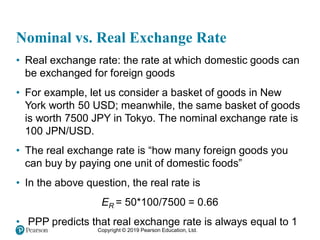

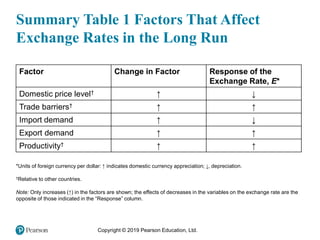

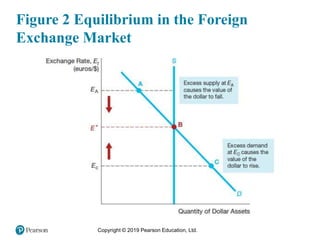

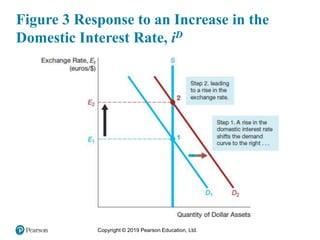

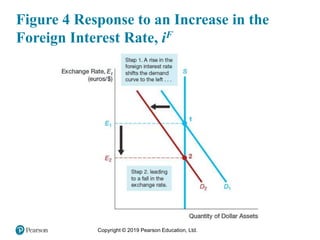

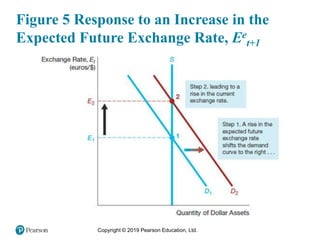

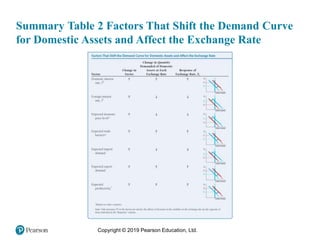

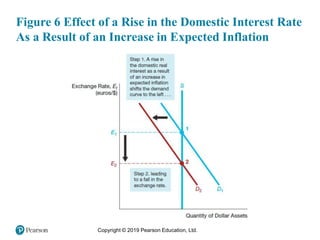

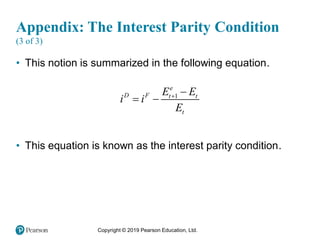

This chapter discusses the foreign exchange market and how exchange rates are determined. It outlines the factors that affect exchange rates in both the long run and short run. In the long run, exchange rates are influenced by relative price levels, trade barriers, productivity, and demand for domestic versus foreign goods. In the short run, exchange rates are determined by supply and demand in the foreign exchange market, and are impacted by interest rates, expected inflation rates, and expectations of future exchange rates. The chapter provides examples and diagrams to illustrate these concepts.