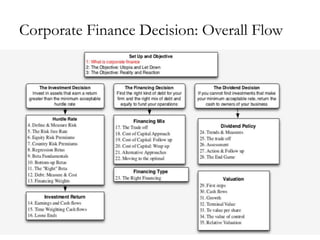

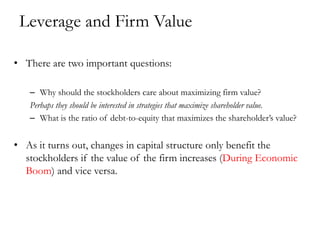

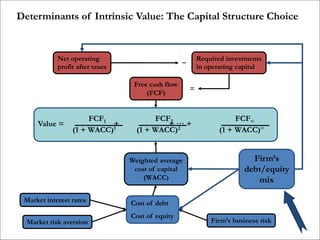

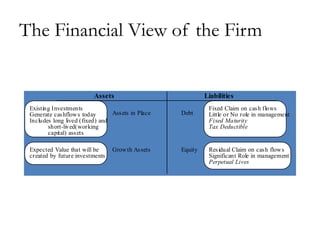

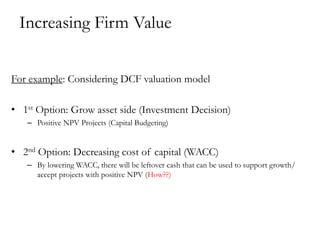

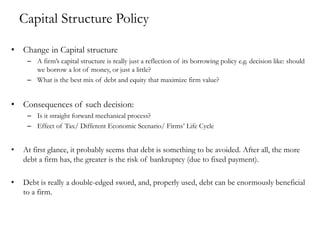

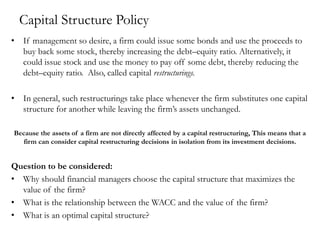

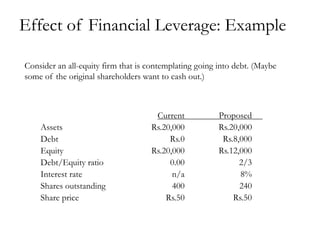

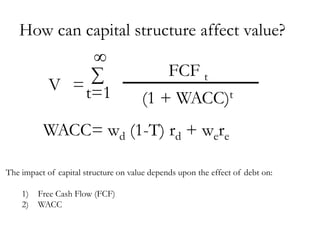

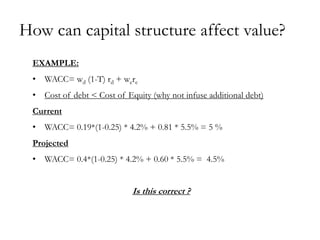

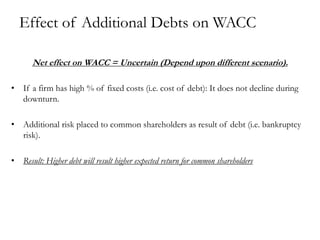

1) The document discusses how a company's capital structure and use of debt can impact its value and shareholder returns. It considers how debt can lower the weighted average cost of capital but also increase bankruptcy risk.

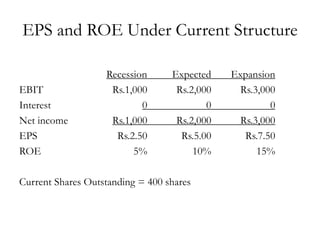

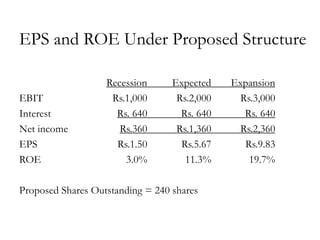

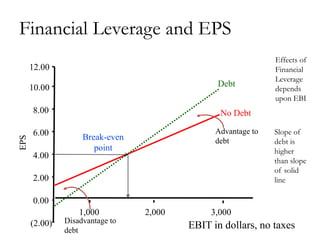

2) An example is provided showing how debt can increase earnings per share but also expose shareholders to more risk in economic downturns. The optimal level of debt depends on factors like a company's fixed costs and risk of bankruptcy.

3) Tax benefits of debt are discussed, as interest expenses are tax deductible. However, higher debt also increases financial risk and the required return on equity. The overall impact on the weighted average cost of capital from debt is uncertain and depends on specific company and economic conditions