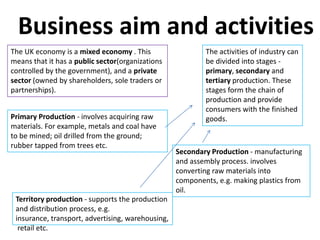

The UK has a mixed economy with both public and private sectors. Primary production involves acquiring raw materials through activities like mining, drilling, and tapping. Secondary production manufactures and assembles raw materials into components and products. Tertiary production supports production and distribution through services like transportation, retail, and insurance. These stages form the chain of production that provides consumers with finished goods.