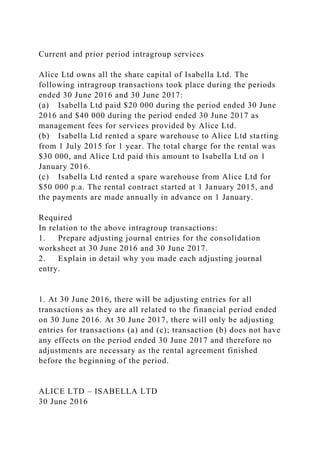

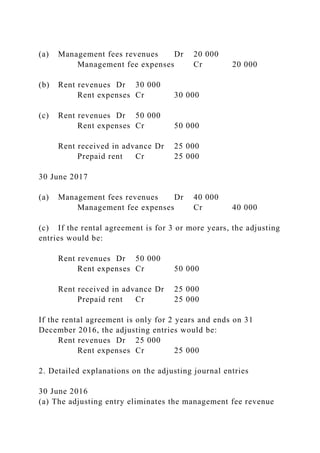

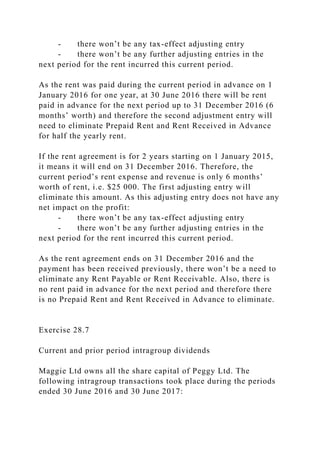

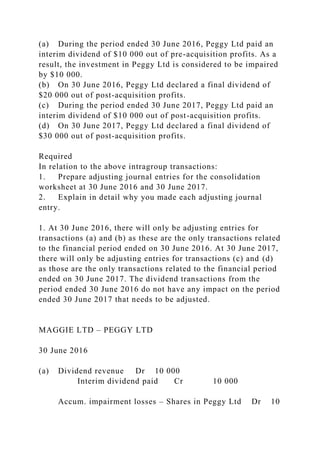

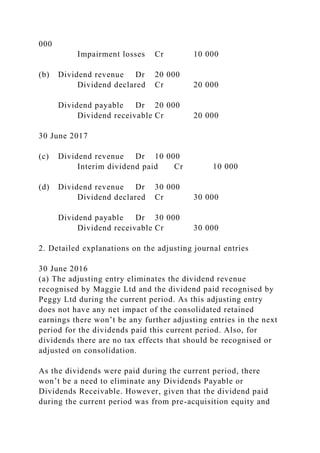

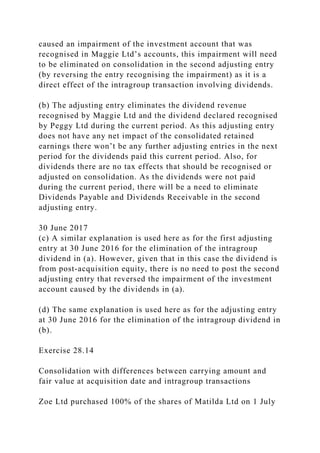

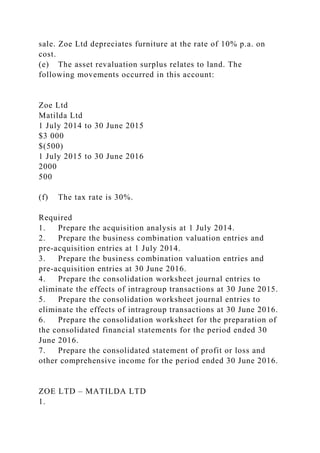

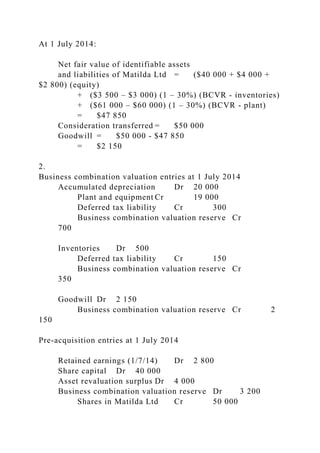

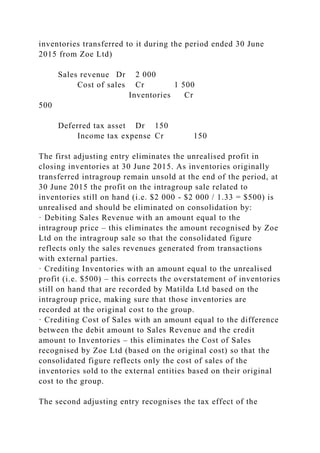

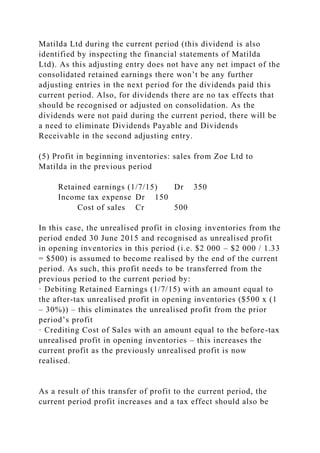

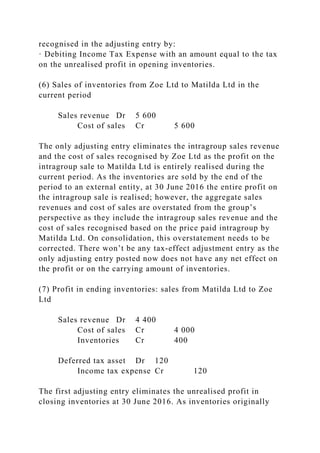

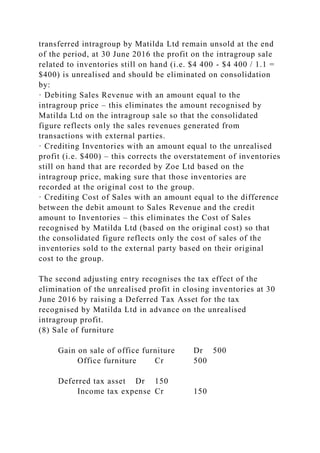

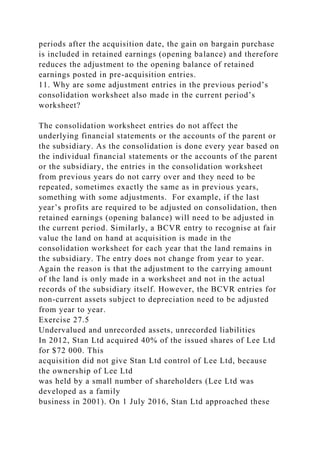

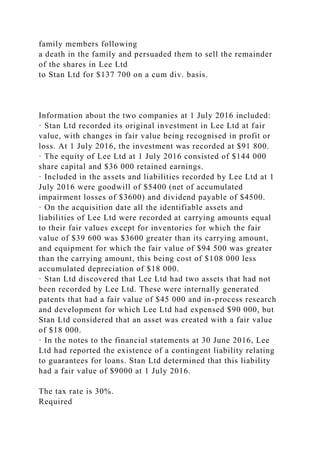

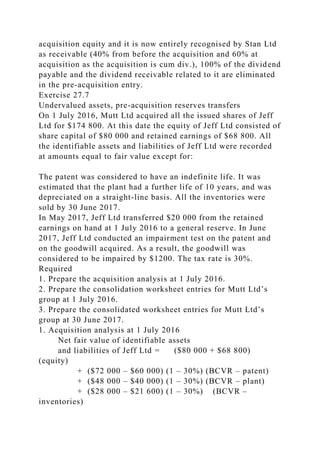

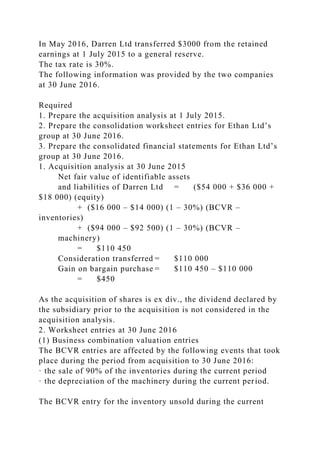

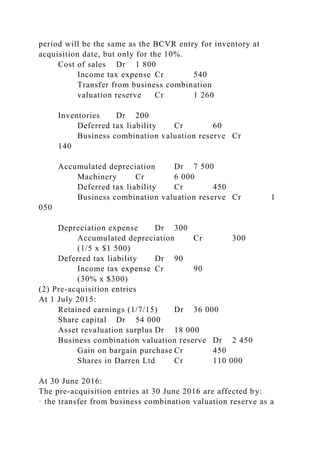

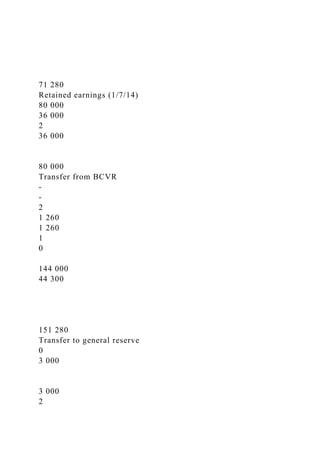

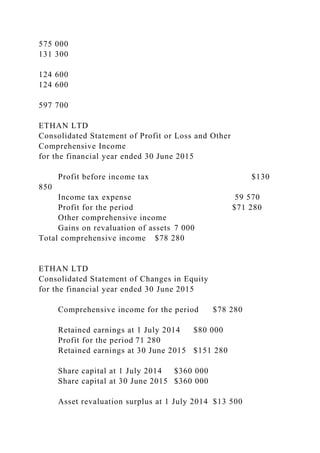

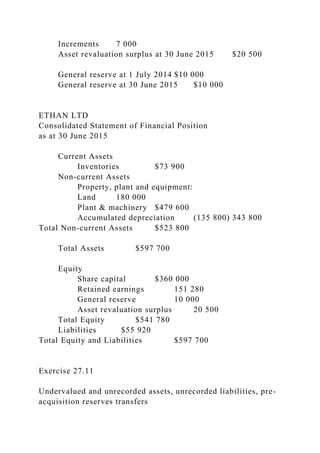

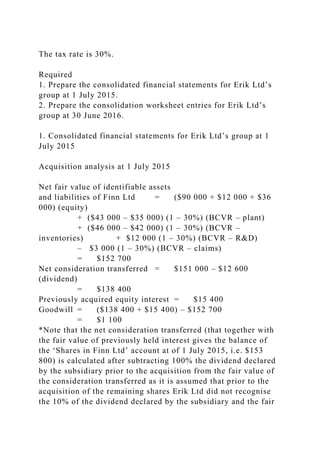

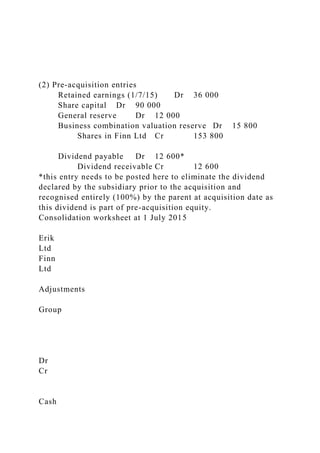

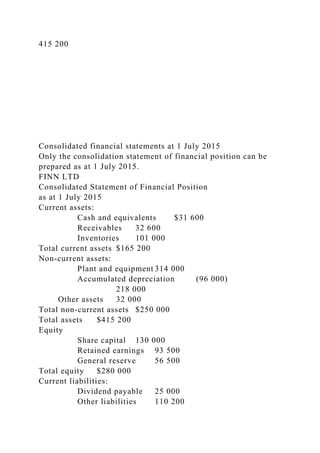

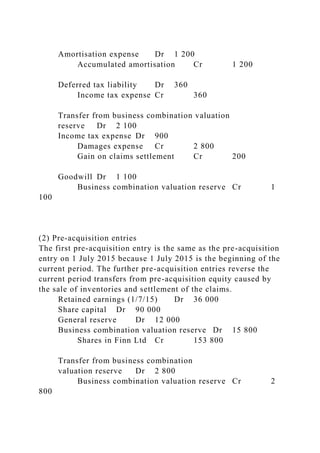

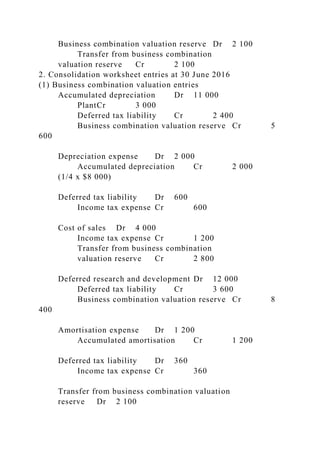

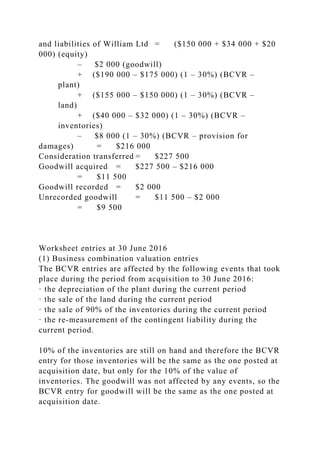

The document outlines the adjustments needed for intragroup transactions in corporate reporting, including sales of inventory, property, plant, equipment, services, dividends, and borrowings. It emphasizes that consolidated financial statements must exclude intragroup transactions to accurately reflect the financial position and performance of the group as a single entity. The importance of tax-effect accounting and the realization of profits upon the sale of inventory to external parties are also discussed.