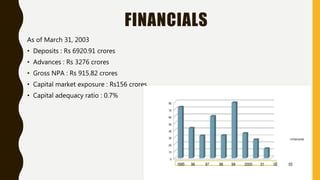

Global Trust Bank (GTB) collapsed in 2004 due to severe financial mismanagement and its involvement in the 2001 Ketan Parekh stock market scam. The bank had high non-performing assets, negative net worth, and had breached prudent lending norms by heavily lending to stock market-related entities. The Reserve Bank of India placed a moratorium on GTB's operations and merged it with Oriental Bank of Commerce to ensure its survival, but this left GTB shareholders with nothing. Questions were raised about the responsibility of GTB promoters and regulators, as well as the treatment of shareholders during the collapse.