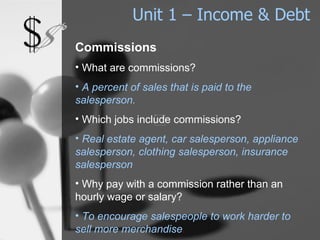

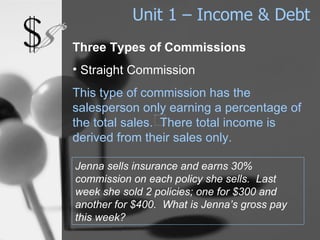

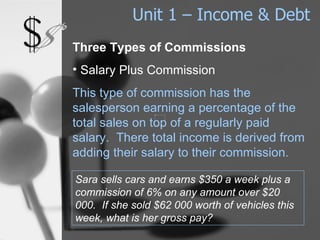

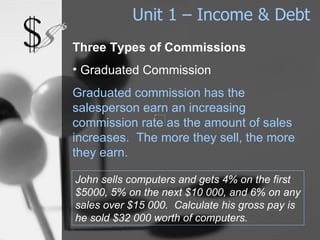

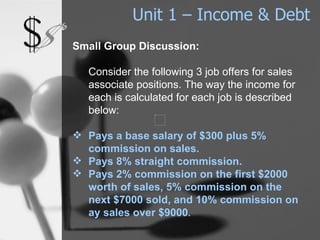

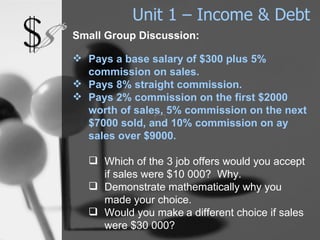

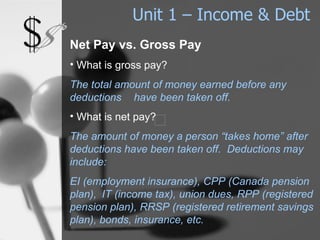

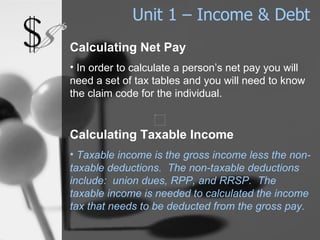

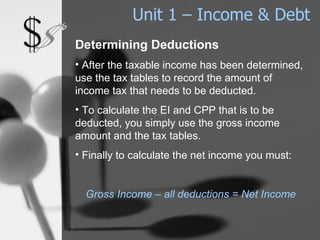

The document discusses calculating employee pay, including commissions. It defines different commission structures like straight commission, salary plus commission, and graduated commission. It provides examples of calculating earnings under each structure. It also discusses calculating net pay by deducting taxes, insurance, and other amounts from gross pay.