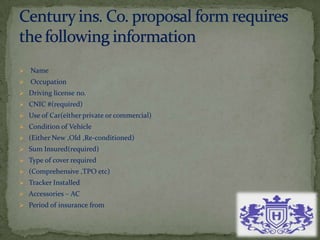

Century Insurance is a leading Pakistani insurance company operating since 1989. It is rated "A" by JCRVIS, signifying a high financial capacity. The company provides various insurance products including fire, motor, marine, travel, and health insurance. It aims to be known for integrity and excellence in customer service. The document then provides details on underwriting procedures, claims handling processes, and key insurance concepts like indemnity, insurable interest, and contribution.