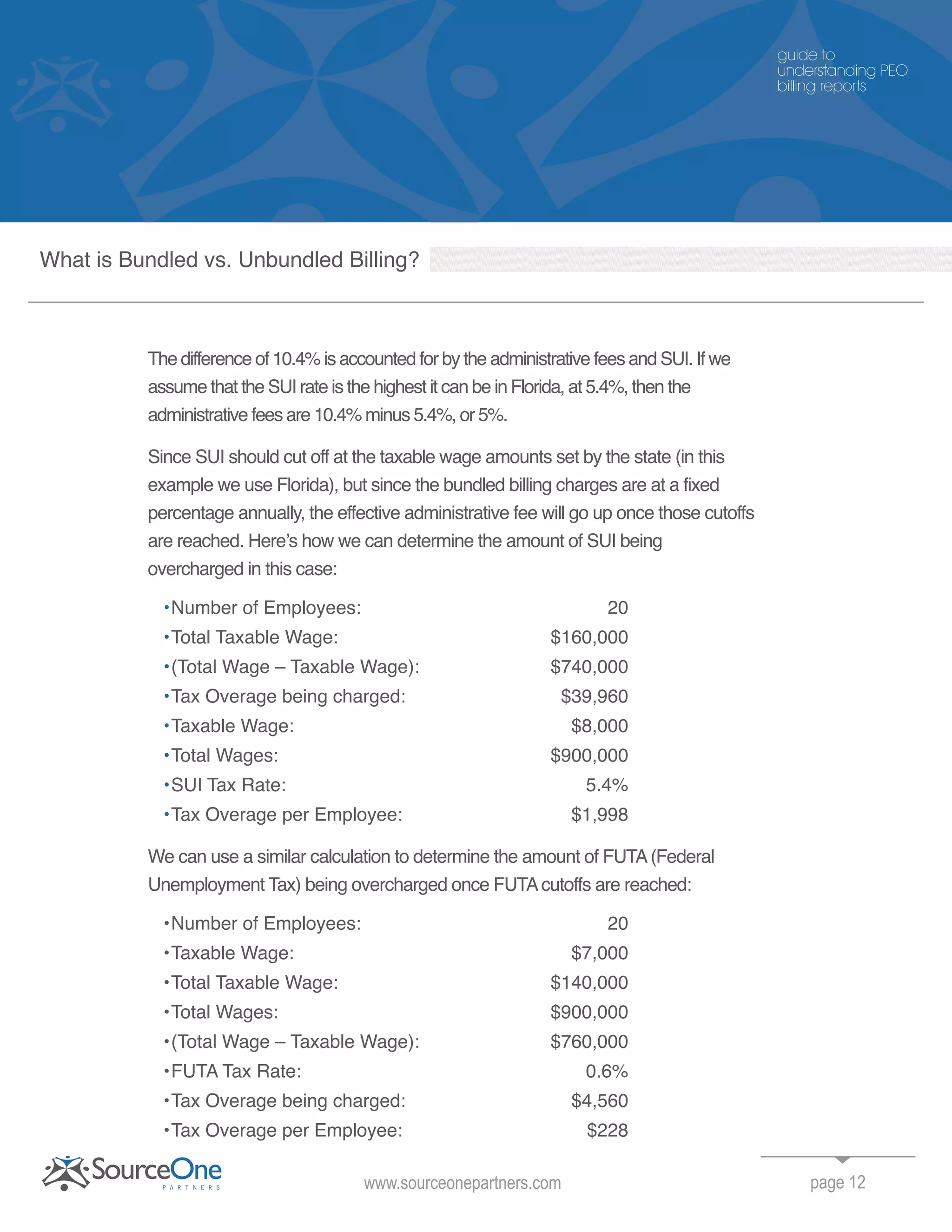

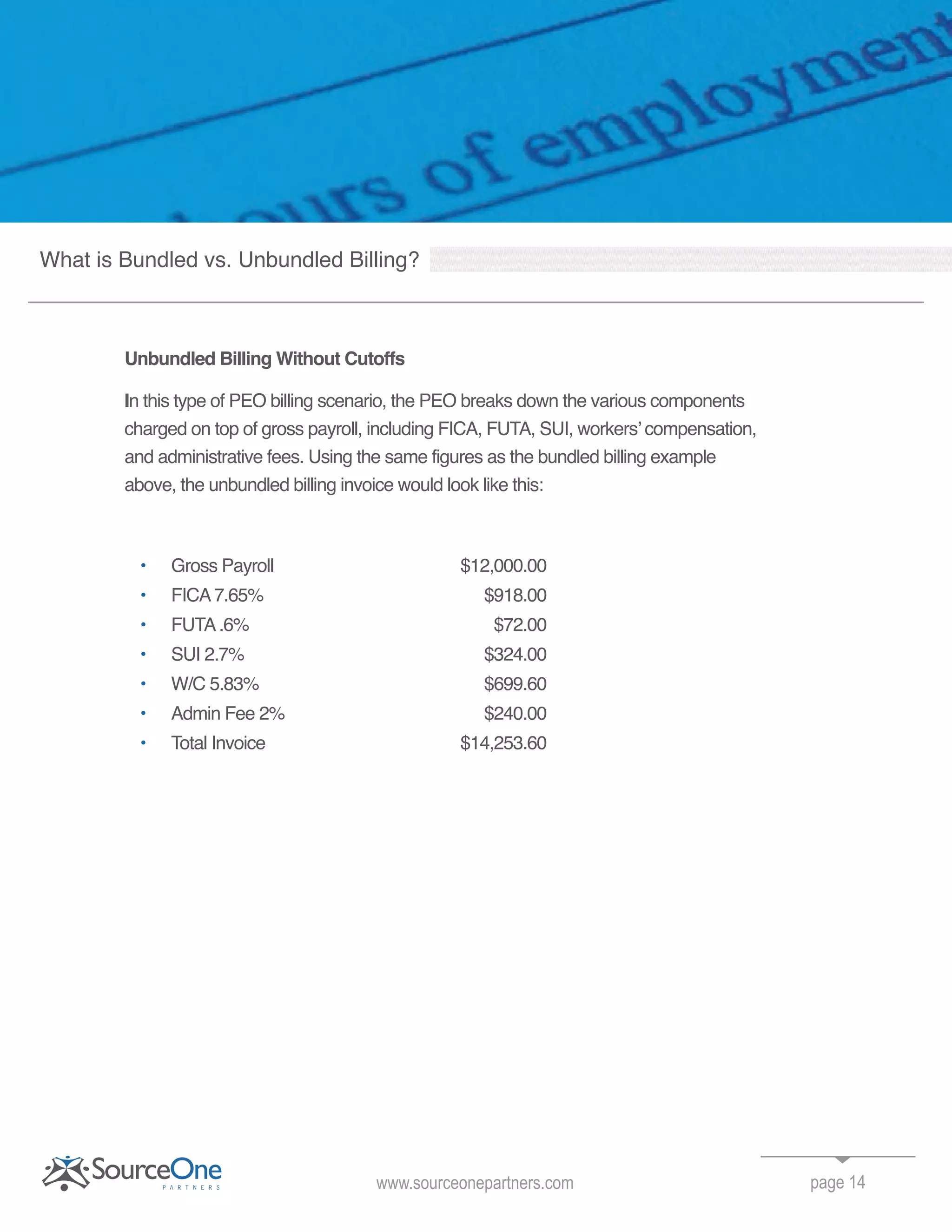

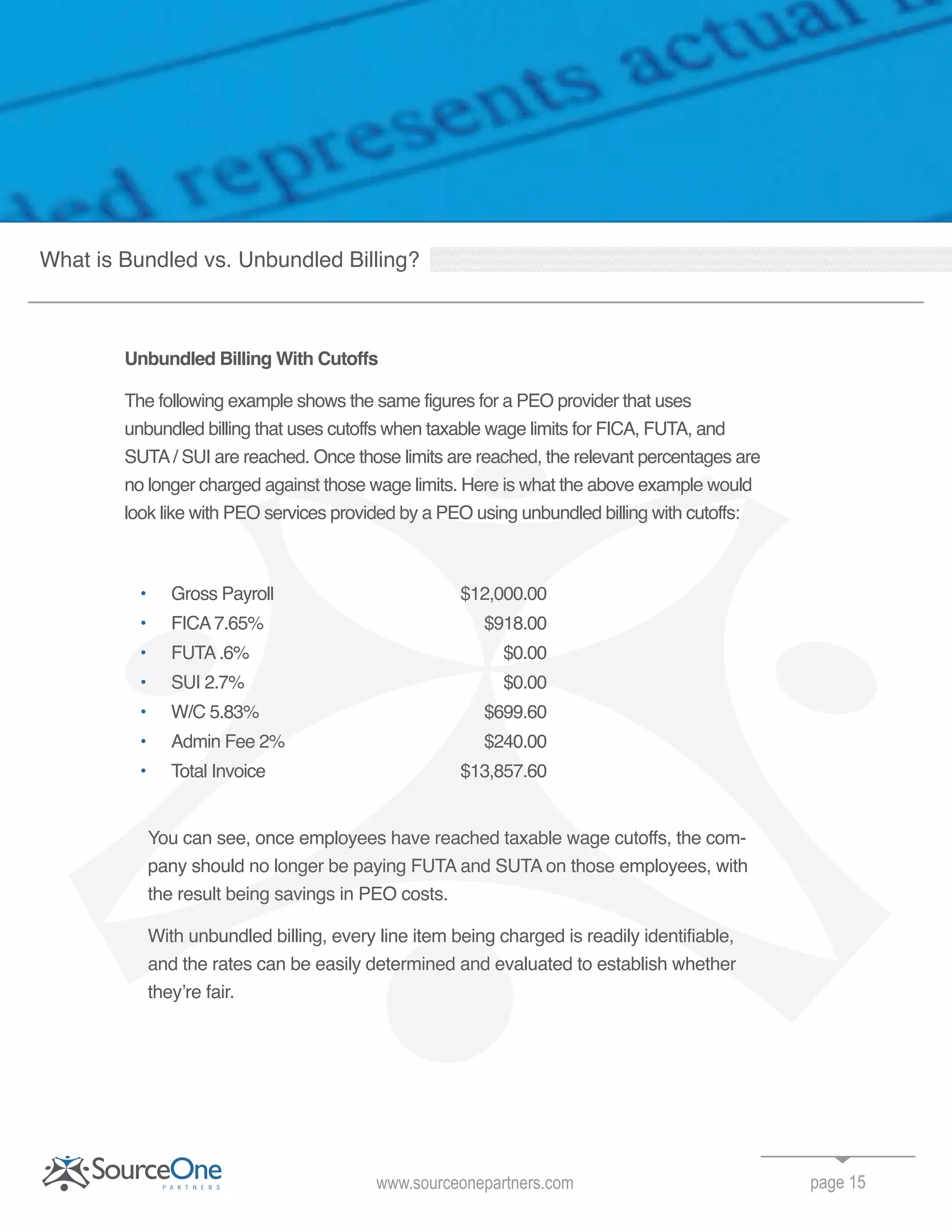

This document is a comprehensive guide to understanding the billing reports used by Professional Employer Organizations (PEOs), detailing how they charge clients for services including payroll processing, taxes, and various employee benefits. Key topics include the distinction between bundled and unbundled billing methods, the implications of each for clients, and how to identify potential hidden fees. The guide aims to empower readers to better navigate PEO billing, ensuring transparency and cost-effectiveness for businesses utilizing these services.