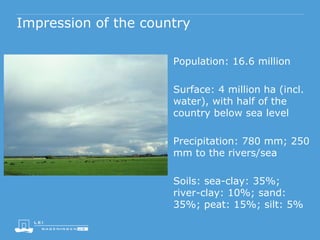

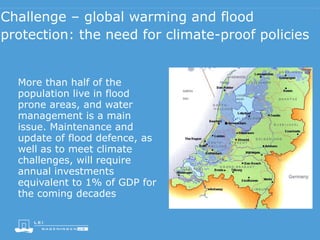

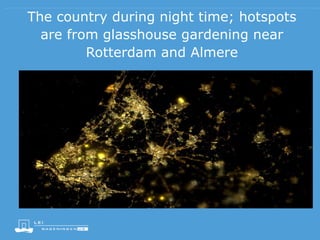

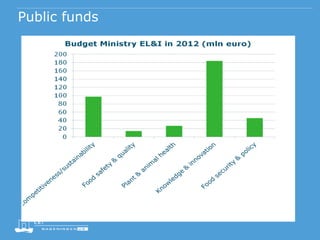

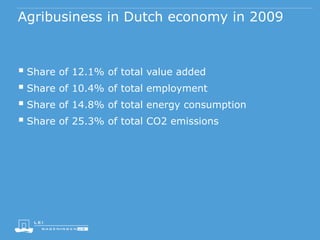

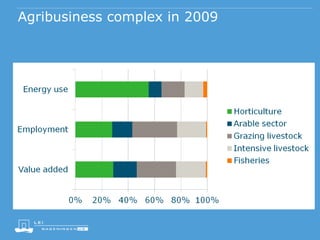

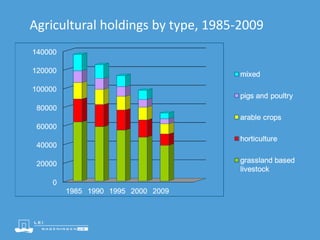

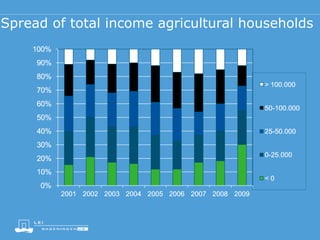

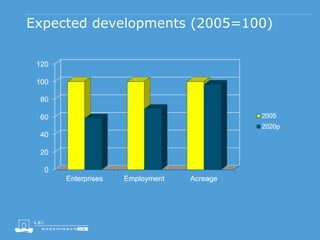

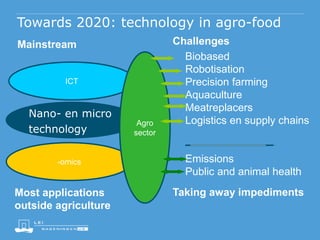

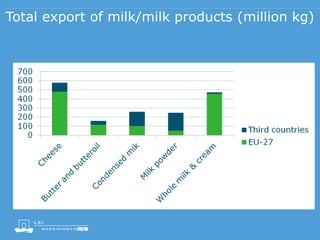

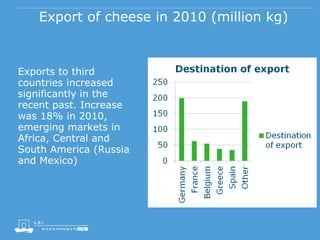

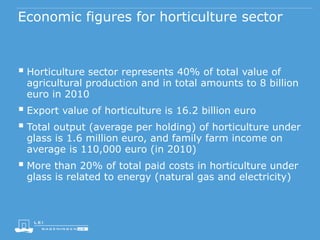

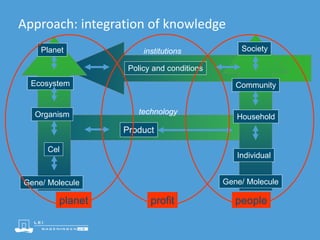

The document summarizes key aspects of Dutch agriculture, including its international focus, public policy support for competitiveness and sustainability, and integration of research and innovation. It notes the agrofood sector represents 12% of the Dutch economy. While agrofood exports and value-added increased in 2011, many farmers experienced declining incomes or losses. The number of farms continues to decline along with long-term trends. Changing global drivers and threats to the food system are discussed. Challenges around affordable food supplies, volatility, climate change and biodiversity are outlined. Features of the Dutch economy and logistics infrastructure are summarized. Successes are attributed to standards, education, cooperation, and agricultural policy. Dairy, horticulture and