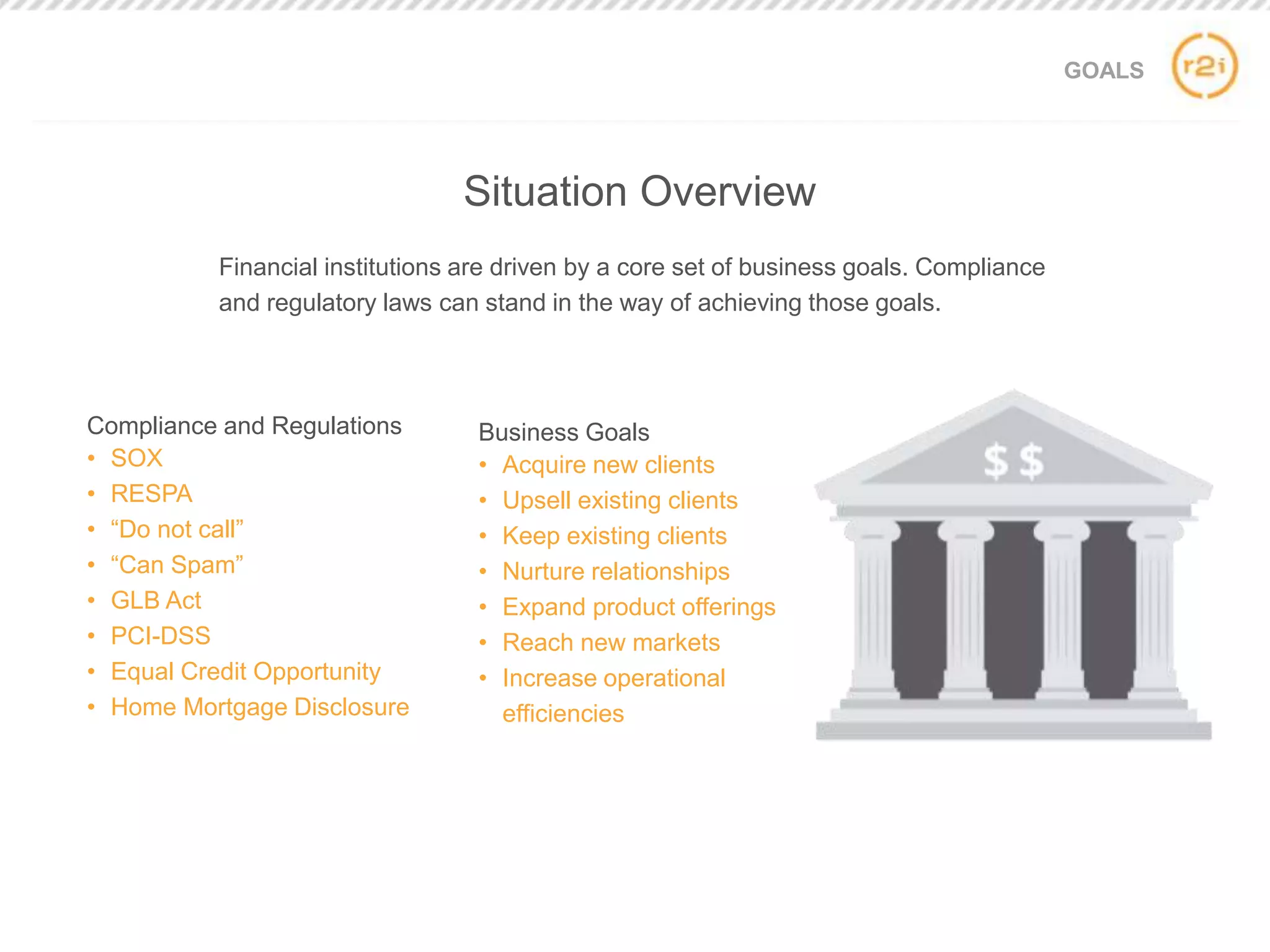

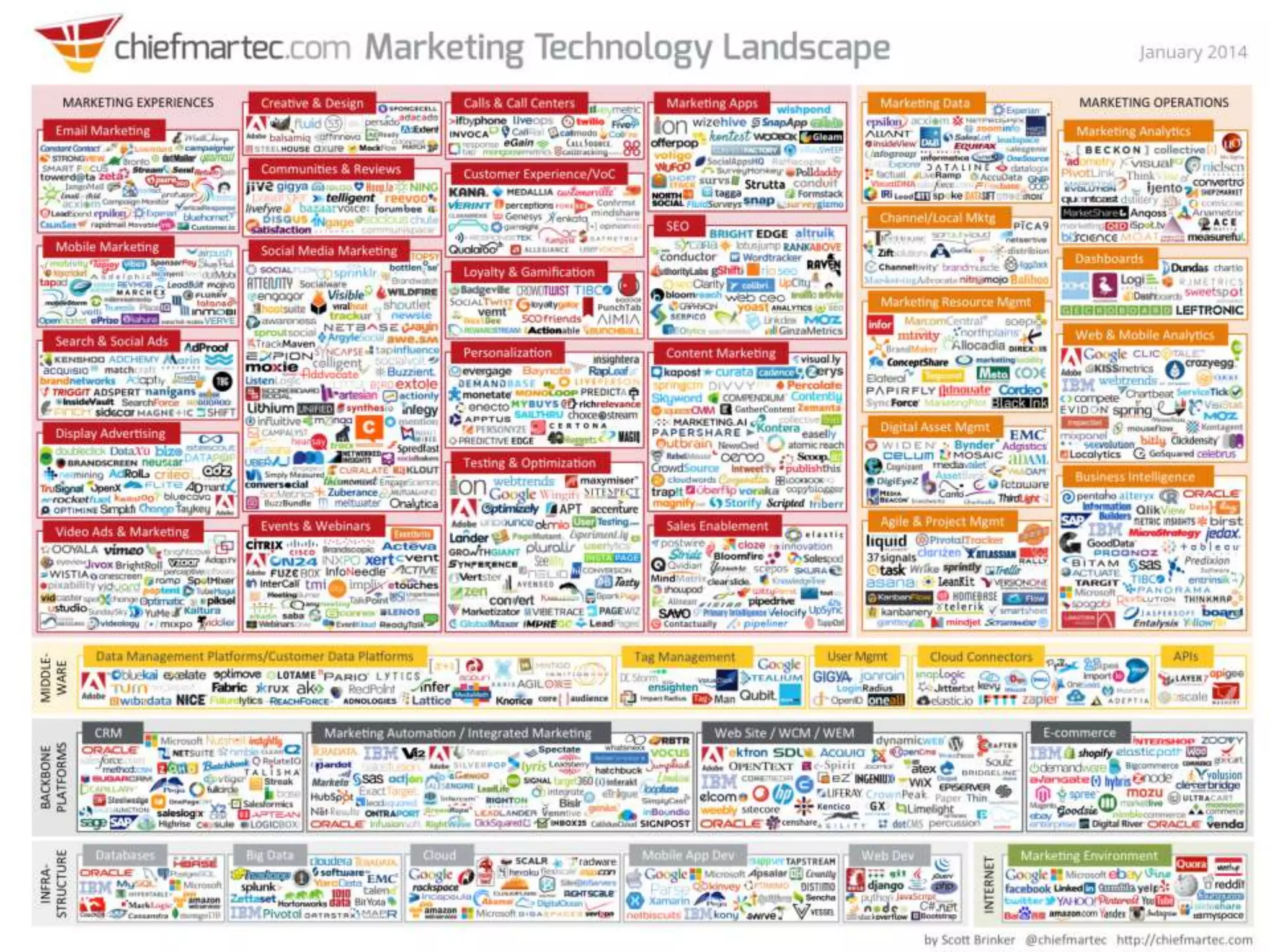

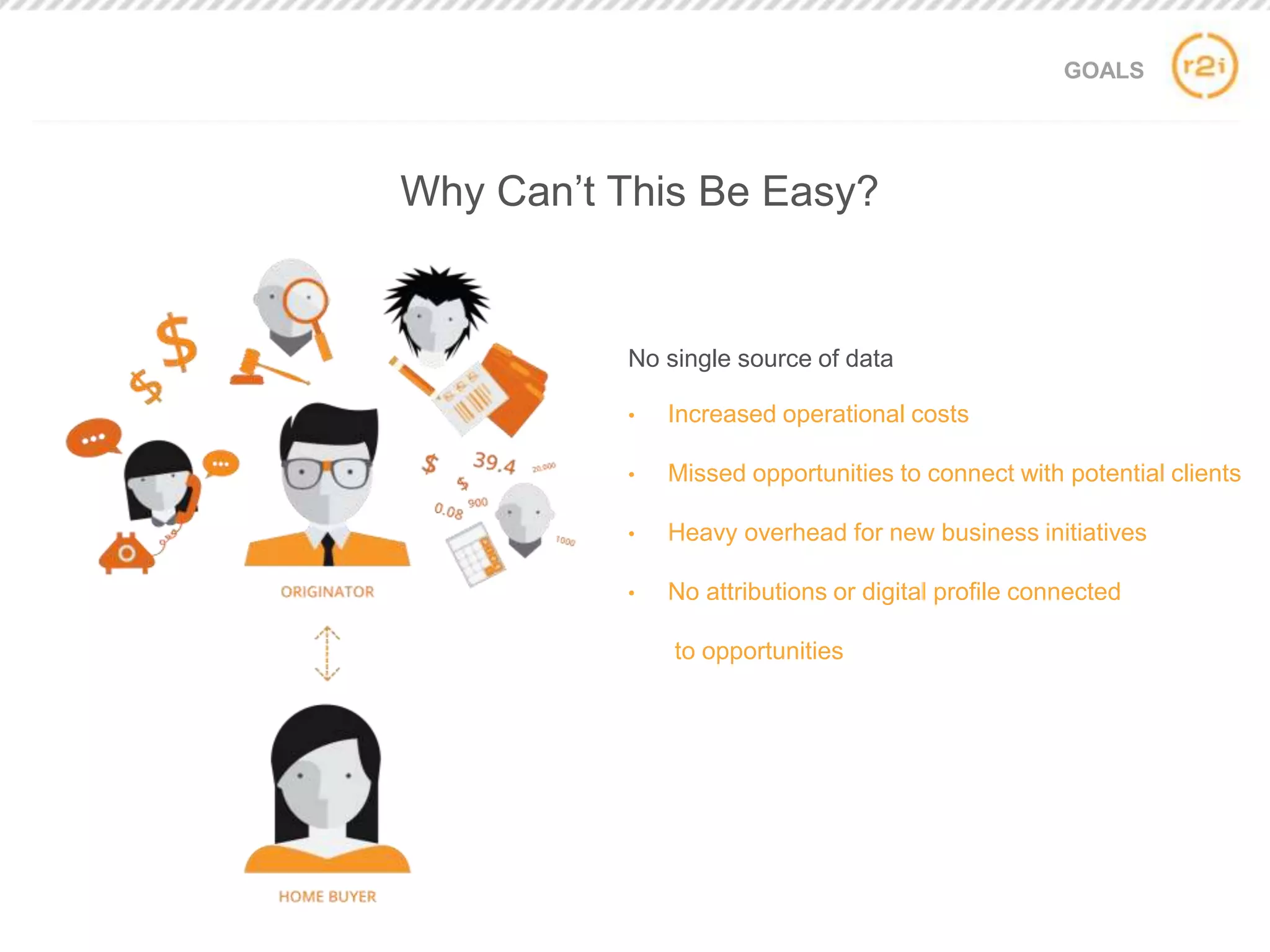

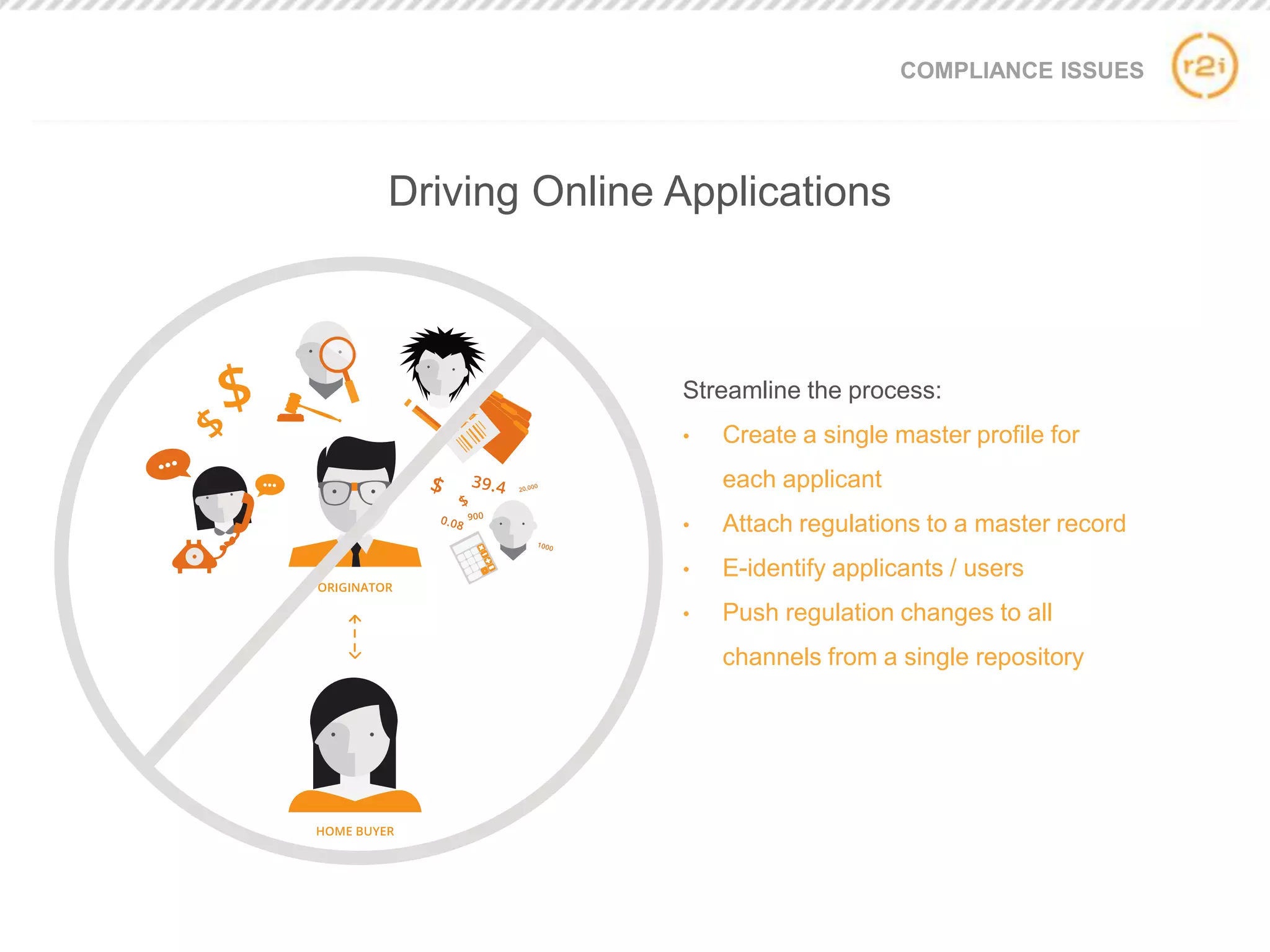

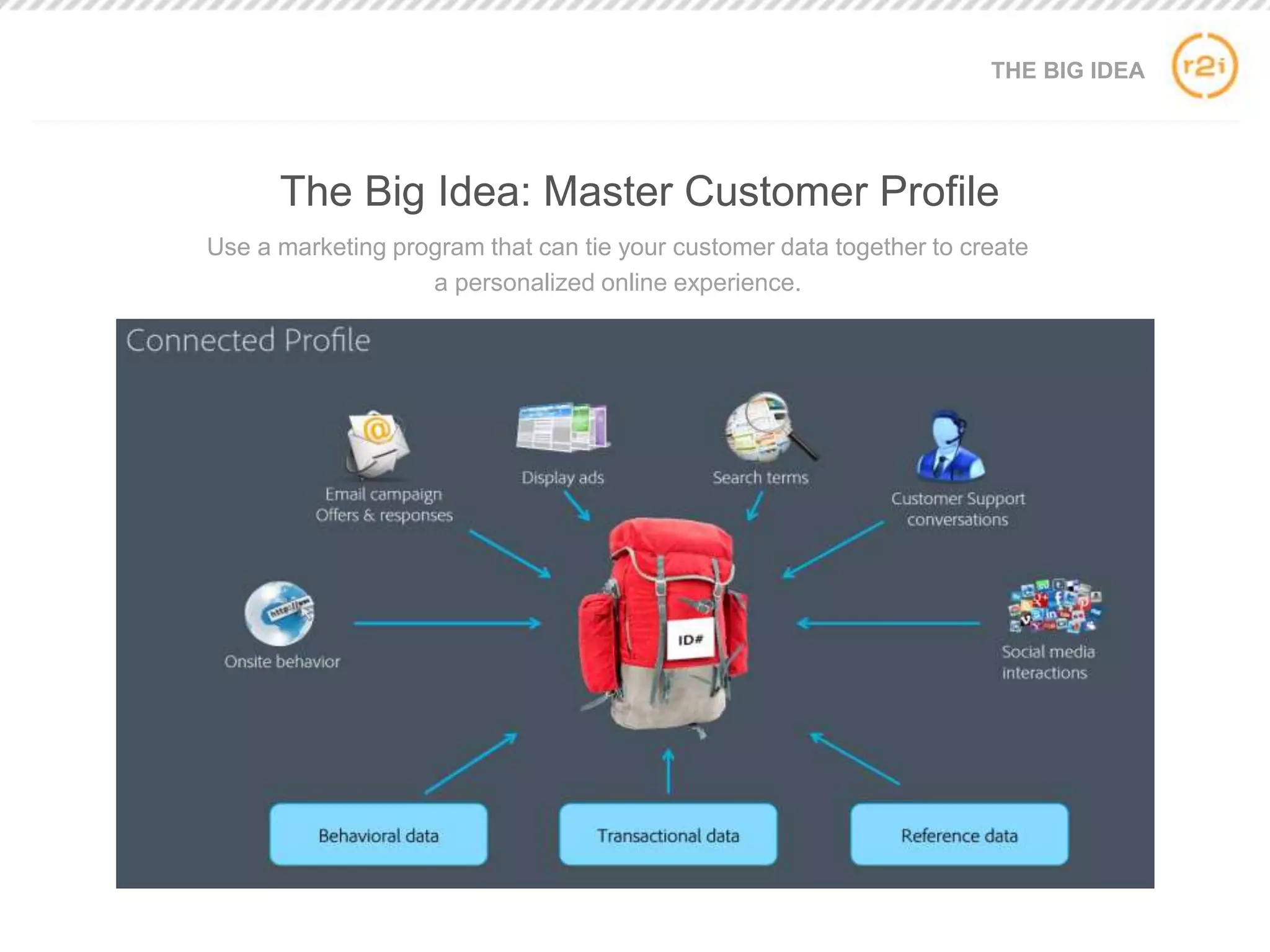

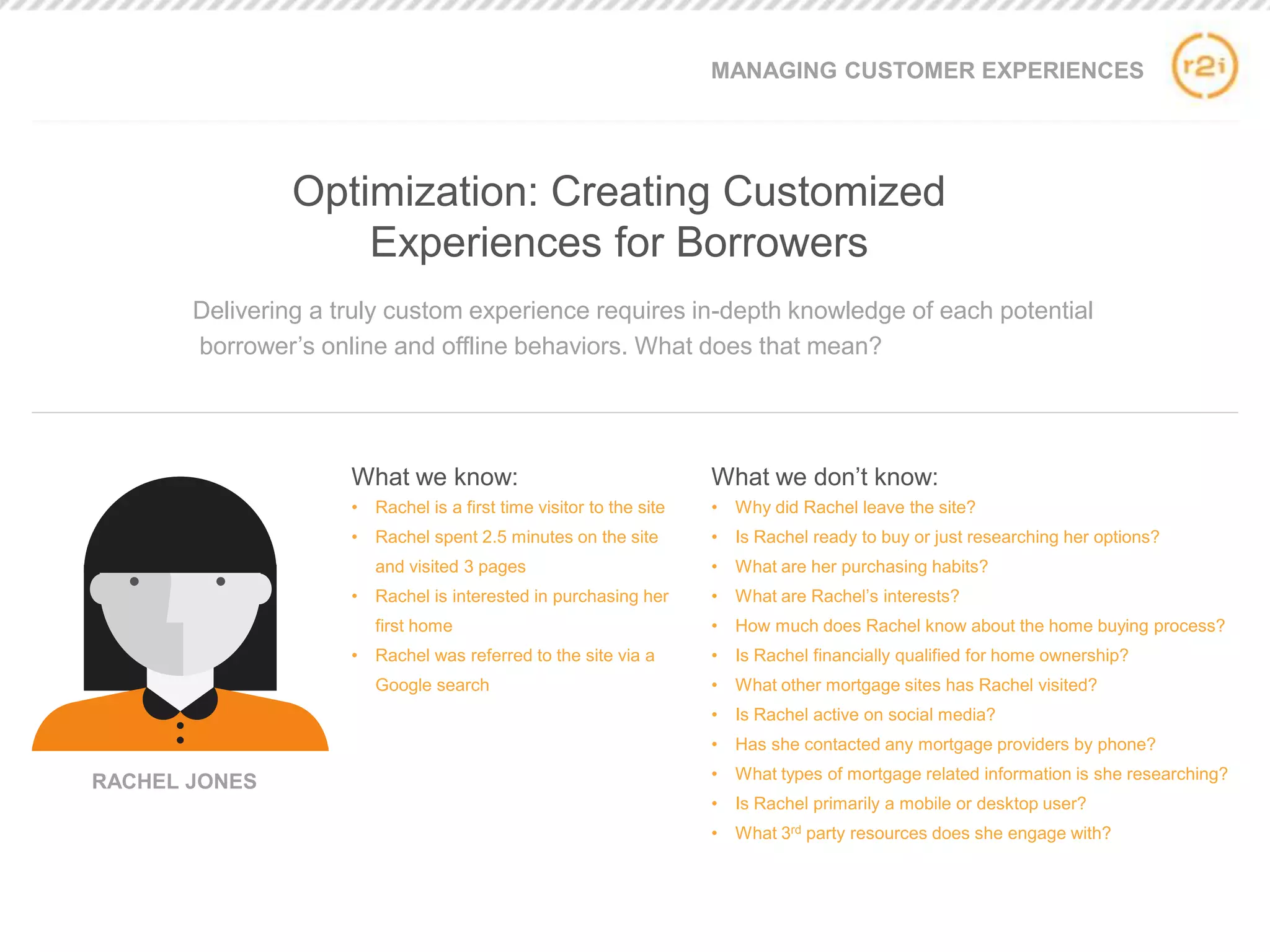

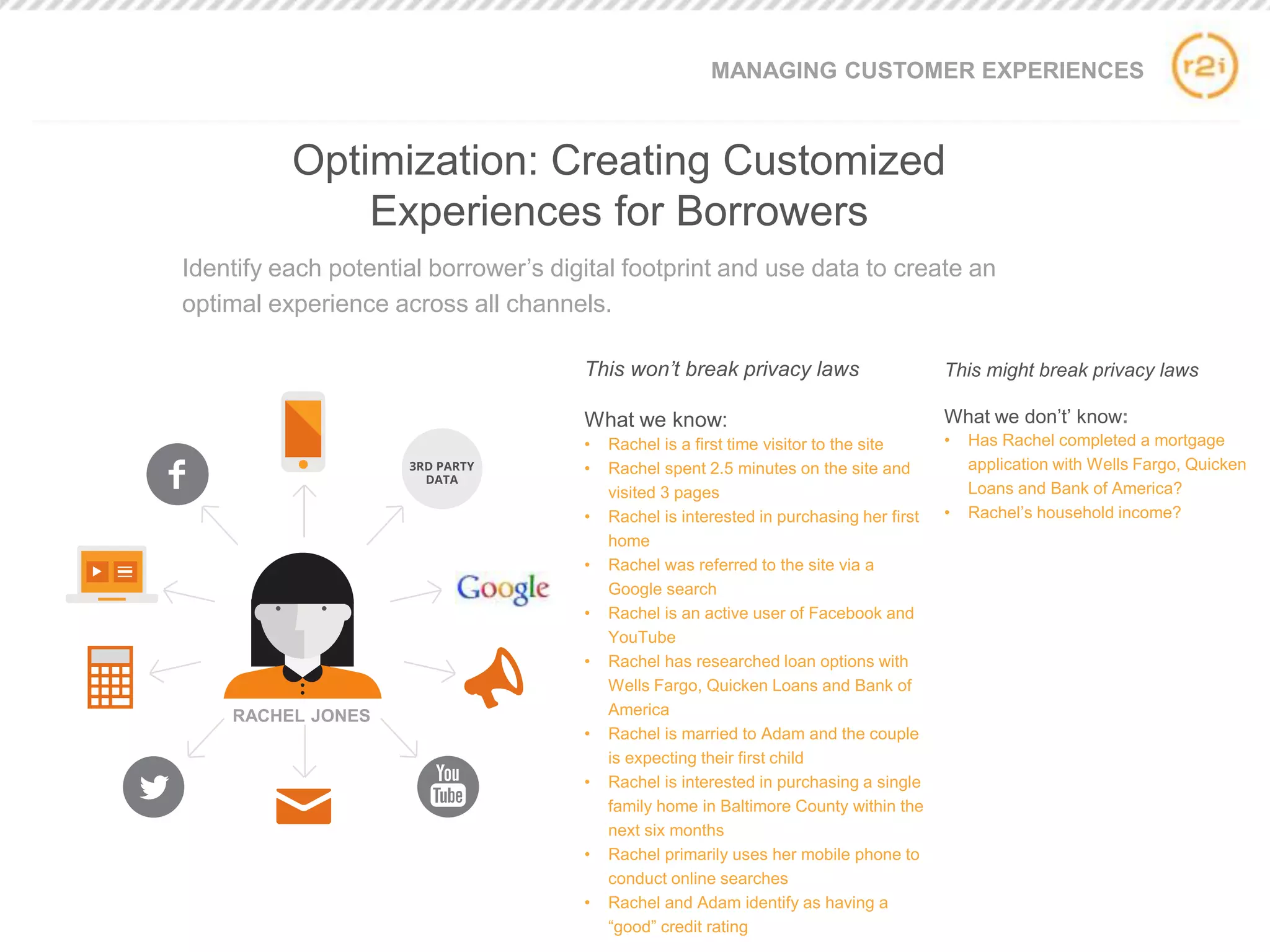

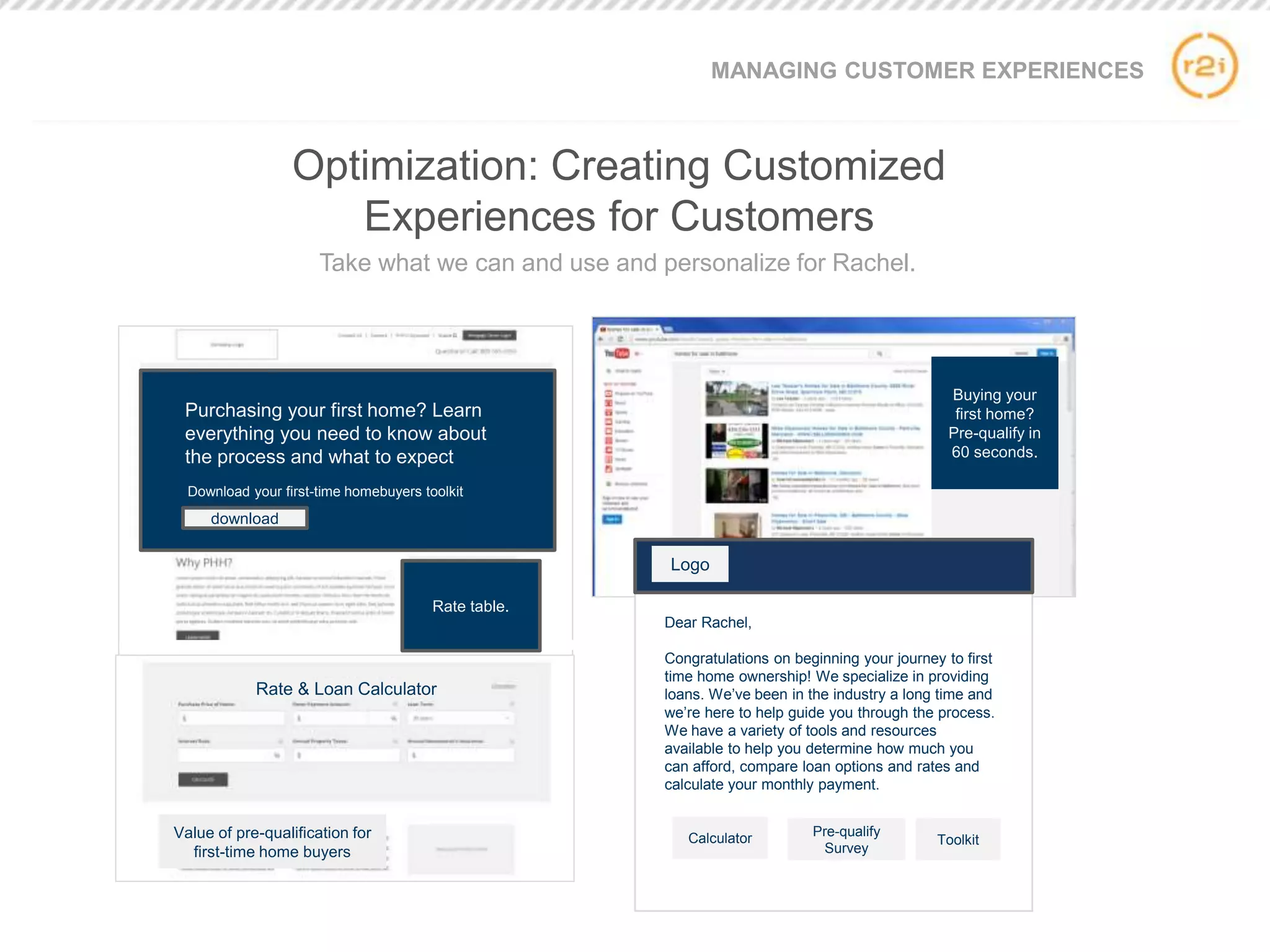

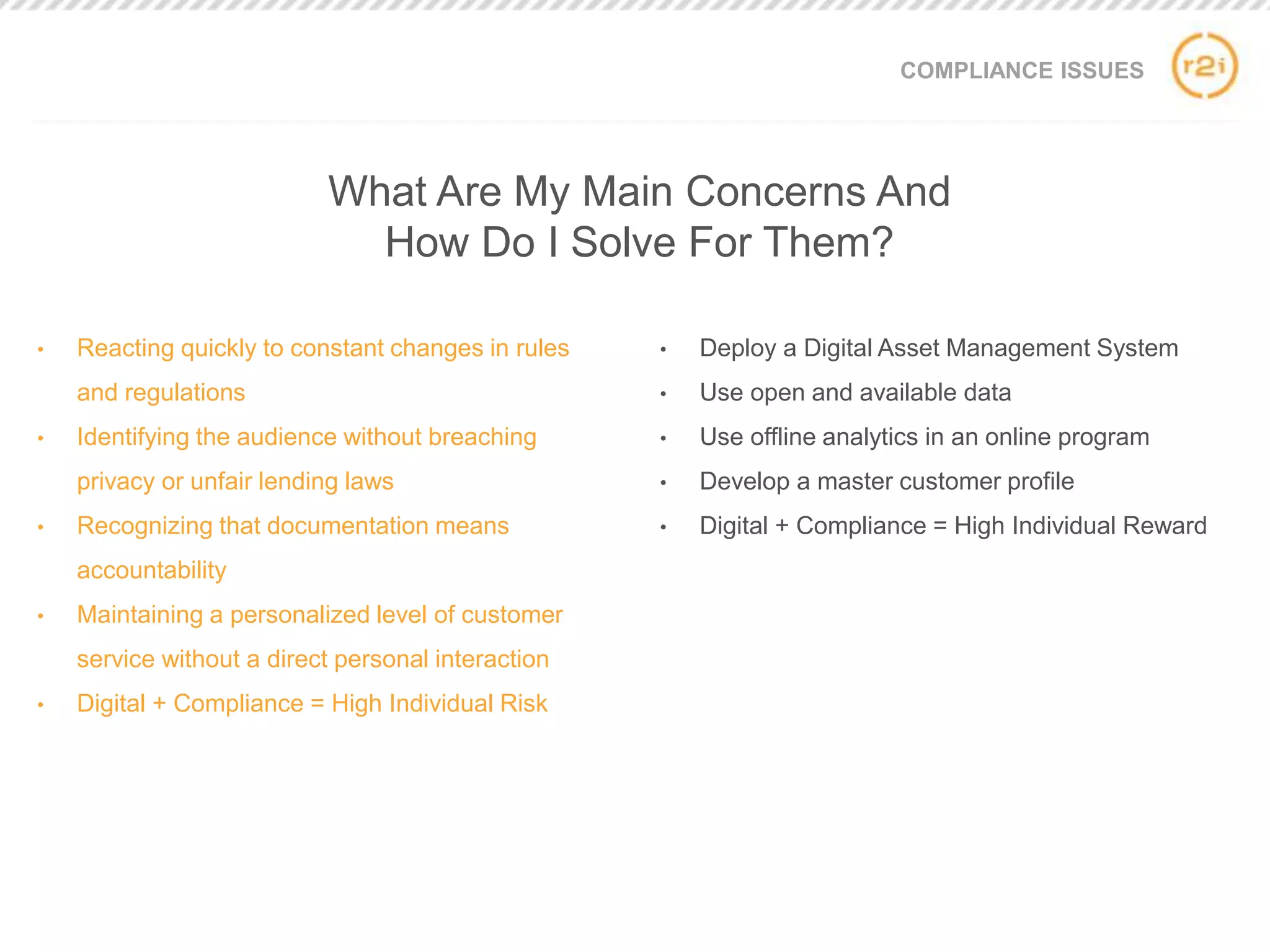

The document discusses the compliance challenges faced by financial institutions in the mortgage industry and outlines how regulations impact both lenders and home buyers. It emphasizes the need for financial institutions to streamline operations and leverage technology to enhance customer experiences while staying compliant. Strategies include creating master customer profiles and utilizing digital asset management to effectively manage and deliver content across channels.

![Q&A

Nick Christy

SVP Enterprise Technology

R2integrated-Digital Marketing & Technology

[P] 410-369-3777 | [M] 410-459-2410

nchristy@r2integrated.com | www.r2integrated.com

Locations in: Baltimore • Seattle • Boston

Twitter: @NickChristy | Skype: NickChristy

http://www.linkedin.com/pub/nick-christy/3/ab4/759](https://image.slidesharecdn.com/r2inetfinance04222014final-140509114621-phpapp02/75/Solving-Compliance-Challenges-Across-Digital-Channels-31-2048.jpg)