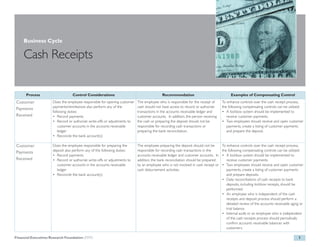

The document is a checklist from BDO Consulting that provides examples of how to properly segregate duties to prevent fraud for various business processes, including cash receipts. It notes that the employee receiving cash payments should not record payments or reconcile bank accounts. For cash receipts, it recommends separating the duties of receiving payments, recording payments, reconciling bank accounts, and adjusting customer accounts. It also provides examples of compensating controls that can be implemented when full segregation of duties is not possible, such as using a lockbox system, having two employees receive and prepare deposits, and having an independent employee review accounts receivable balances.