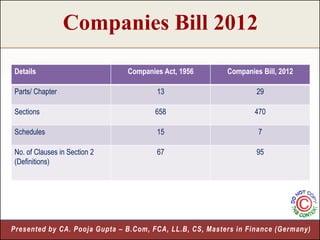

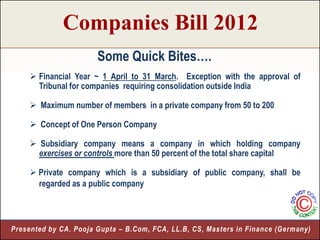

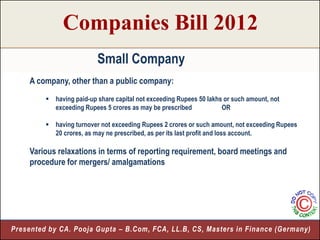

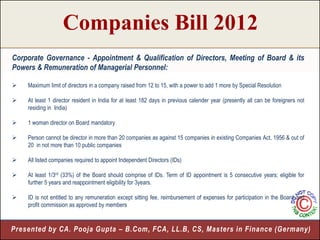

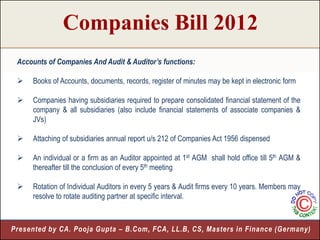

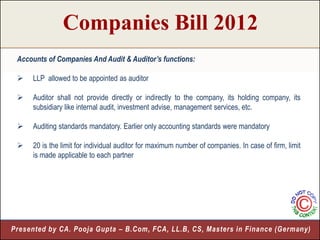

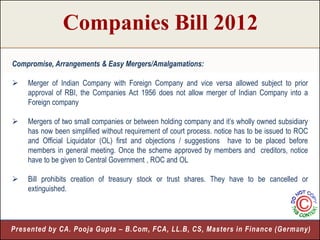

The document summarizes key aspects of the Companies Bill 2012 in India. It discusses the history of the bill and changes from previous versions. Some of the major changes covered include increasing the maximum number of members in a private company, introducing the concept of a One Person Company, mandating at least one woman director on boards, and increasing the limit of directors from 12 to 15. It also covers changes related to corporate governance, auditing standards, CSR requirements, and serious fraud investigations.