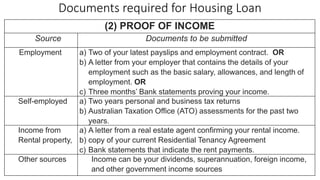

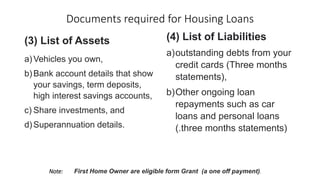

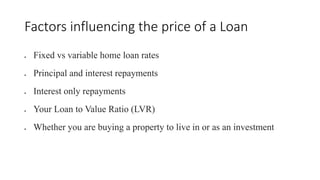

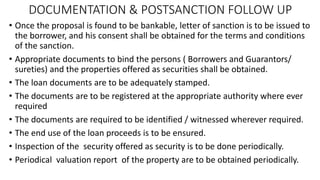

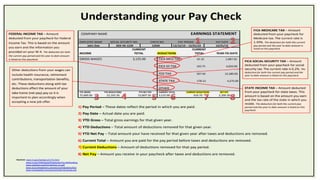

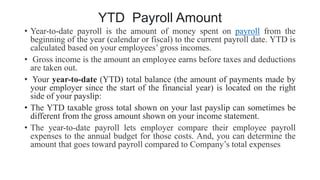

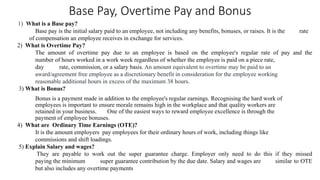

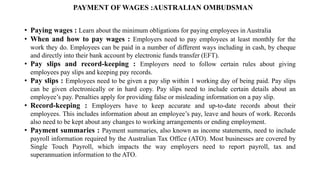

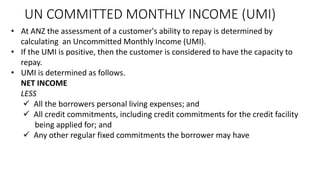

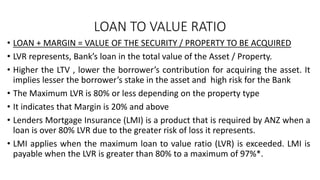

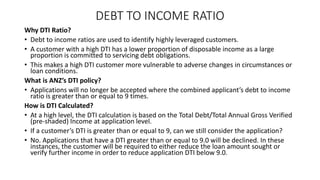

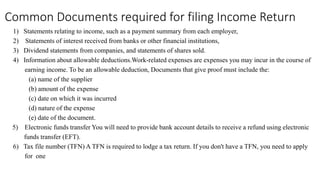

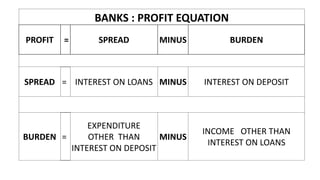

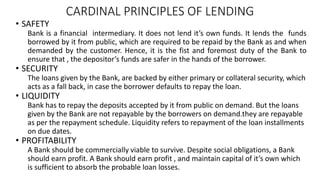

This document provides information about assessing credit and housing loans in Australia. It covers topics such as understanding the principles of credit, calculating simple interest, the Australian financial year, payslips, income types such as base income and overtime pay, documents used to verify income, assessing a customer's financial position through metrics like debt-to-income ratio and loan-to-value ratio, and the home loan application process. Key documents that may be used to verify income include payment summaries and tax records. Financial assessments consider a customer's uncommitted monthly income, debts, and the ratios of their debt to income and the loan value to the property value.

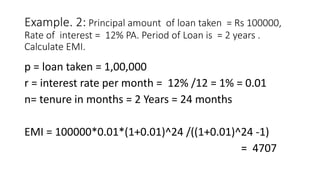

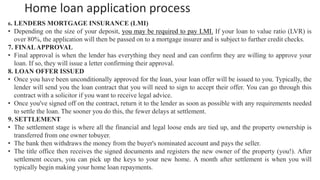

![EMI CALCULATION

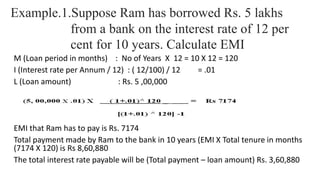

Mr. Amar wants to avail Car loan of Rs

10 lakhs, from the Bank repayable in 5

years, at an interest rate of 12%PA

L = Loan Amount = Rs 10,00,000

I = Interest rate per = 12% / 12=

0.12 / 12 = 0.01

M= Loan period in month = 5 years

=60 Months

1000000 *0.01[(1.01)^60]

[1.01^60] -1

[10000 *1.8167] /0.8167

18167 / 0.8167

22244

EMI = Rs 22244](https://image.slidesharecdn.com/anz-230518202147-a3304ef2/85/ANZ-pdf-23-320.jpg)