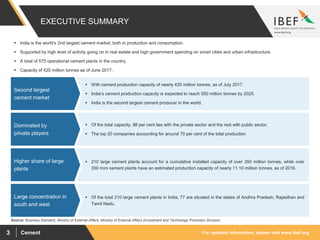

- India has a cement production capacity of nearly 420 million tonnes as of July 2017 and is expected to reach 550 million tonnes by 2025, making it the second largest producer of cement globally.

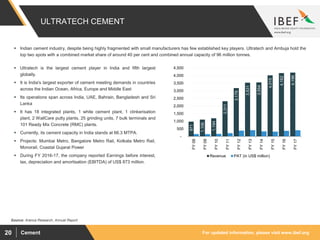

- The private sector accounts for 98% of total cement capacity in India and the top 20 companies account for around 70% of total production.

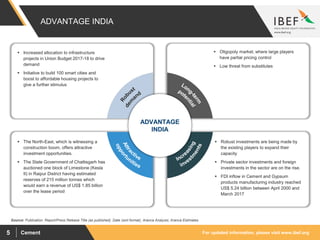

- Supported by government initiatives like development of smart cities and affordable housing, demand for cement is expected to outpace supply over the next few years, driving growth of 5-6% annually for the Indian cement industry.