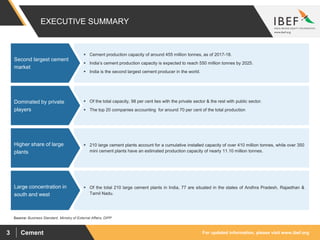

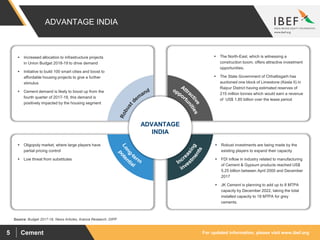

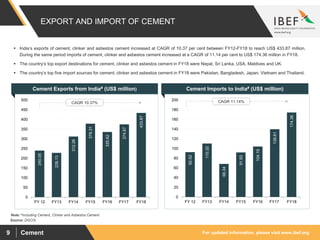

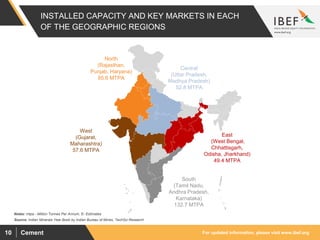

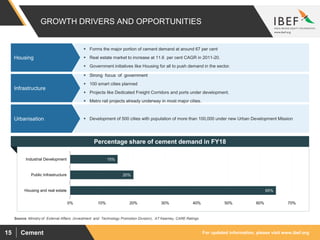

India is the second largest cement producer in the world with a production capacity of around 455 million tonnes as of 2017-18. The cement industry is dominated by large private players who account for around 70% of total production. Cement demand in India is expected to grow at 5-6% CAGR between FY17-FY20, supported by growth in housing, infrastructure development, and industrial activity. Key growth opportunities for the cement sector include increased allocation to infrastructure projects in the Union Budget, initiatives to build 100 smart cities, and the boost to affordable housing.