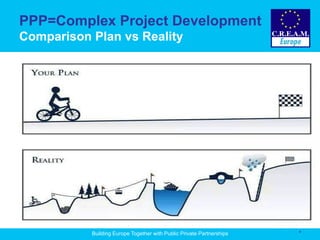

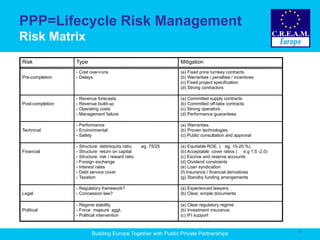

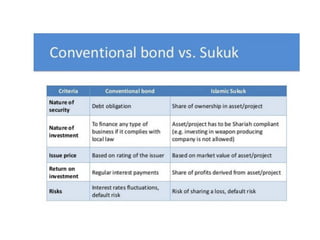

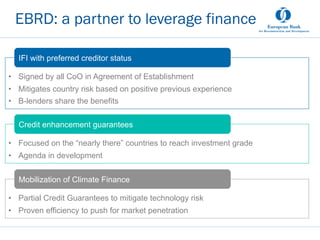

The presentation from the 5th GIB Summit discusses the challenges of structuring sustainable infrastructure projects, emphasizing the importance of understanding government perspectives and risk management. It highlights various strategies for overcoming barriers, including legal frameworks, capacity building, and tailored financing options provided by institutions like the EBRD. The next GIB Summit is scheduled for May 24-25, 2016, in Basel, and further information is available at www.gib-foundation.org.