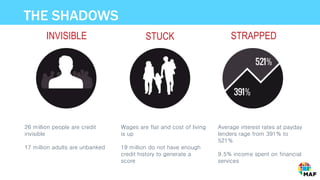

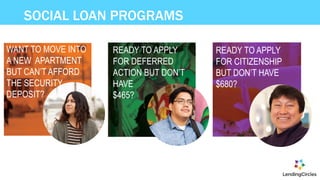

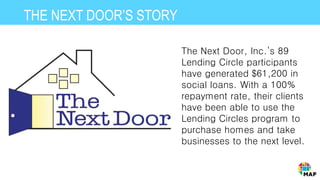

Mission Asset Fund is a nonprofit aiming to establish a fair financial marketplace for families, addressing the needs of the 26 million credit invisible and 17 million unbanked individuals. They propose a solution through lending circles, providing financial education and support, which has shown significant individual and national impact by helping participants build credit and reduce debt. The initiative seeks new partnerships to expand its reach and support community development.