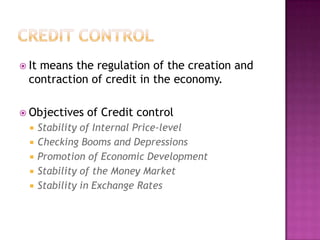

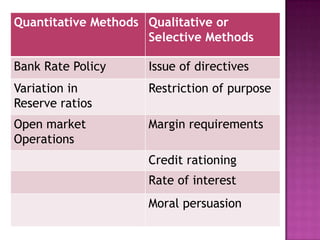

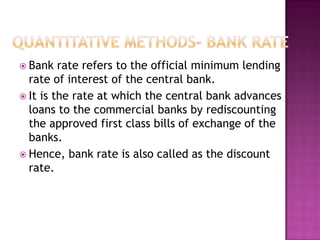

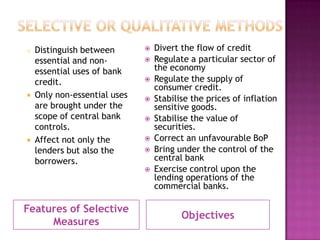

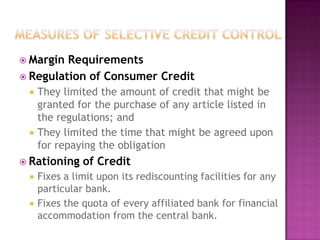

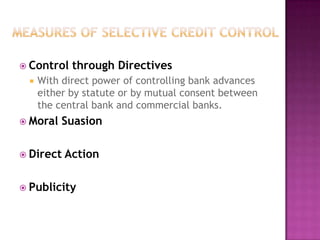

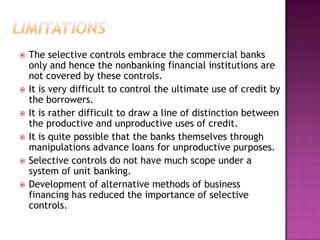

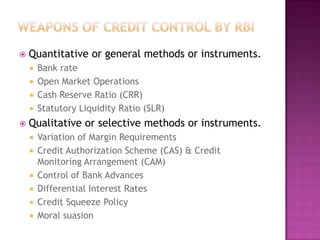

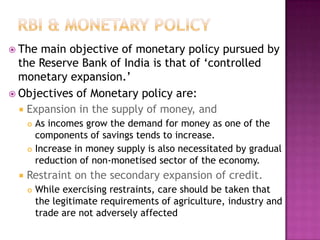

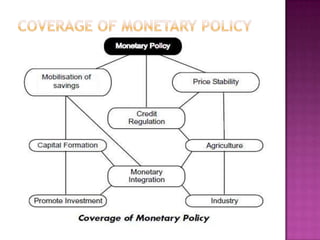

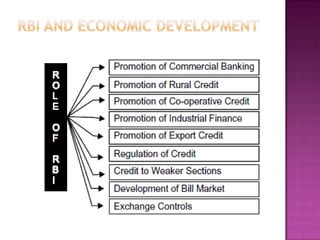

This document discusses the role and functions of central banks. It explains that central banks act as the leader of the money market in each country, supervising commercial banks and regulating currency and credit. Central banks have objectives like promoting financial stability, maintaining currency value, ensuring price stability, and promoting economic growth. They engage in various activities like issuing currency, managing foreign exchange reserves, acting as a lender of last resort, and conducting monetary policy through tools like bank rates, open market operations, and reserve requirements. The document provides details on various monetary policy tools and their objectives.