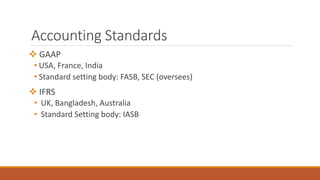

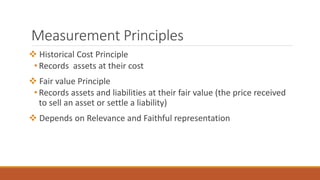

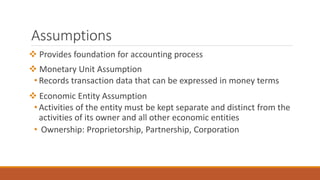

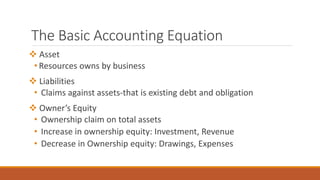

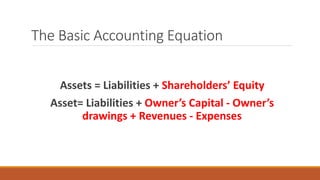

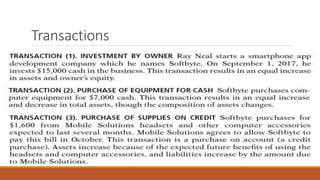

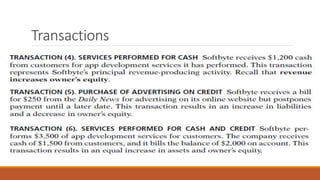

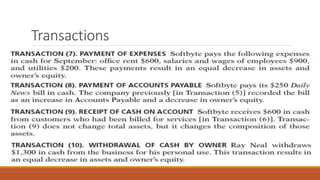

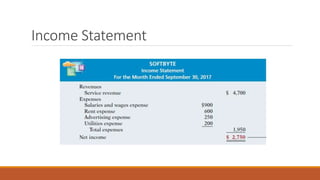

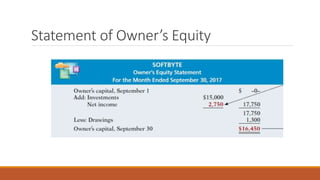

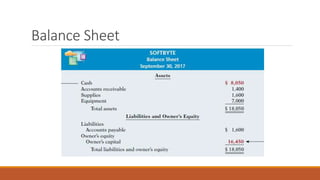

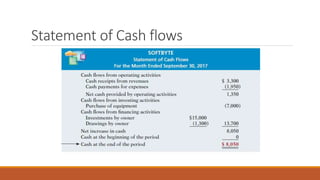

Accounting provides comparable, reliable financial information to both internal and external users through identifying, recording, and communicating a company's transactions and financial position. It uses standards like GAAP and IFRS and principles such as historical cost and fair value. The basic accounting equation is Assets = Liabilities + Shareholders' Equity, and every transaction has a dual effect. Financial statements like the balance sheet, income statement, and statement of cash flows are produced and there are career opportunities in fields like public, private, and governmental accounting.