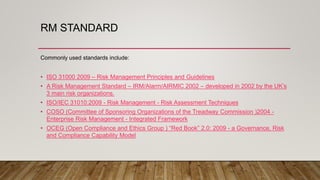

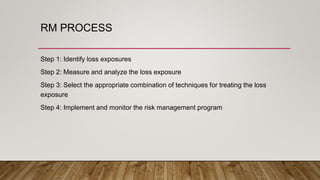

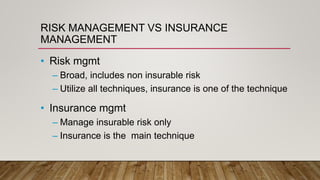

This document provides an overview of corporate risk management. It discusses the history and evolution of risk management from a focus on insurance to a broader scientific approach. The key aspects covered include the importance of risk management, common risk management standards, the risk management process, and the objectives of risk management both before and after a loss occurs. Risk management aims to identify exposures, analyze risks, and select appropriate techniques to treat exposures, such as risk control methods and risk financing options. The ultimate goals are to reduce costs, losses, and business disruption.