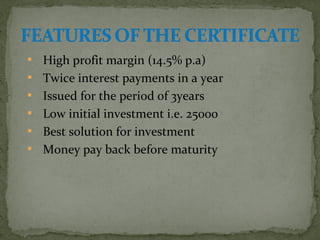

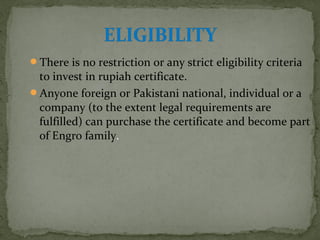

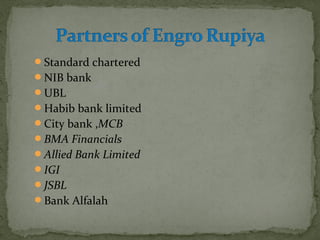

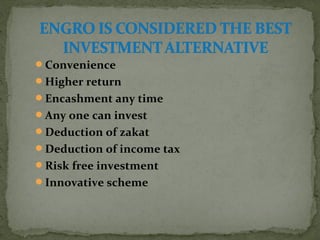

This document discusses bonds and debt instruments in Pakistan. It notes that bonds provide opportunities for investment diversification and help finance government development activities. However, political instability and uncertainty pose challenges. Specific bond offerings from companies like Engro and OGDCL are mentioned, along with the benefits they provide and financial institutions involved. Government bond auctions and sukuk issuances are also summarized.