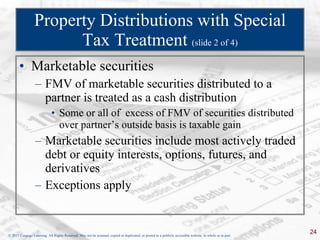

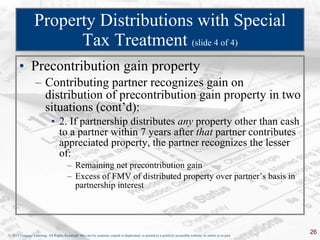

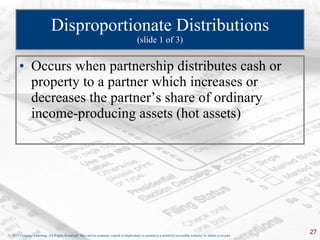

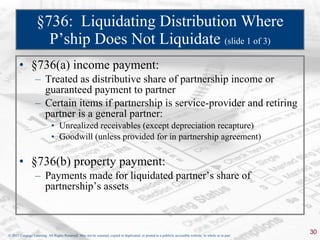

The document discusses various types of partnership distributions including liquidating distributions, nonliquidating distributions, and disproportionate distributions. It provides details on how these different types of distributions are treated for tax purposes, such as whether the partner or partnership recognizes gain or loss, how basis is allocated, and special rules around precontribution gain property and marketable securities. Examples are also provided to illustrate the tax treatment of proportionate liquidating and nonliquidating distributions.

![If you have any comments or suggestions concerning this PowerPoint Presentation for South-Western Federal Taxation, please contact: Dr. Donald R. Trippeer, CPA [email_address] SUNY Oneonta](https://image.slidesharecdn.com/chapter11-110410195018-phpapp01/85/Chapter-11-54-320.jpg)