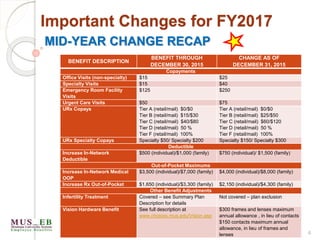

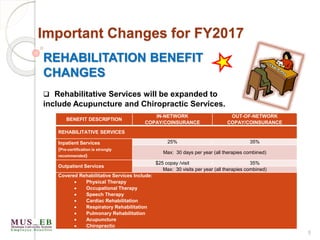

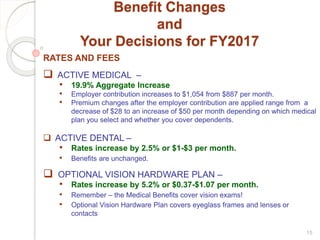

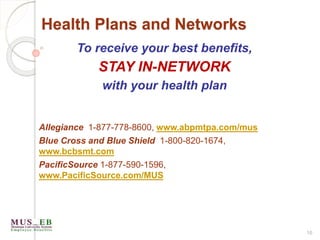

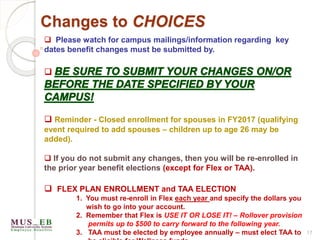

This document provides information about benefit changes and open enrollment for the FY2017 benefit year. It summarizes important changes to medical, dental, and vision plans including increased copays and deductibles. Rehabilitation benefits will be expanded to include acupuncture and chiropractic services. The document reviews eligibility, flexible spending accounts, tax advantaged accounts and outlines rates and fees for FY2017. It emphasizes the importance of using in-network providers and provides contact information for the various medical plan vendors.