The document discusses India's 2012-13 budget and its impact on the infrastructure sector. Some key points include:

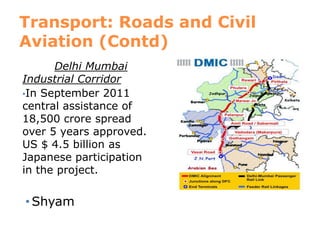

- Investment in infrastructure is projected to reach Rs. 50 lakh crore over the next five years, with half coming from the private sector.

- Tax-free bonds of Rs. 60,000 crore will be issued to finance infrastructure projects in 2012-13.

- More sectors were added as eligible for viability gap funding to encourage public-private partnerships.

- Measures like extra funding and allowing external commercial borrowing will help ease financing constraints and spur growth in the infrastructure industry.