This document discusses different types of shareholder equity, including:

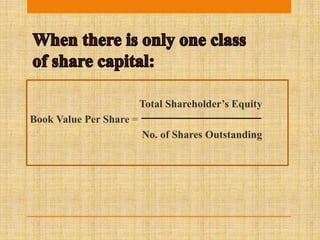

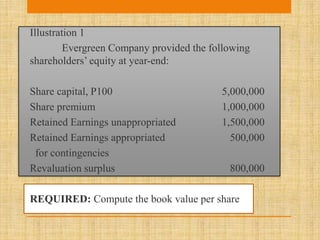

- Book value per share, which is shareholder equity divided by number of shares

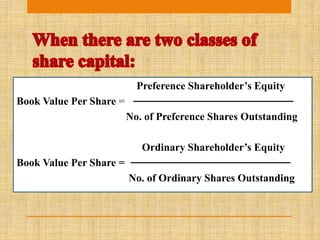

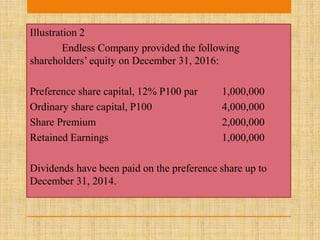

- Preference shareholder equity divided by preference shares

- Ordinary shareholder equity divided by ordinary shares

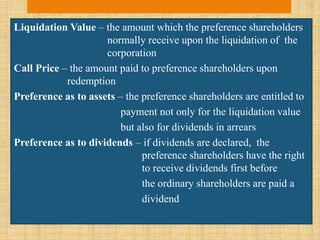

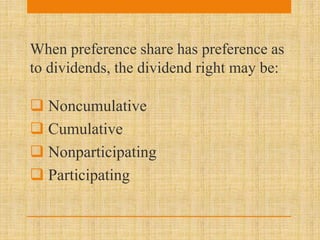

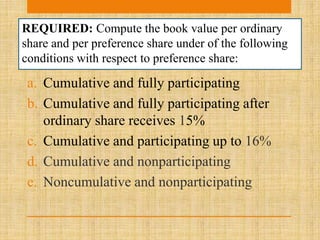

It also defines liquidation value, call price, and different types of preference shares and their dividend rights, such as cumulative, noncumulative, participating, and nonparticipating.

The document includes two illustrations calculating book value per share under different shareholder equity structures.