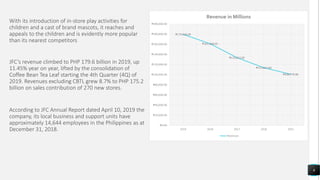

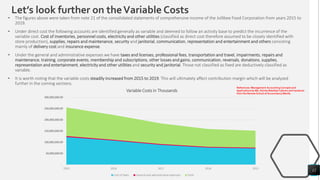

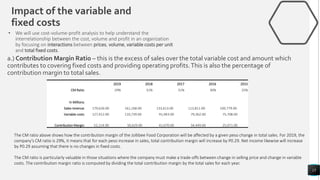

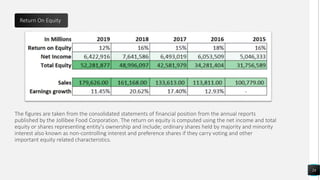

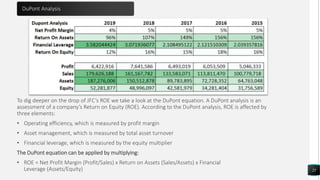

Jollibee Food Corporation is a major Philippines-based food company that operates quick-service restaurants under the Jollibee brand. The document analyzes Jollibee's costs, revenues, market capitalization, and strategies from 2015-2019. It finds that Jollibee's variable costs increased over this period as sales grew. While revenue and number of stores increased each year, market capitalization declined in 2019. The document recommends ways for Jollibee to cut expenses to improve profits, such as reducing electricity and travel costs.