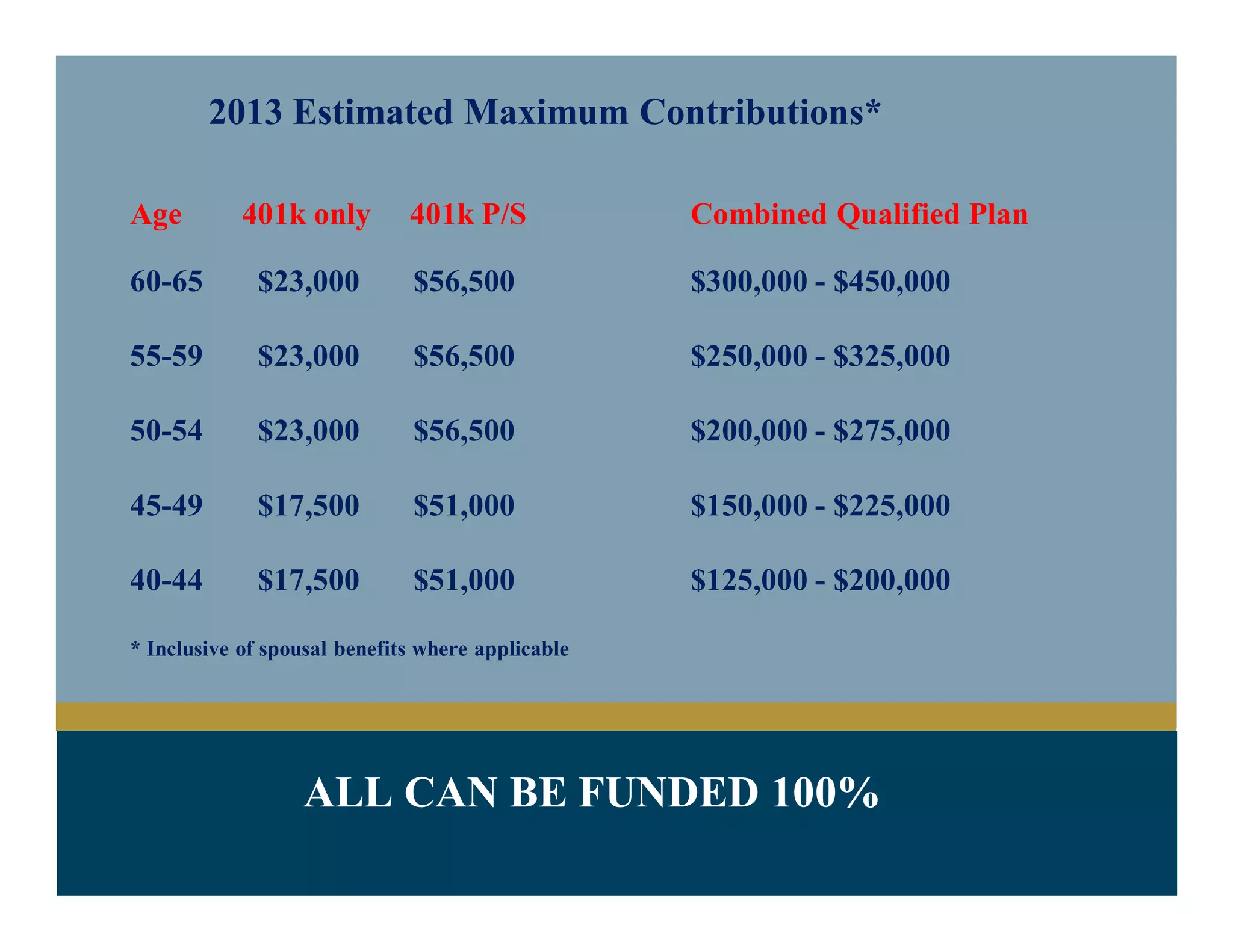

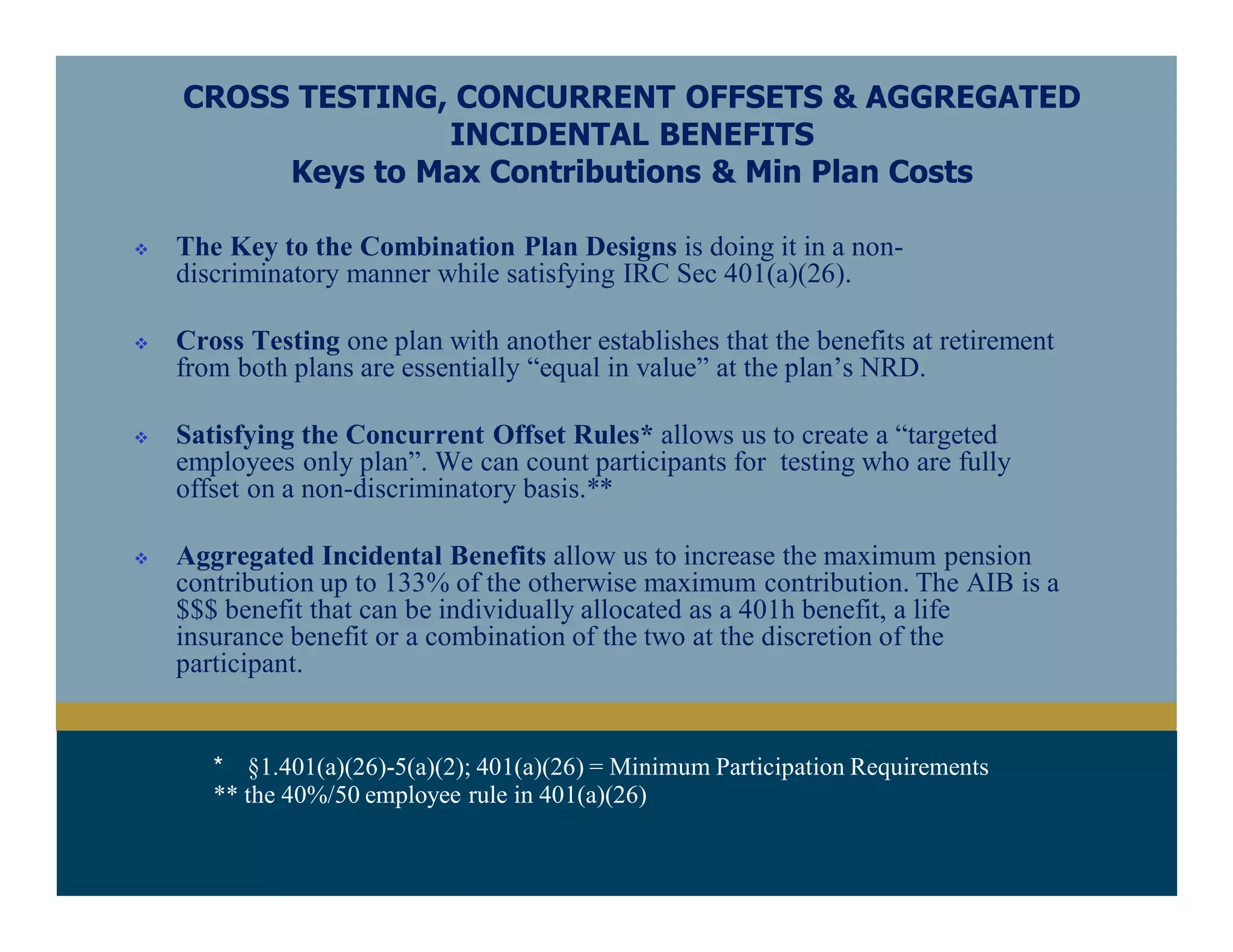

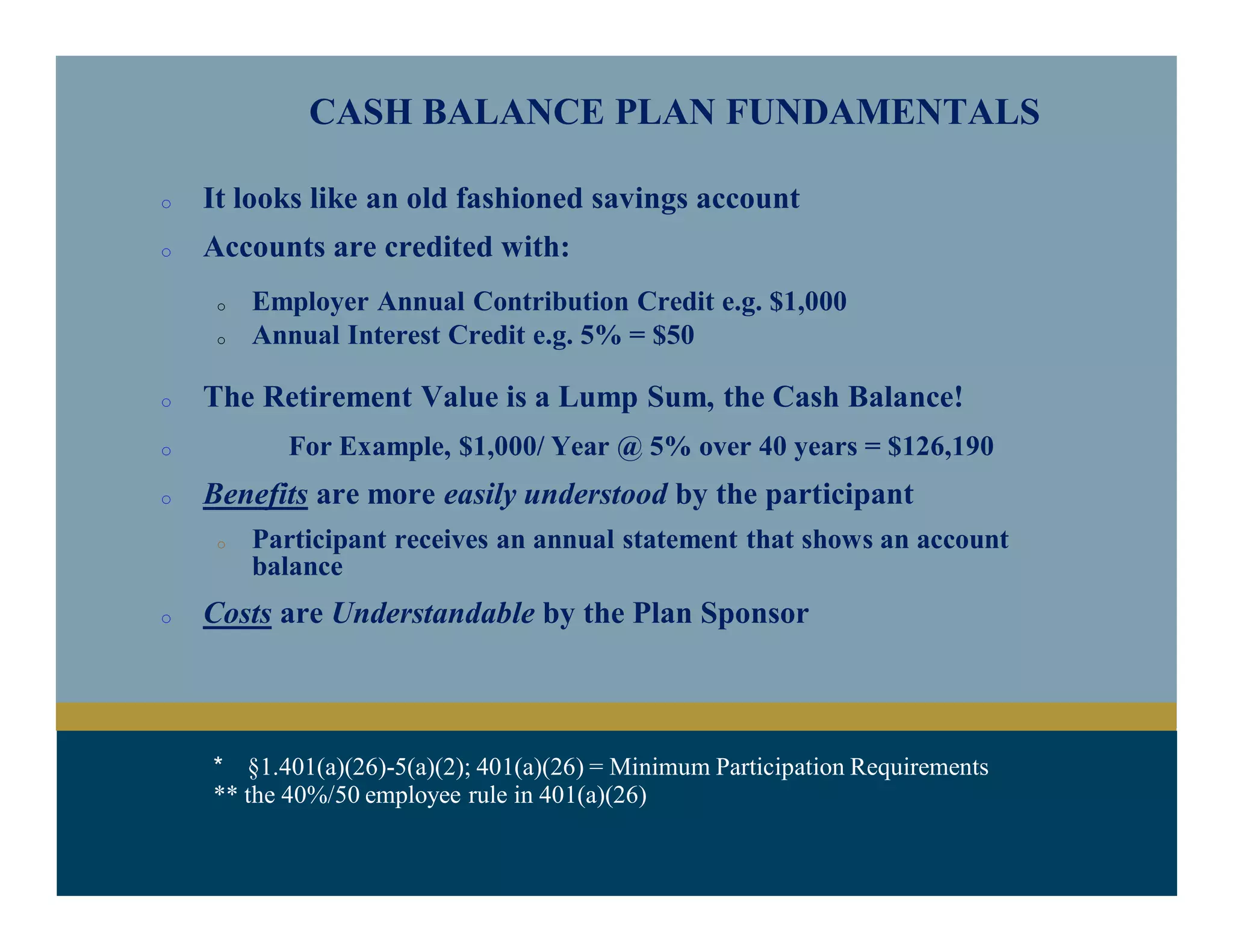

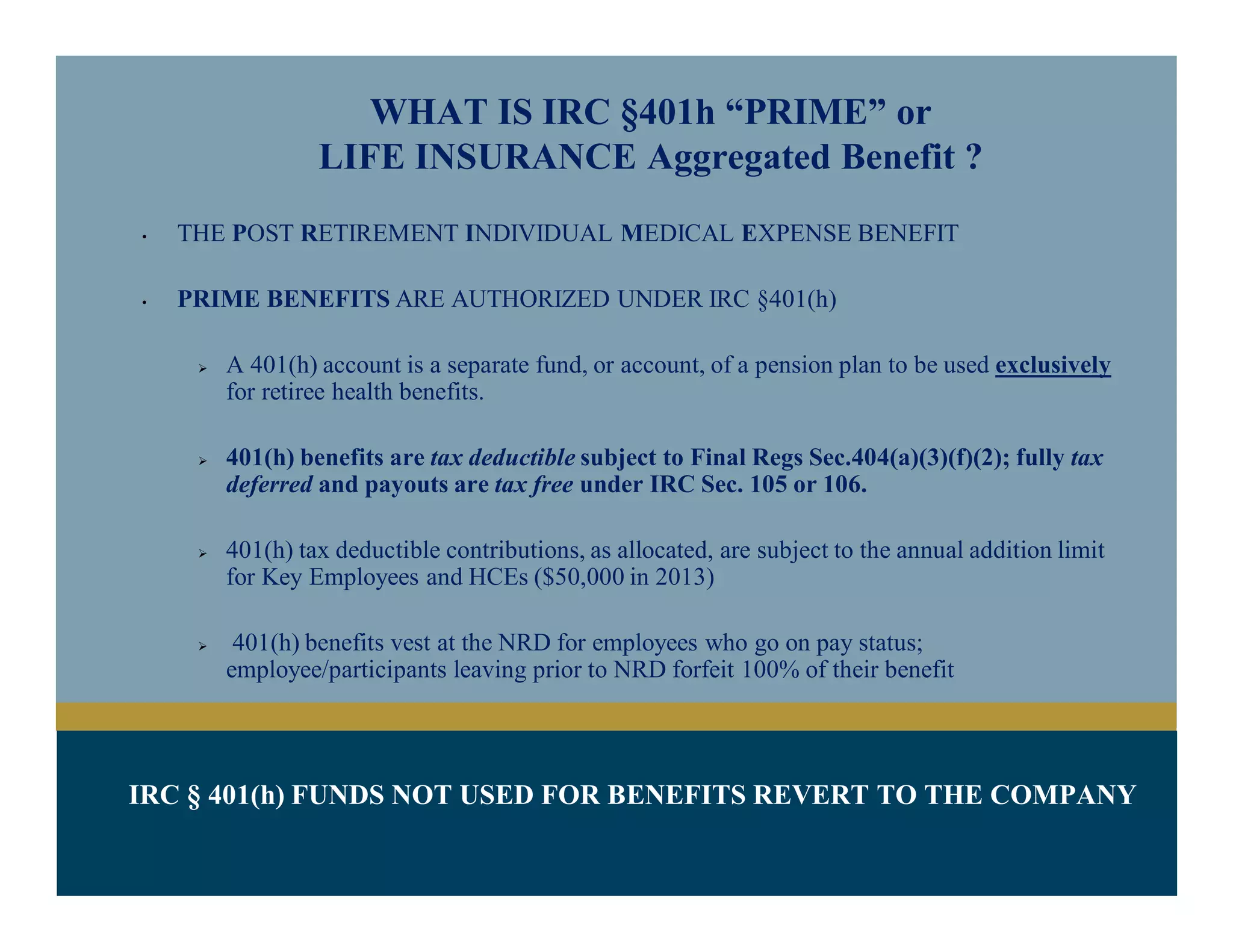

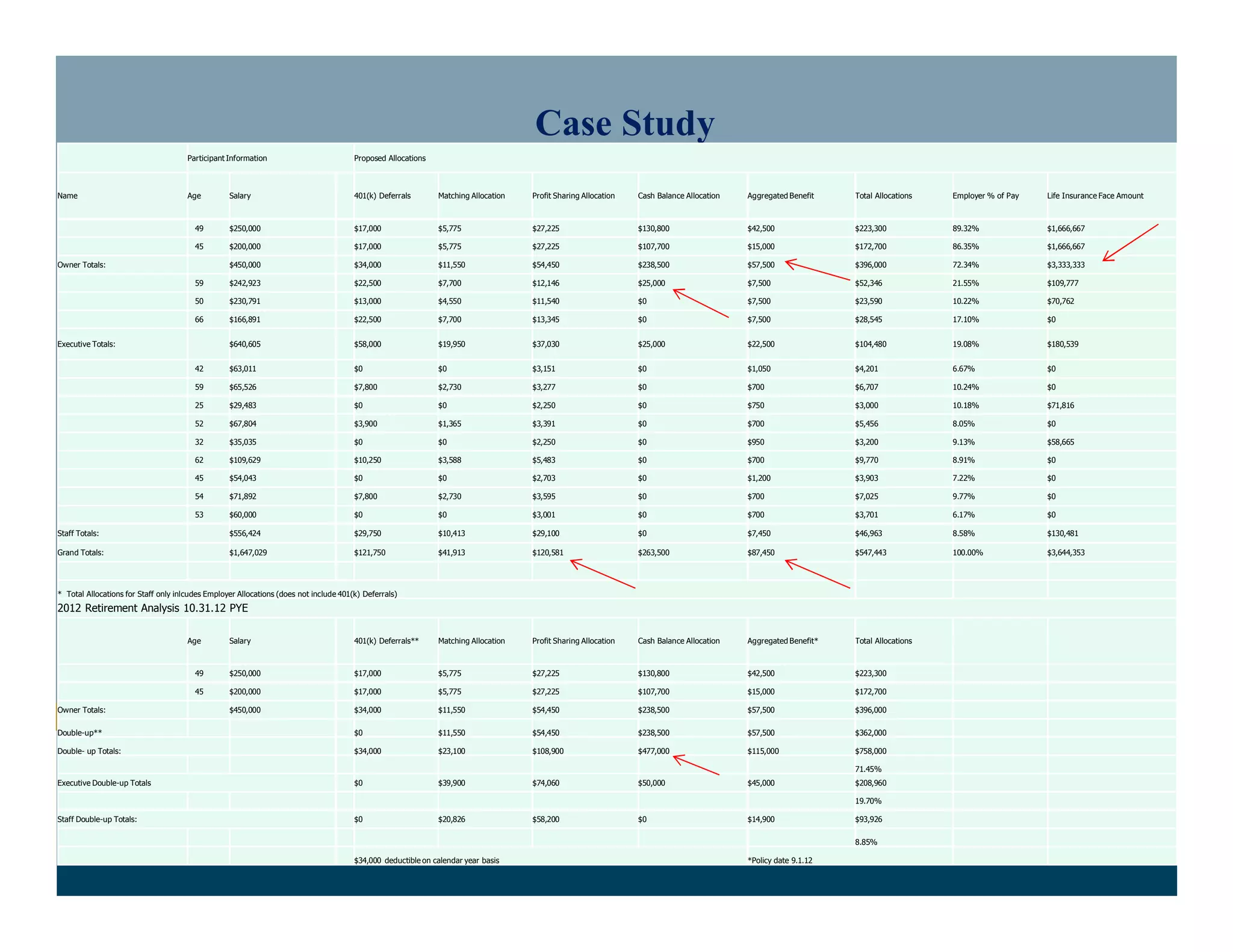

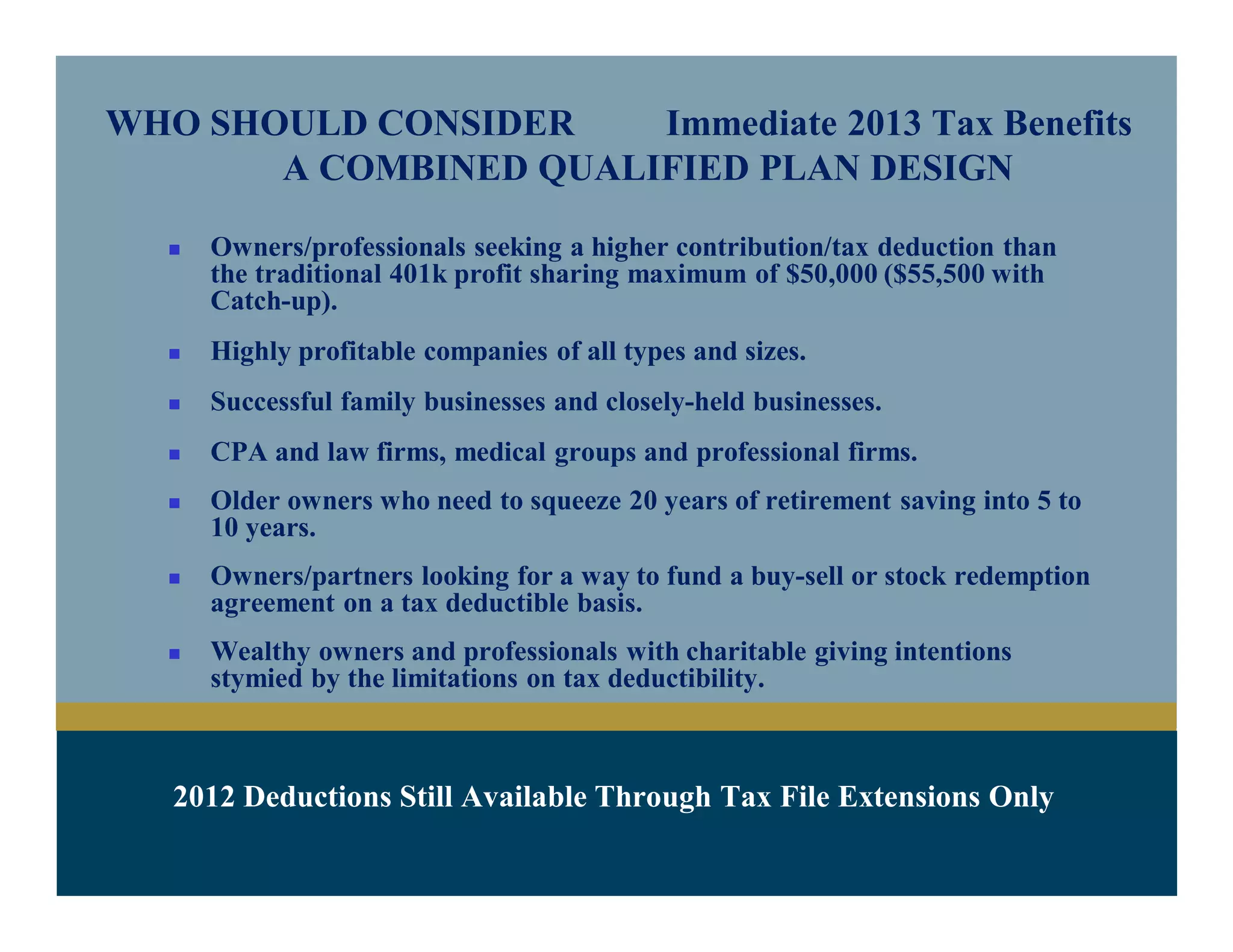

The document outlines the benefits and strategies of combined qualified pension plans and their tax advantages under IRC §401(h). It highlights key plan design rules, maximum contribution limits for various age groups, and the significance of ensuring non-discriminatory practices. Additionally, it emphasizes the role of Finex Wealth Management in providing comprehensive consulting and administrative services for plan sponsors.