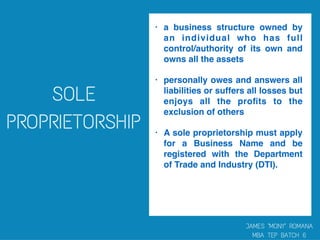

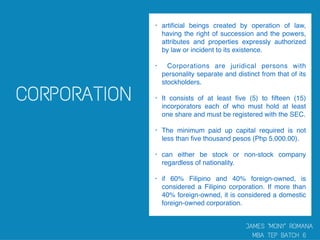

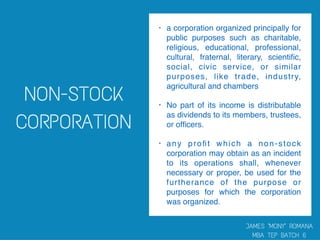

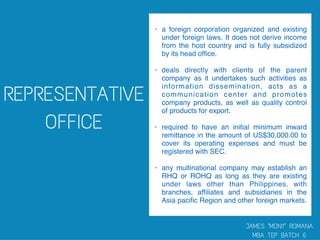

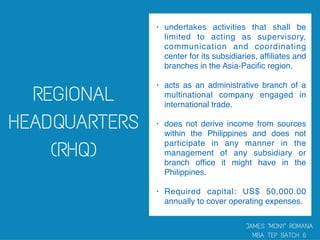

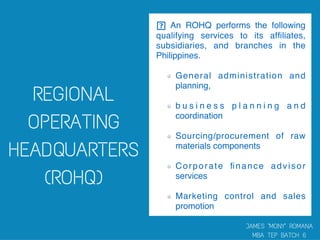

The 2010 Annual Survey of Philippine Business and Industry found that there were 148,266 establishments in the formal sector in 2010, a 0.7% decline from 2009. The document then provides definitions and requirements for different types of business organizations under Philippine law, including sole proprietorships, partnerships, corporations (stock and non-stock), and foreign corporations.