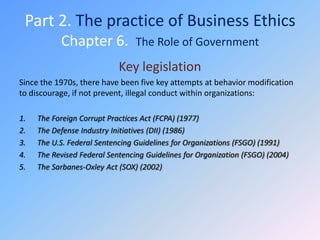

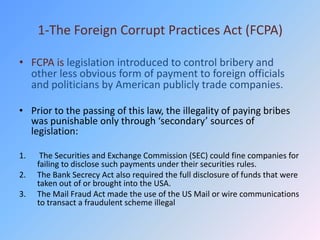

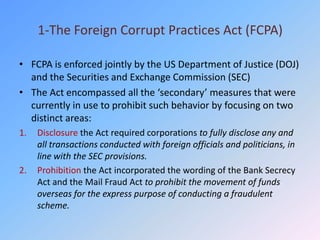

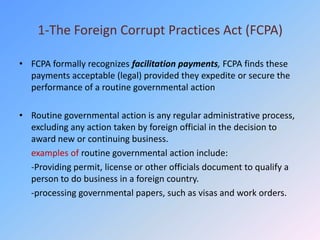

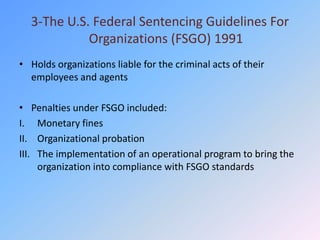

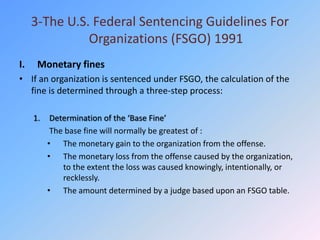

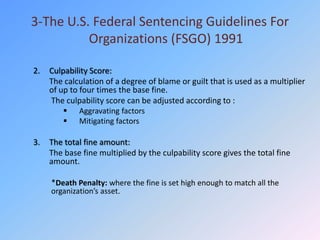

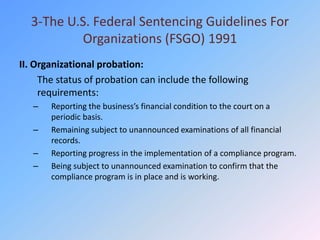

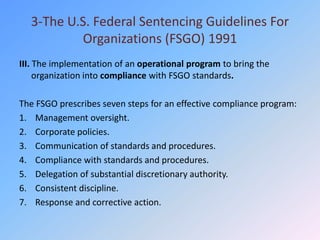

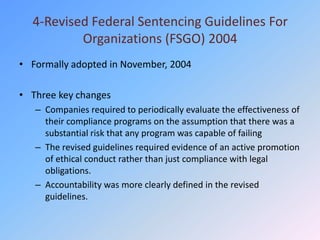

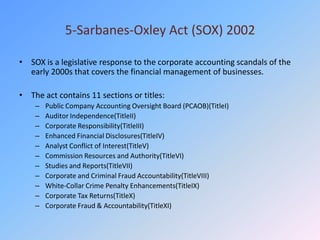

This document summarizes five key pieces of US legislation related to business ethics: 1) The Foreign Corrupt Practices Act (FCPA) of 1977 which prohibits bribery of foreign officials; 2) The Defense Industry Initiatives (DII) of 1986 which established ethics principles for defense contractors; 3) The US Federal Sentencing Guidelines for Organizations of 1991 which hold companies criminally liable and established compliance programs; 4) Revisions to the Guidelines in 2004 which strengthened compliance program requirements; and 5) The Sarbanes-Oxley Act of 2002 which addressed accounting scandals through increased financial disclosure standards and oversight.