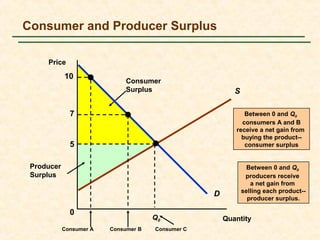

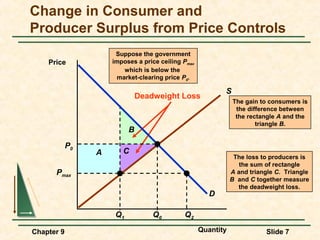

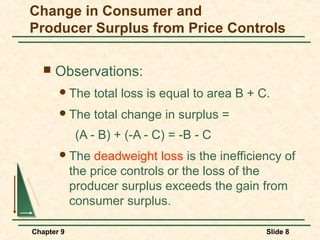

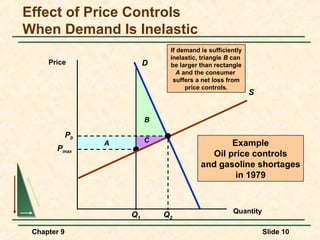

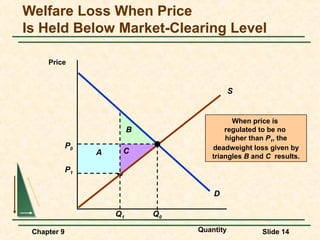

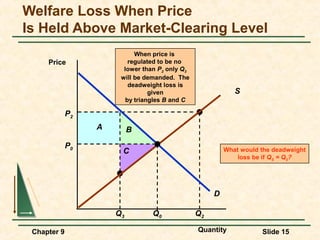

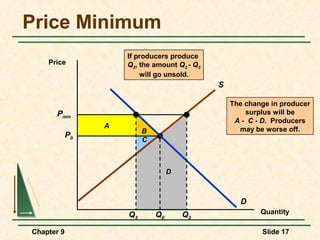

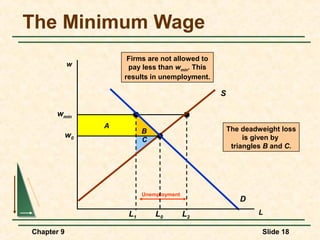

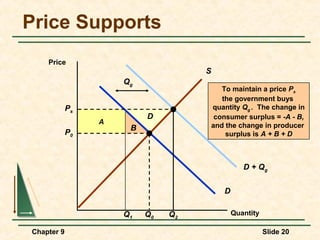

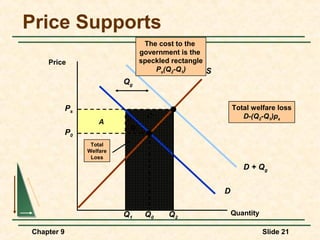

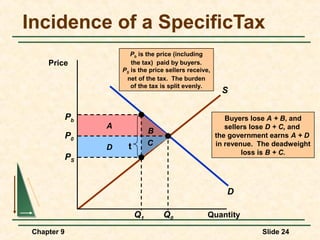

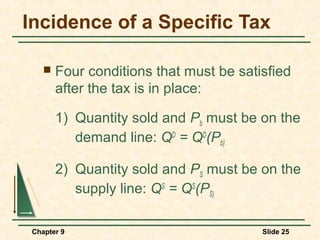

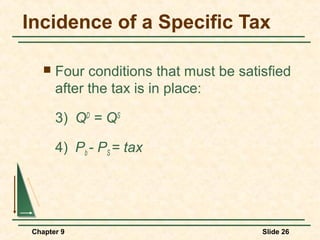

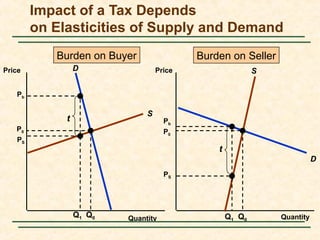

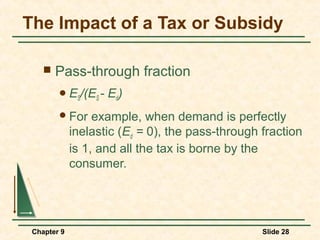

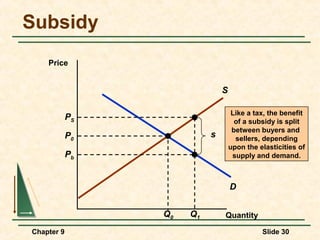

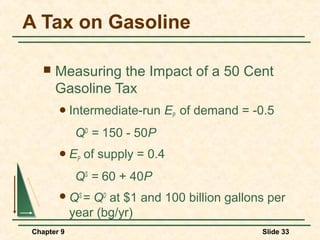

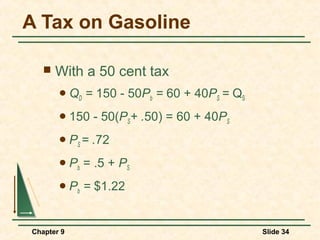

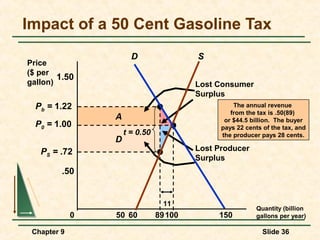

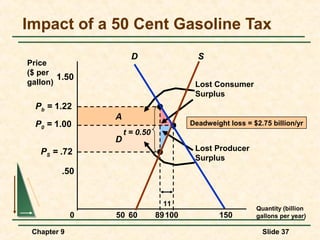

This chapter discusses the analysis of competitive markets and evaluating the effects of government policies. It covers topics such as consumer and producer surplus, price controls, minimum prices, price supports, production quotas, and taxes/subsidies. The key concepts are how these policies impact the gains and losses to consumers and producers through changes in surplus, and how this relates to the efficiency and potential deadweight loss in competitive markets when the government intervenes.