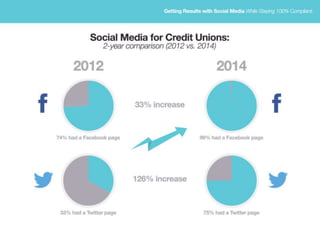

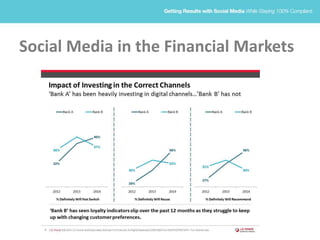

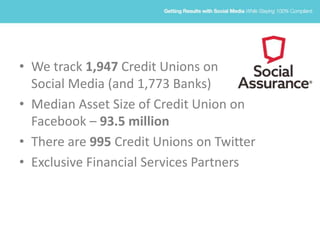

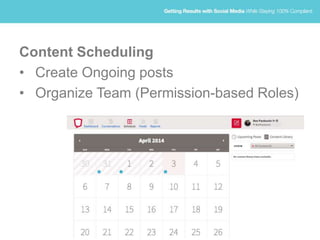

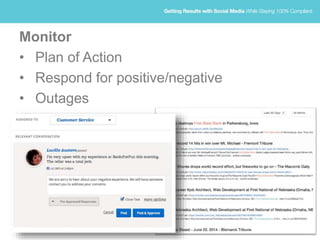

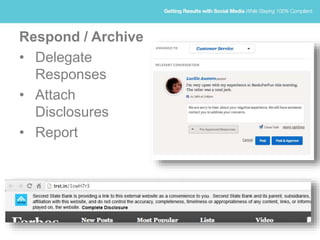

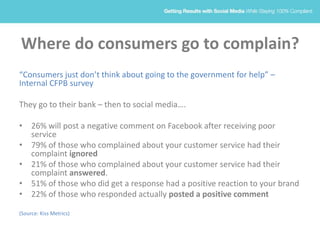

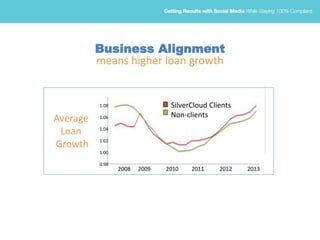

The document discusses the impact of social media on financial markets, highlighting its utilization for information gathering by customers and the necessary compliance strategies for financial institutions. It emphasizes the importance of a cohesive social media presence, addressing customer complaints efficiently, and adhering to regulatory guidelines while enhancing member experiences. Additionally, it outlines the benefits of social media monitoring tools and analytics in improving loan growth and reducing operational costs.