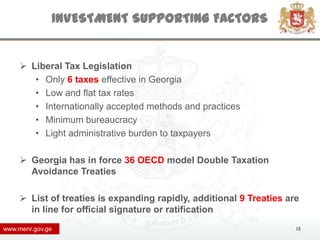

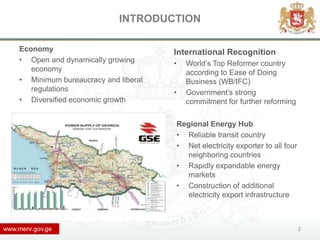

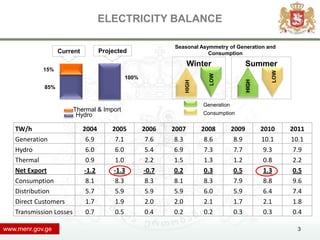

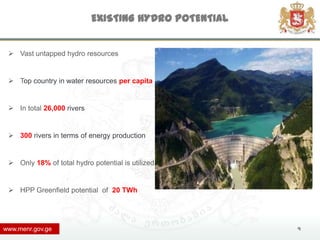

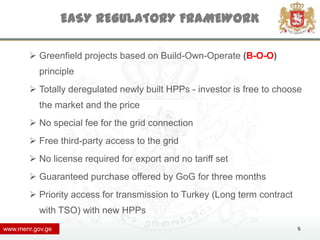

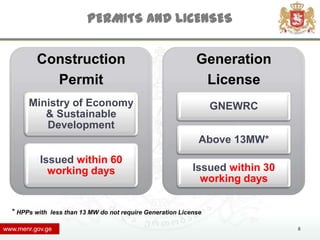

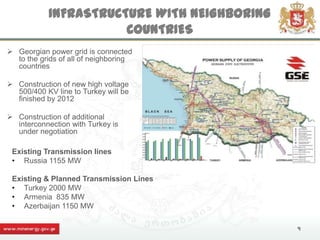

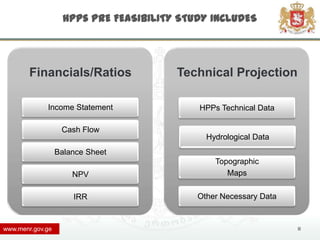

The document summarizes hydropower potential and investment opportunities in Georgia. It notes that Georgia has vast untapped hydro resources and an easy regulatory framework for hydropower projects. The country aims to utilize its hydro potential to become a regional energy hub and export electricity to neighboring countries. The Ministry of Energy and Natural Resources of Georgia invites investors to develop numerous hydropower plant projects ranging from small to large scale.

![LARGE-SIZE HYDRO PROJECT

Namakhvani HPP (Cascade Type)

Installed capacity – 450 MW;

Av. Annual Generation – 1,6 TWh;

Estimated investment cost – USD 800 mln.

Namakhva

Tvishi Joneti

ni

Installed capacity 100 MW 250 MW 100 MW

Annual average

386 GWh 941 GWh 354 GWh

generation

Height of dam 56.5 m 111.0 m 31.0 m

Concrete

Type of dam CVC gravity Rock fill

arch

Type of diversion Tunnel Tunnel Channel

Gated over Tunnel, In river,

Type of spillway

Expression of interests on: dam gated gated

Maximal water head 36.3 m 83.0 m 32.0 m

Number of turbines 2 units 3 units 2 units

A. Consultancy services and, Type of turbines Kaplan Francis Kaplan

2 x 110, 1 x 2 x 50

B. EPC contractor Power of units [MW] 2 x 50

30 MW

www.menr.gov.ge 12](https://image.slidesharecdn.com/2tbilisi-120731091431-phpapp01/85/Changes-in-Georgian-Energy-Sector-12-320.jpg)