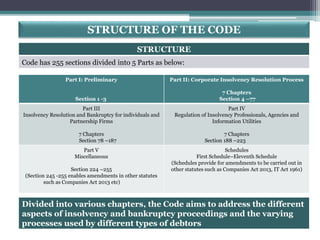

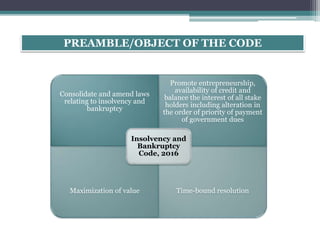

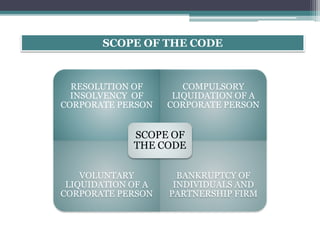

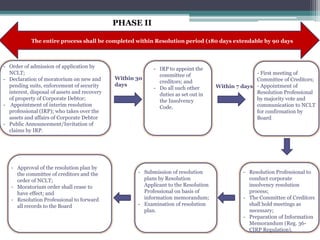

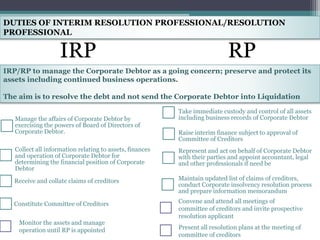

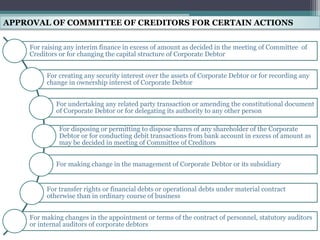

The document provides an overview of the Insolvency and Bankruptcy Code of 2016 in India. It discusses the key reasons for introducing the code, including reducing time to resolve insolvency, developing investor confidence, and addressing non-performing assets. The code aims to create a single framework for insolvency and bankruptcy proceedings. It allows for insolvency resolution and bankruptcy procedures for both corporate entities and individuals/partnership firms. The document outlines the structure and various parts of the code, as well as the roles and responsibilities of different authorities and professionals involved in insolvency resolution processes under the code.

![WHAT DOES IT CHANGE FOR THE BORROWERS

Any creditor can file an insolvency petition on default of INR 1

lakh or more

Insolvency Professional to take over the management and

operations of the borrower during Corporate Insolvency

Resolution Process

Need to be proactive in identifying issues/claims,

communicating with lenders and developing/implementing a

turnaround plan

In case of fraudulent diversion of assets, personal contribution

can be sought; imprisonment possible [Section 68]](https://image.slidesharecdn.com/ppt-interpretingibc-180626185700/85/Interpreting-Insolvency-and-Bankruptcy-Code-2016-4-320.jpg)

![APPLICABILITY OF THE CODE

The Code applies to whole of India except

Part III (Insolvency Resolution and

Bankruptcy for individuals and Partnership

Firms) which does not apply to Jammu and

Kashmir [Section 1]

The provision of the Code applies to:

a) Companies incorporated under

Companies Act, 2013 or under any

previous company law;

b) Company governed by any special Act

except so far as the said provisions are

not inconsistent with provision of such

special act;

c) LLP incorporated under Limited Liability

Partnership Act, 2008

d) Any body corporate incorporated under

any law for time being in force, as Central

Government may, by notification specify

in this behalf;

e) Personal Guarantors of Corporate

Debtor;

f) Partnership firms and Proprietorship

firms; and

g) Any other individuals.

[Section 2]](https://image.slidesharecdn.com/ppt-interpretingibc-180626185700/85/Interpreting-Insolvency-and-Bankruptcy-Code-2016-8-320.jpg)

![INSOLVENCY RESOLUTION AND LIQUIDATION FOR

CORPORATE PERSON [Part II of the Code]

When can the insolvency resolution process get triggered?

When the minimum amount of default by Corporate Debtor is Rs. 1,00,000/-

Central Government may, by notification, specify the minimum amount of

default of higher value which shall not be more than Rs. 100,00,000/- [Section

4]](https://image.slidesharecdn.com/ppt-interpretingibc-180626185700/85/Interpreting-Insolvency-and-Bankruptcy-Code-2016-10-320.jpg)

![Who can trigger the insolvency

resolution process?

Who cannot trigger the insolvency

process?

The Code provides for three types of

applicants who can trigger the corporate

insolvency resolution process:-

The Insolvency Code specifically

provides for following persons who

cannot trigger the corporate insolvency

resolution process:-

Financial Creditors;

Operational Creditors;

Corporate Applicants/Corporate Debtors

itself. [Section 7,9,10 read with Rule 4, 6

and 7 of Insolvency and Bankruptcy

(Application to Adjudicating Authority)

Rules, 2016]

A corporate debtor undergoing a corporate

insolvency resolution process;

A corporate debtor having completed

corporate insolvency process 12 months

preceding the date of making application;

A corporate debtor or financial creditor who

has violated any of the terms of resolution

plan which was approved 12 months before

the date of making application under this

chapter;

A corporate debtor in respect of whom a

liquidation order has been made. [Section 11]](https://image.slidesharecdn.com/ppt-interpretingibc-180626185700/85/Interpreting-Insolvency-and-Bankruptcy-Code-2016-11-320.jpg)

![TIME BOUND CORPORATE INSOLVENCY RESOLUTION PROCESS [S.6-54

read with Rule Insolvency and Bankruptcy (Application to Adjudicating Authority) Rules, 2016]

PHASE I

FINANCIAL CREDITOR

- Filing of application on

occurrence of default. Default

here means default not only

qua the applicant financial

creditor but also by any other

Financial creditor.

- Along with application, to

furnish record of default and

to propose of interim

resolution professional

OPERATIONAL CREDITOR

- Deliver a default notice to the corporate

debtor on occurrence of default

Within 10 days

Adequate reply Inadequate reply

Settlement

of dues

Dispute

Or

Filing of

application

CORPORATE APPLICANT

- Filing of application on occurrence

of default

- Along with application, to

furnish record of default and

to propose name of interim

resolution professional

Within 14 days

- To ascertain the existence of default. If satisfied, it shall accept, otherwise reject.

Accept

Proceed with

Phase II

Prior to rejection

Suggest rectification

Reapply Reject](https://image.slidesharecdn.com/ppt-interpretingibc-180626185700/85/Interpreting-Insolvency-and-Bankruptcy-Code-2016-12-320.jpg)

![Liquidation Estate –Inclusions and Exclusions

Inclusions [S. 36(3)] Exclusions [S. 36(4)]

Any assets over which the corporate debtor has

ownership rights.

Assets that may/ may not be in possession of the

corporate debtor, including encumbered assets.

Tangible assets (movable/ immovable).

Intangible assets (such as IPs), shares held in a

subsidiary, financial instruments, insurance policies,

contractual rights.

Assets subject to determination of ownership by the court

or authority.

Assets recovered through proceedings for avoidance of

transactions.

Assets in respect of which secured creditor has

relinquished security interest.

Any other property belonging to or vested in the

corporate debtor on the insolvency commencement date.

Proceeds of liquidation when realized.

Assets in the possession of corporate debtor but owned

by third parties.

Assets in security collateral held by financial service

providers and are subject to netting and set-off in multi-

lateral trading or clearing transaction.

Personal assets of shareholder or partner of corporate

debtor provided they are not held on account of

avoidance transaction.

Assets of subsidiaries (Indian/ foreign) of the corporate

debtor.

Any other assets as may be specified by the IBBI.](https://image.slidesharecdn.com/ppt-interpretingibc-180626185700/85/Interpreting-Insolvency-and-Bankruptcy-Code-2016-17-320.jpg)

![ Application for fast track insolvency resolution may be made in respect of following

corporate debtors, namely:

a small company as defined under clause (85) of section 2 of Companies Act, 2013 (18 of

2013)

a Start-up (other than the partnership firm) as defined in the notification of the

Government of India in the Ministry of Commerce and Industry dated the 23rd May,

2017

an unlisted company with total assets, as reported in the financial statement of the

immediately preceding financial year, not exceeding rupees one crore.

Fast Track Insolvency process to be completed within 90 days from commencement date.

Provision for 1 extension only, for a period of 45 days.

Process may be initiated by a creditor or corporate debtor by furnishing proof of default

or any other specified details.

Process largely the same as that for regular insolvency resolution.

FAST TRACK CORPORATE INSOLVENCY RESOLUTION [S. 55-58]](https://image.slidesharecdn.com/ppt-interpretingibc-180626185700/85/Interpreting-Insolvency-and-Bankruptcy-Code-2016-18-320.jpg)

![VOLUNTARY LIQUIDATION [S. 59-67]

• May be initiated by the corporate debtor even without existence of default.

• Declarations from majority of directors needed, to be verified by an affidavit of solvency and that the

company is not being liquidated to defraud any creditor.

• Special resolution of members needs to be passed within 4 weeks of declaration by directors requiring

the company to be liquidated and appointing an Insolvency Professional to act as a liquidator.

• If the company owes debt then resolution to be approved by creditors representing 2/3rd value of debt

within 7 days of the members resolution.

• RoC and the Board to be notified of the decision to voluntarily liquidate within 7 days of passing such

resolution and subsequent approval by the creditors.

• Liquidation process shall be deemed to have commence from date of passing resolution.

• Liquidator to make application to NCLT for dissolution when the affairs are wound up and assets have

been completely liquidated.

• NCLT to pass an order dissolving the corporate debtor from the date of such order

• Copy of such order to be forwarded to the RoC within 14 days from the date of order](https://image.slidesharecdn.com/ppt-interpretingibc-180626185700/85/Interpreting-Insolvency-and-Bankruptcy-Code-2016-19-320.jpg)

![Insolvency resolution process costs & liquidation costs

Secured creditors, if security has

been relinquished as specified in

section 52

Workmen’s dues (past 24

months)

Employees’ wages (past 12 months)

Financial debts to unsecured creditors

Government dues

Secured creditors

(residual amt. if the

creditor enforces his

securities)

Other remaining debts

Preference Shareholders

Equity Shareholders

or partners

LIQUIDATION WATERFALL [S. 53]](https://image.slidesharecdn.com/ppt-interpretingibc-180626185700/85/Interpreting-Insolvency-and-Bankruptcy-Code-2016-20-320.jpg)