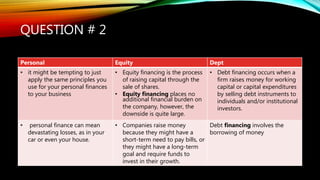

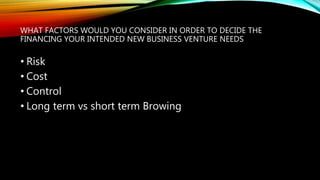

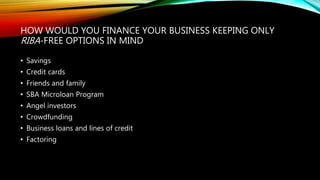

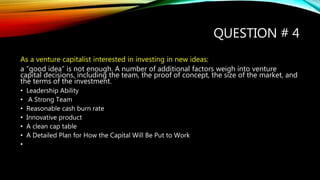

This document contains the questions and responses from a student's terminal exam. It discusses personal equity financing options for a new business venture, including equity financing, debt financing, and risk factors to consider. It also includes the student's proposed business idea of a bioinformatics tech startup and factors a venture capitalist would consider when deciding on an investment.