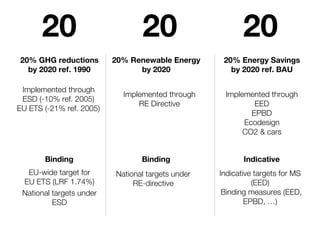

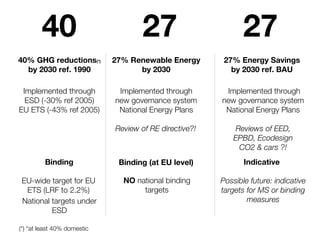

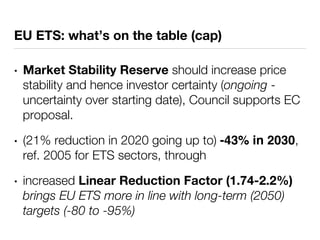

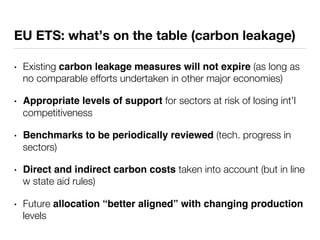

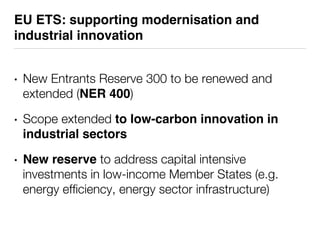

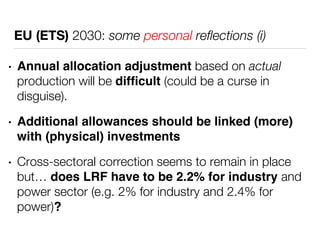

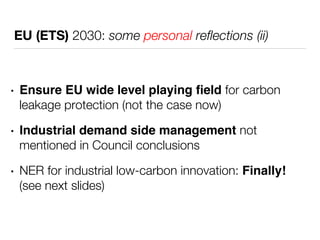

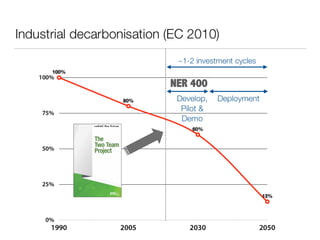

The EU's 2030 Climate and Energy Framework aims for a 40% reduction in greenhouse gas emissions and a 27% increase in renewable energy, with various binding and indicative measures for implementation. The framework includes adjustments to the EU Emissions Trading System to enhance price stability and support industrial innovation, particularly in low-carbon technologies. Additionally, it emphasizes addressing carbon leakage risks and fostering collaboration for innovation in industrial sectors.