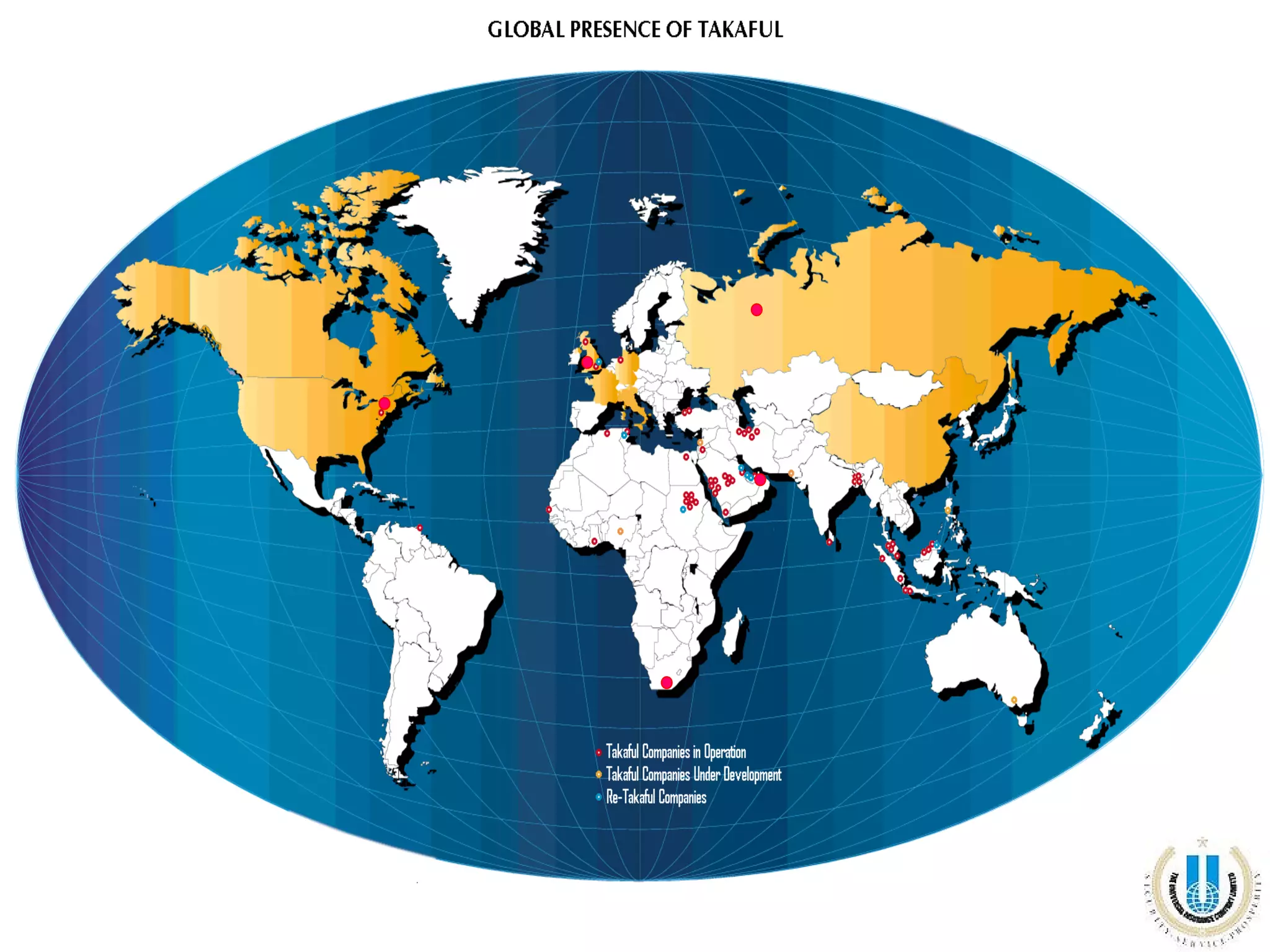

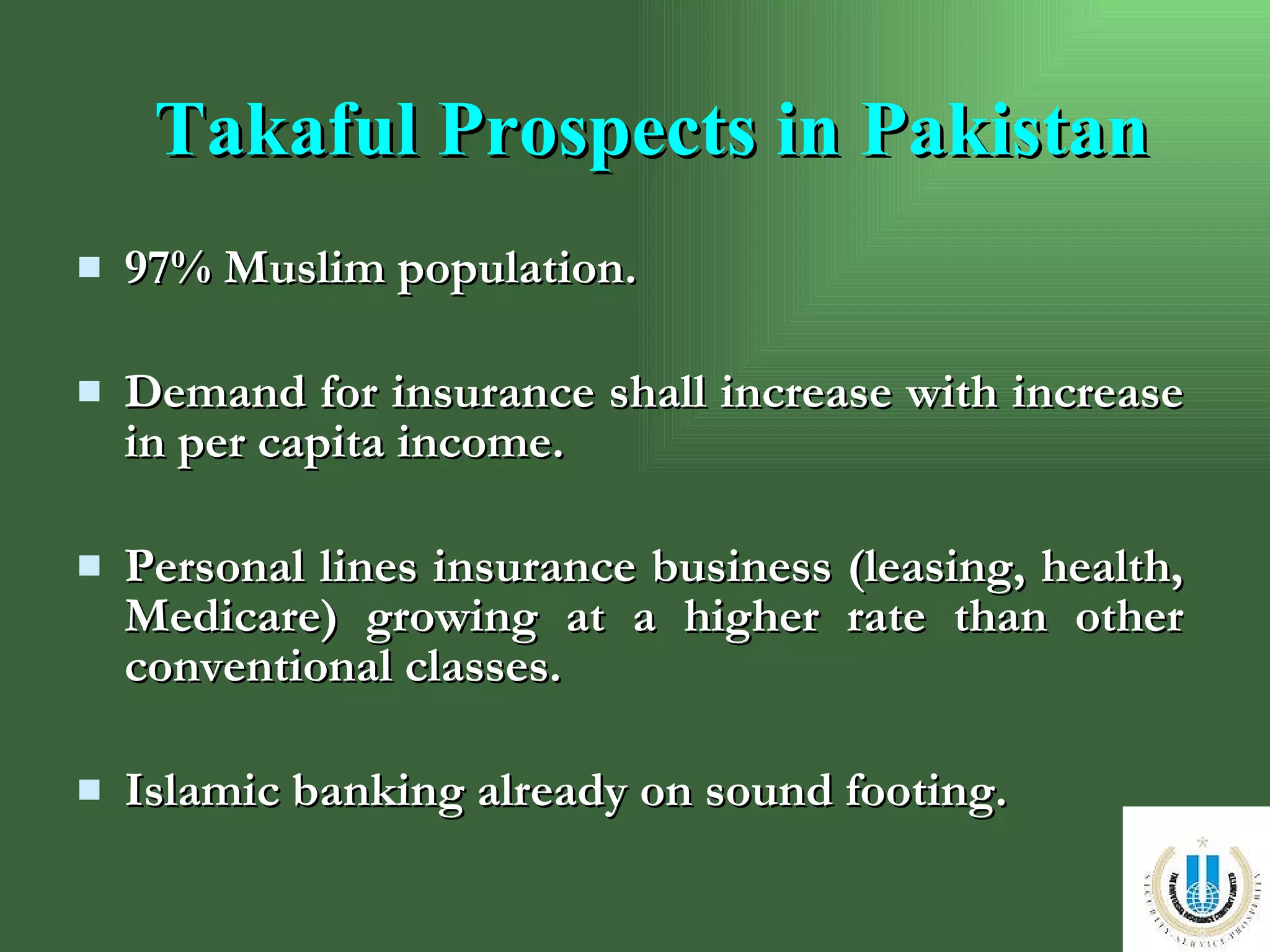

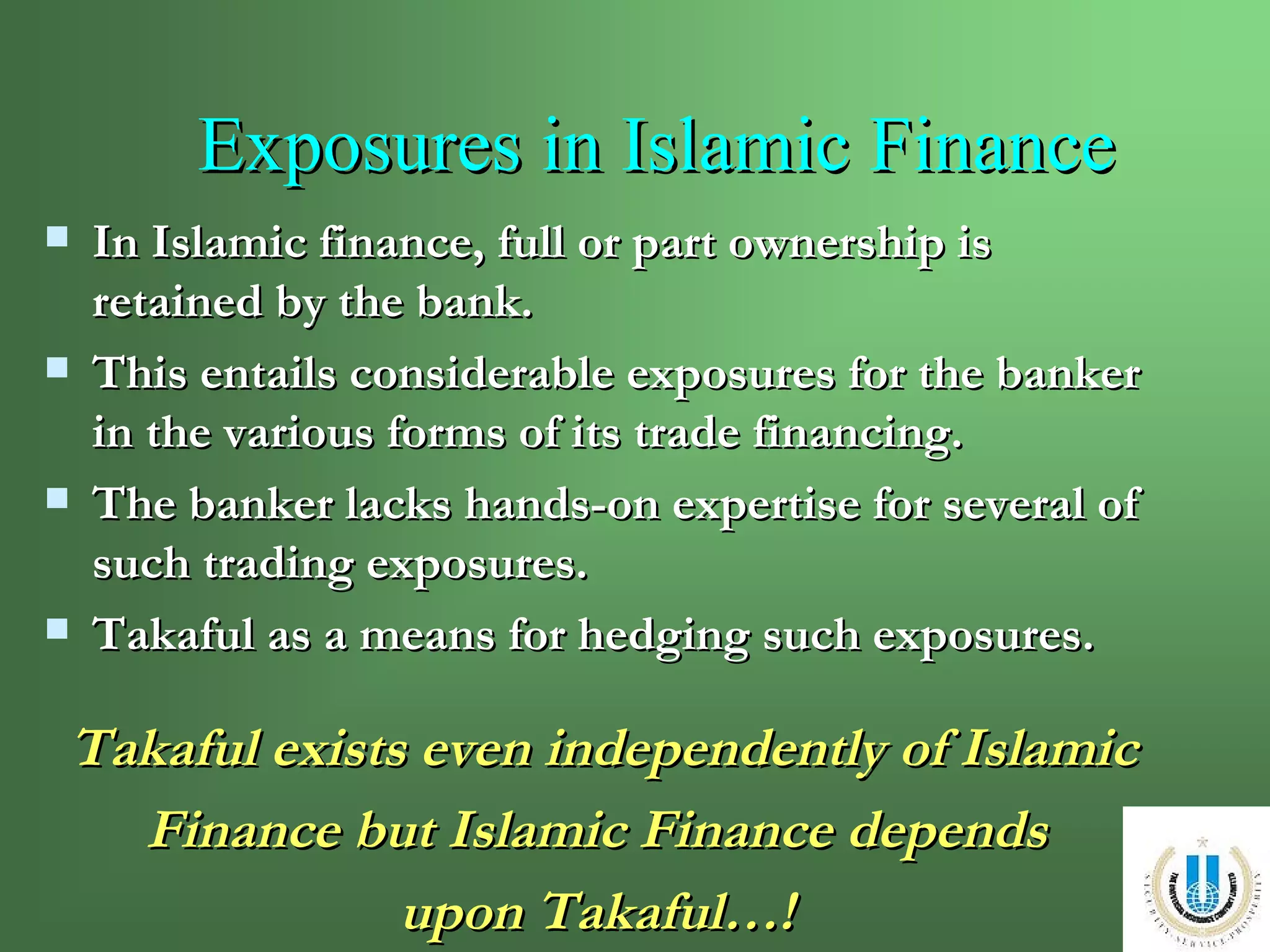

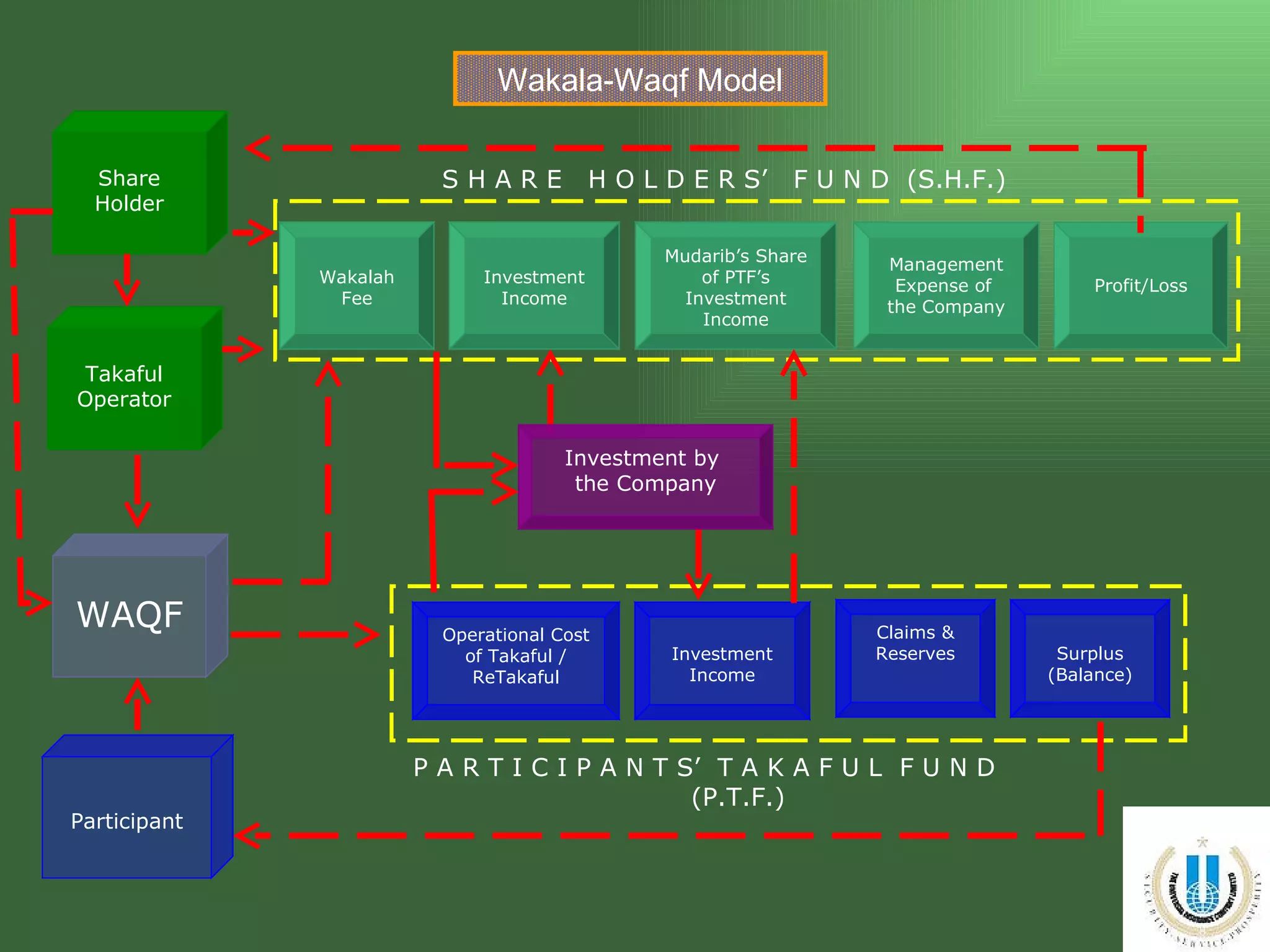

The document discusses the role of takaful in Islamic finance, highlighting its definition, historical development, and current status with over 180 takaful companies globally. It emphasizes how takaful provides mutual protection and risk mitigation within Islamic financial practices, contrasting it with conventional banking. The Universal Insurance Company Ltd. outlines its strategic plans for expanding takaful services in Pakistan, targeting growing demand and the unique needs of the Muslim population.

![Thankyou for your attention [email_address]](https://image.slidesharecdn.com/capt-m-jamilakhtarkhan-110106042626-phpapp01/75/Presentation-by-Capt-m-jamil-akhtar-khan-21-2048.jpg)