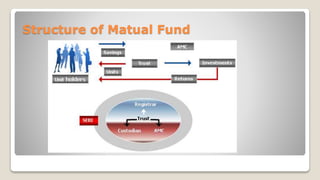

This document presents a comparative study on the performance evaluation of mutual fund schemes of SBI bank and HDFC bank. It includes an overview of the mutual fund industry in India, literature review on performance evaluation models, objectives of comparing equity diversified funds of SBI and HDFC on metrics like Sharpe ratio, Treynor ratio, Jensen's alpha. The methodology involves collecting secondary data on various fund categories like debt, equity, hybrid and analyzing the risk-adjusted returns. Key findings from the analysis of metrics and conclusions from the study are also presented.