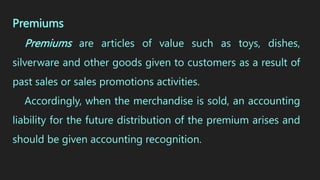

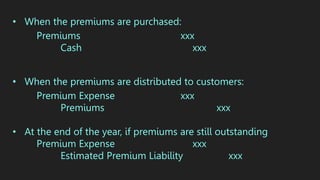

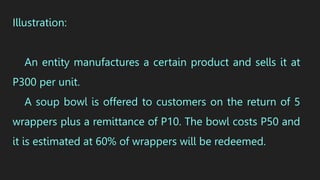

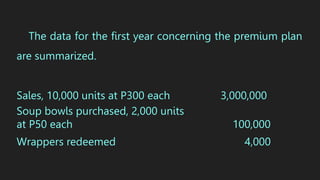

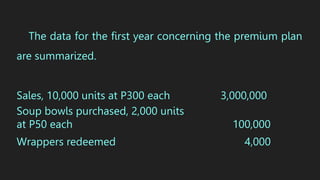

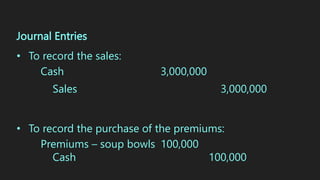

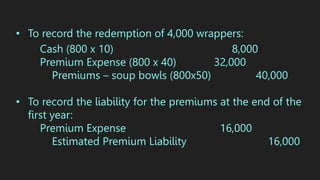

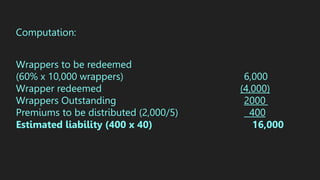

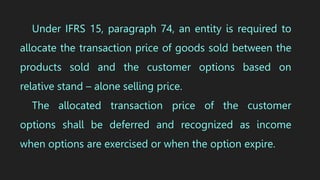

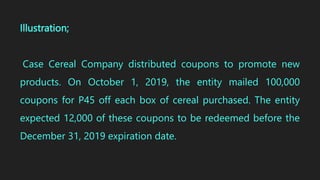

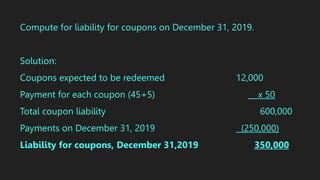

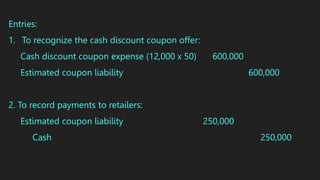

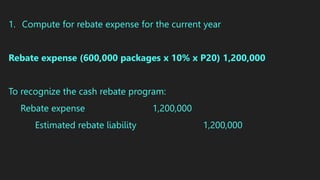

Premiums, coupons, and cash rebates given to customers to promote sales are accounted for as liabilities at the time of sale. When premiums are purchased, an asset is recorded. As premiums are distributed to customers, an expense is recorded to reduce the liability. At year-end, any remaining liability is estimated based on expected future redemptions. The transaction price from goods sold must be allocated between the products and any customer options, like coupons, based on standalone selling prices.