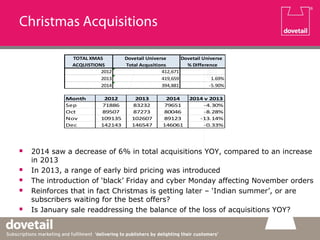

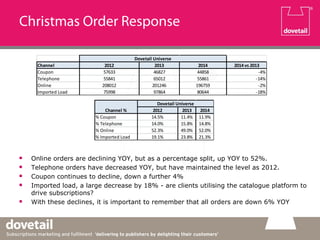

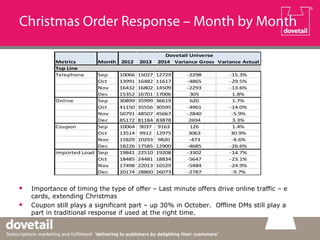

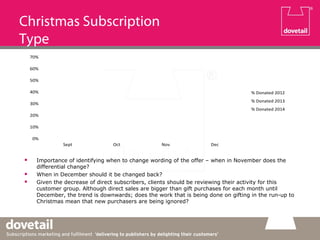

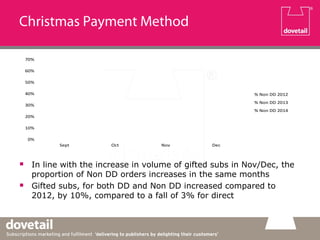

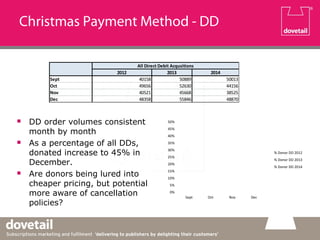

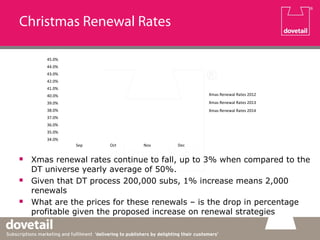

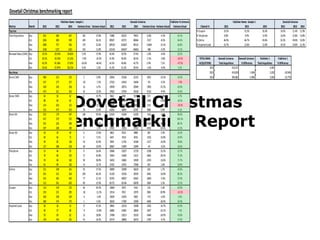

The Dovetail Christmas Performance Report indicates a 6% year-on-year decline in acquisitions with online orders up to 52% of total orders. Key insights include a growing trend for subscribers to wait for better offers, such as during Cyber Monday, and a consistent volume of direct debit orders despite falling renewal rates. The report emphasizes the importance of timing promotional offers and the need to analyze individual performance data to adapt strategies effectively.